HYPE Tightens Range as On-Chain Data Hints at $45 Breakout

- HYPE token stays in a tight range as buyers defend key support and pressure builds.

- On-chain whale activity rises as large orders and exchange outflows strengthen demand.

- A break above the $41–$43 price range may unlock momentum toward the $45 target and beyond.

HYPE is building pressure inside one of its tightest consolidation phases of the quarter, with on-chain data and market structure increasingly pointing toward a decisive move. As the token compresses between key support and resistance zones, trading activity, whale behavior, and technical patterns all suggest that momentum may be shifting beneath the surface.

Price Holds Steady as Symmetrical Triangle Tightens

The HYPE token has been moving inside a clear symmetrical triangle since mid-October, a pattern known for compressing volatility before a breakout. Recently, the token revisited the $36–$33 support band, where buyers stepped in and triggered a four-day bullish streak.

This rebound returned HYPE to its short-term resistance zone near the 50% Fibonacci retracement level at $41. This Fib level remains a critical technical barrier. A clean break above it would confirm renewed bullish strength and open the path toward the next technical target at $45.

However, if bulls fail to reclaim this level, the market could see another retest of the $36 support region, which has been repeatedly defended since late October. Momentum indicators show early signs of improvement.

The daily RSI sits at 51 and is trending higher, indicating the potential for continuation toward 60, which would confirm a stronger bullish shift. While still in neutral territory, the RSI provides evidence that HYPE maintains upside capacity before approaching overbought conditions.

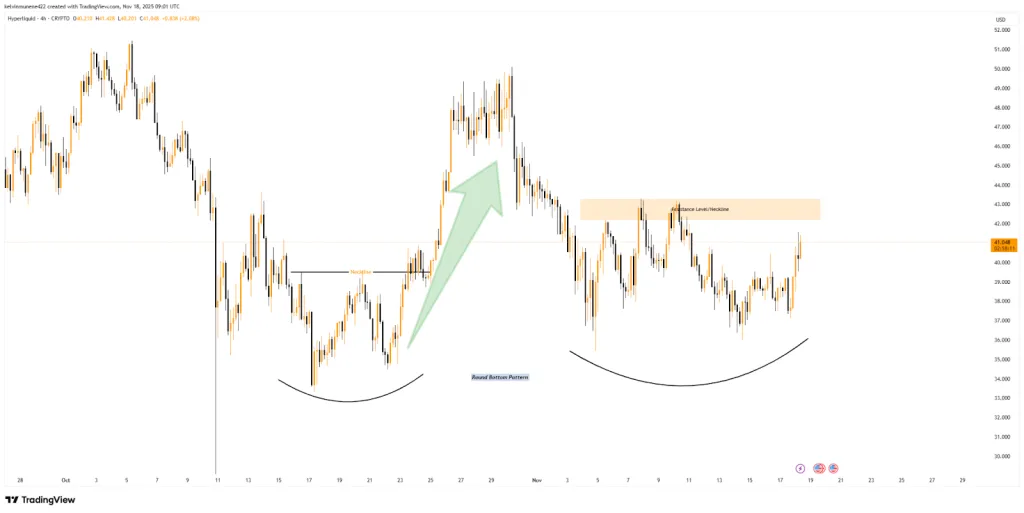

Rounded-Bottom Structure Echoes Previous 28% Rally

Lower-timeframe behavior mirrors one of HYPE’s strongest reversals earlier this year. A rounded-bottom pattern is forming again, similar to the October setup that triggered a nearly 28% climb to the $50 zone once the neckline was broken.

The current neckline rests at $42–$43, overlapping with major resistance. A decisive break above this band would align the daily and intraday structures, creating the conditions needed for a measured move into the upper range between $45 and $50. Until that neckline gives way, HYPE remains locked inside consolidation.

Whale Activity Rises as Order Sizes Expand Across Markets

Fresh trading data highlights growing participation from large players. According to CryptoQuant’s data, Hyperliquid order-flow charts show a steady increase in oversized green trades on both spot and futures markets since late October. These inflows strengthened as prices settled around the $40–$45 region, signaling active accumulation.

Through 2025, spot and futures order sizes have continued to rise, supporting the view that deeper liquidity is entering the market. Historically, consistent whale activity during flat price action often appears before major trend expansions.

Additional on-chain indicators reinforce this behavior. Exchange outflows are increasing, the count of active large addresses continues to climb, and the average transaction size is trending higher. These metrics typically emerge when larger participants are positioning well before volatility returns to the market.

Related: Bitcoin Nears $87K as Holder Demand Climbs to Record Heights

Technical and On-Chain Metrics Point Toward a Critical Break

Despite HYPE’s muted spot price, the internal market structure paints a different picture. Consolidation, rising order-flow strength, accumulation patterns, and tightening volatility are converging at the same moment.

The key area remains the $41–$43 resistance band. A clean move above this zone would line up the symmetrical triangle, the rounded-bottom neckline, the strengthening RSI, and the persistent whale inflows. Such alignment rarely occurs without producing a directional follow-through, making $45 a technically reasonable milestone based on past behavior.

For now, HYPE sits inside one of its narrowest structures of the quarter. The pressure continues to build, and all eyes are on the resistance band that will decide whether the next expansion takes shape.