Bitcoin Slides as Market Deleverages Across Major Platforms

- BTC sinks as analysts cite leverage reduction and major liquidations across key venues.

- Macro strain rises as risk appetite cools and ETF outflows weaken market strength.

- On-chain metrics hold firm while long-term holders sustain strong supply control.

Bitcoin faced sharp pressure this week as the price dropped below $100,000 and later touched $89,420 during early Asian trading. Coin Bureau reported that the slide erased all gains made during 2025. At the same time, on-chain data still showed strong accumulation, tight supply, and firm conviction among long-term holders. CryptoQuant added fresh detail and linked the latest leg lower to a major deleveraging phase on Binance. Together, the two research teams described a market hit by leverage, macro shifts, and mechanical liquidations.

Sharp Reversal From Record Bitcoin Highs

Coin Bureau explained that Bitcoin reached a new all-time high above $126,000 on October 6. Sentiment looked strong while buyers extended the advance across major venues. Then conditions changed rapidly, and a flash crash on October 10 triggered liquidations worth more than $19 billion.

Selling pressure returned on November 4 as Bitcoin slipped below $100,000 for the first time since June. Traders then watched momentum weaken again through mid-November. During early Asian hours on November 18, Bitcoin touched $89,420, and the pullback from the peak reached almost 29%.

He linked the move to rising fear across the market. The analyst described a shift from euphoria near the highs to broad caution after the crash. Yet the analyst also noted that long-term holders still kept a large share of supply off exchanges.

Macro Shifts and ETF Outflows Weigh on BTC

Coin Bureau pointed to several macro drivers behind the correction. First, the Federal Reserve reduced expectations for a December interest rate cut. Traders lowered the implied odds from around 95 percent to below 50 percent, and risk assets cooled in response.

Second, a United States government shutdown created what market watchers described as one of the driest fiscal liquidity periods in years. This backdrop reduced depth across markets and left leveraged positions more exposed. Third, spot Bitcoin ETFs moved from steady demand to clear net selling.

He also reported that spot Bitcoin ETFs recorded nearly $2.8 billion in redemptions during November. These outflows came after months of strong inflows earlier in the cycle. As redemptions grew, more selling pressure reached the open market, and liquidation engines activated more often.

Across three major events, liquidation systems cleared more than $3 billion in leveraged positions. Each wave removed a layer of leverage, forcing traders to reduce exposure. The combination of weaker macro expectations, tight liquidity, and ETF outflows created a difficult environment for BTC.

Related: Bitcoin Drop Deepens With Heavy ETF Outflows and Market Fear

Leverage Flush on Binance and On-Chain Accumulation

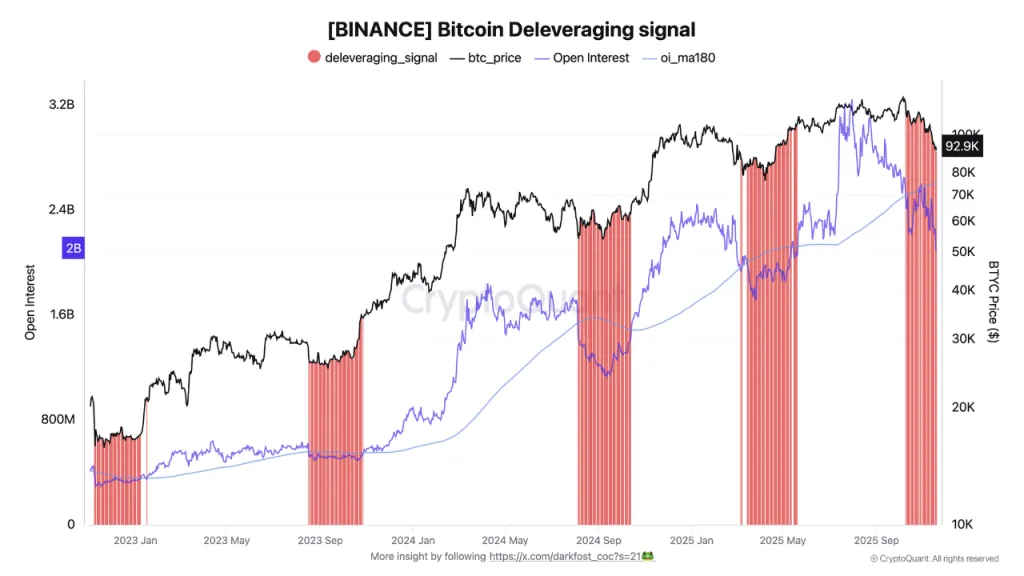

A CryptoQuant analyst added that the current cycle carried an extraordinary level of leverage. In 2021, aggregated open interest peaked near $16.5 billion. In 2025, that record climbed to about $46.5 billion, nearly three times higher.

Binance followed the same pattern and held the largest concentration of trading activity. Open interest on the exchange reached a record of nearly $3.25 billion during the year. CryptoQuant stated that such leverage created an imbalance that the market eventually addressed through deleveraging.

Since October 10, Binance has entered a strong deleveraging phase as BTC continued its correction. Open interest collapsed sharply while liquidations piled up. Many traders closed positions and reduced risk as concerns increased across the platform.

Coin Bureau also described the ‘on-chain firms’ trends during the decline. Exchange reserves kept falling, and holdings on trading platforms dropped to a seven-year low near 2.38 million Bitcoin. The MVRV ratio sat around 1.8, which aligned with a mid-cycle structure in prior periods. Long-term holders released about 400,000 Bitcoin during the month, yet more than 70 percent of the supply still remained in their wallets.