DOGE Defends $0.14 Support as ETFs Launch: Is a Move to $0.20 Ahead?

- DOGE defends the $0.14 zone after a 50 percent fall and rebounds from a low of $0.13304.

- New DOGE ETFs draw fresh inflows as GDOG hits $1.80 million on Tuesday (25th).

- Bullish chart patterns show HH and HL structures with targets near $0.176 to $0.180.

Dogecoin is stabilizing after two months of steep declines that erased more than half of its market value. The meme token touched a low of $0.13304 last Friday before buyers quickly stepped in, defending the critical $0.14–$0.13 support zone for the first time since September.

The rebound coincides with fresh institutional attention following the launch of DOGE-focused ETFs, raising questions about whether the token’s momentum is strong enough to push toward the $0.20 region.

DOGE Reclaims Key Support After a 50% Two-Month Slide

DOGE spent nearly eight weeks in a sharp downtrend that erased more than 50% of its value, sending the token to a local bottom. This was the point where buyers re-entered aggressively, halting the sell-off and kicking off a broader crypto market rebound.

That reaction helped Dogecoin reclaim the $0.14–$0.13 support zone, a level it had lost only briefly. As of press time, DOGE trades at $0.1517, up roughly 2% in the past 24 hours. Trading volume has also improved, increasing 2.03% to $1.59 billion, indicating renewed activity after a quiet stretch.

Despite the short-term relief, larger timeframes still show persistent weakness. DOGE remains down 5% on the week and 27% over the past 30 days, according to CoinMarketCap. Even so, the defense of $0.14 marks one of DOGE’s stable accumulation points, appearing for the first time since the latest downtrend began.

ETF Launches Spark New Institutional Attention

The turning point for sentiment arrived with the launch of Grayscale’s GDOG, the first U.S.-listed pure spot Dogecoin investment product. GDOG debuted on Monday with 0 inflows, but the product attracted $1.80 million in inflows on Tuesday, signaling new institutional interest. This positions Grayscale ahead of competing issuers, securing a first-mover advantage in the expanding altcoin ETF landscape.

While REX-Osprey previously launched a Dogecoin ETP in Europe, GDOG becomes the first spot DOGE vehicle to enter the U.S. market. Bitwise is also set to begin trading its Dogecoin ETF today, following the end of the U.S. government shutdown, which had paused approvals.

With that hurdle removed, analysts expect a wave of altcoin-linked investment vehicles to reach exchanges in the coming weeks. This shift reflects growing institutional demand for regulated exposure to large-cap digital assets.

Bullish Chart Structures Surface on Lower Timeframes

Analyst Trader Tardigrade highlights that DOGE is attempting its first notable bullish reversal since September. His charts show DOGE shifting from a persistent downtrend into a clean higher-high (HH) and higher-low (HL) structure, often the first signal of an early trend reversal.

The chart highlights a long series of lower highs pressed against a falling red trendline. DOGE eventually broke through that trendline, retested it, and bounced, confirming a structural shift. Price then printed consecutive HHs and HLs between $0.14 and $0.15, suggesting buyers are gradually reclaiming momentum.

Another chart shows an even stronger bullish pattern: a fully developed inverse head-and-shoulders with a diagonal neckline. DOGE broke above that neckline at roughly $0.152, circled on the chart, activating a projected 17.99% upside target that places potential continuation near $0.176–$0.180.

Related: XRP Surges 7% After Long Lull as New Ripple-Focused ETFs Hit the Market

On-Chain Outflows and Short-Side Liquidity Provide Support

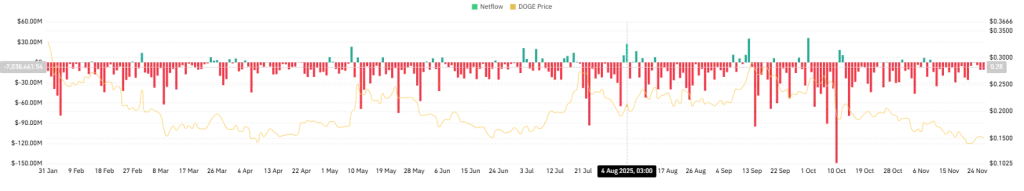

On-chain data adds further weight to the bullish case. DOGE exchange netflows remain deeply negative, with consistent outflows dominating the chart. This signals reduced sell-side pressure as fewer coins move toward exchanges.

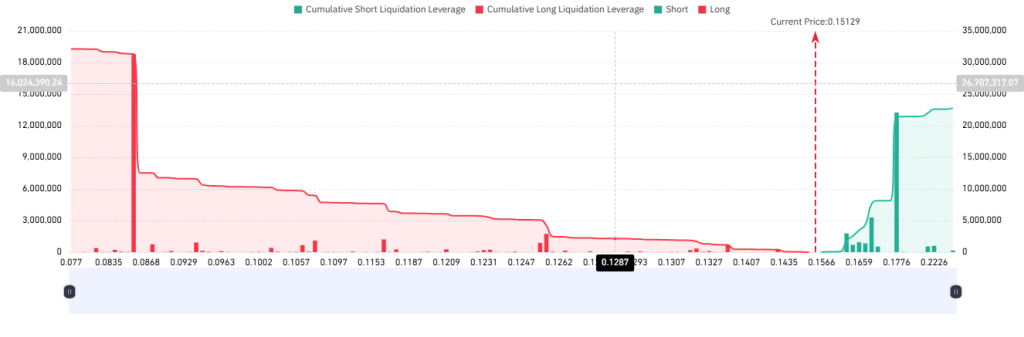

Historically, such sustained outflow phases have aligned with local bottoms and early trend reversals, supporting DOGE’s push toward the $0.17–$0.20 target zone. Liquidation data further strengthens the bullish setup.

The heatmap shows a heavy cluster of short liquidations building above the current price near $0.1776, with more than $21M in short-side leverage stacked toward the upside. In contrast, long-side liquidity beneath $0.1296 is far thinner. This imbalance suggests DOGE could trigger an upward liquidation cascade if momentum continues, fueling a potential breakout toward the $0.17–$0.20 zone.

For now, Dogecoin holds steady as fresh inflows and improving market signals offer support, yet its next move will hinge on whether buyers can keep pressure through the heavier resistance levels ahead.