ENA Price Rebounds on Rising Accumulation: Is a Break Toward $0.40 Next?

- ENA rebounds 37% from the $0.21 low and holds above the key $0.23–$0.19 support zone.

- Large wallets withdraw over 300M ENA as strong accumulation signals rising confidence.

- ENA must clear $0.30 to target resistance at $0.36, $0.41, and the $0.50 Fibonacci zone.

Ethena’s ENA token is staging a notable recovery after retesting a key support band, with fresh accumulation from large wallets adding new momentum to the reversal attempt. The token rebounded sharply after touching the $0.23–$0.19 zone last week, an area that has now acted as a strong foundation following a months-long decline.

ENA dropped nearly 60% from its late-October peak, sliding to a low of $0.21 last Friday. However, the token surged by 37% off that level and is now trading at $0.2779, reflecting a 1% 24-hour rise and 5% weekly gain. Market data shows ENA holding above its major support band again, its first meaningful bullish signal in weeks.

Rising From Oversold Levels as Price Nears First Resistance

The rebound comes as ENA hovers just beneath the 23.60% Fibonacci level at $0.30, which currently acts as temporary resistance. A successful break above this mark would open the door to the next resistance cluster at $0.36, followed by the 38.20% Fib at $0.41, representing a 50% rise from current pricing.

Technical indicators support the renewed buying interest. The Relative Strength Index (RSI) sits at 42, climbing from oversold territory. This suggests buying pressure is gaining momentum, although a decisive move above the 50 neutral level would strengthen the bullish case.

However, the broader structure remains bearish. The 50-day moving average at $0.37 and the 200-day moving average at $0.46 remain well above ENA’s price, confirming both as significant resistance zones that bulls must overcome before any larger trend reversal can occur.

Large Wallet Accumulation Signals Strengthening Confidence

The strongest signal supporting ENA’s rebound comes from sizeable on-chain accumulation.

Onchain Lens reports that:

- Wallet 0xa19, newly created, withdrew 105.35 million ENA worth $28.7 million from Coinbase Prime.

- Wallet 0x631 removed 20 million ENA worth $5.45 million from Bybit, bringing its total holdings to 305.15 million ENA valued at $88.67 million.

Earlier withdrawals add even more weight:

- On Nov. 25, the same 0x631 wallet bought 25 million ENA worth $6.7 million from Bybit.

- Across the past two weeks, Onchain Lens identified a combined 260.15 million ENA, valued at $78.66 million, accumulated from Bybit and Coinbase Prime by a wallet likely linked to Ethena Labs.

The repeated pattern of withdrawing ENA from exchanges into self-custody suggests a preference for long-term holding rather than short-term trading—typically a sign of investor confidence in future price action.

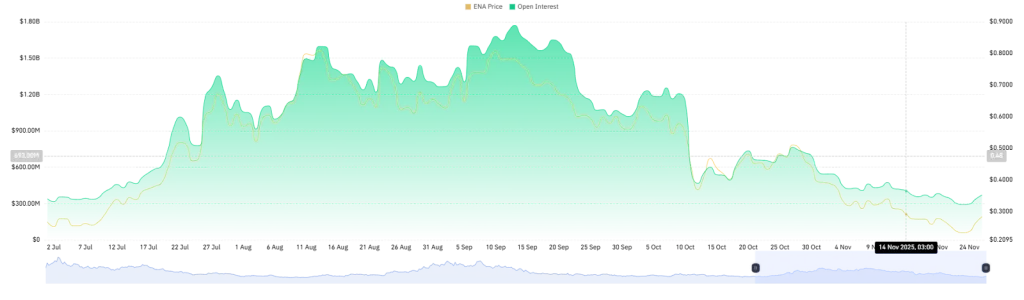

Open Interest Climbs, Yet Market Volatility Remains Low

On-chain derivatives data show a cautious but steady increase in market activity. ENA’s open interest has risen to $371 million, up from $292 million on Sunday. This indicates traders are keeping their positions open instead of taking profits from the recent bounce.

However, the market still lacks the volatility required for a rapid breakout. The current positioning hints at strategic accumulation and patient trend-building rather than a fast, aggressive rally.

This aligns with the large wallet accumulation trend, suggesting that bullish participants are preparing for potential upside but are not forcing high-volatility moves. Combined with a support base at $0.23–$0.19, the setup implies that any pullback could retest this zone before bulls attempt another upward expansion.

Related: DOGE Defends $0.14 Support as ETFs Launch: Is a Move to $0.20 Ahead?

Outlook: Can ENA Break Toward $0.40?

A break above the $0.30 threshold remains the crucial first step. If successful, momentum could carry ENA toward:

- $0.36 (temporary resistance)

- $0.41 (38.20% Fibonacci)

- $0.50 (50% Fibonacci)

For now, ENA’s recovery is driven by strong accumulation and improving market strength, though major moving averages still challenge the bullish path. With rising open interest, a revived RSI, and multi-million-dollar withdrawals from exchanges, market sentiment has shifted from capitulation to cautious optimism.

If accumulation continues and volatility strengthens, ENA may soon test higher resistance zones, with $0.40 emerging as a realistic medium-term target within its technical structure.