Bitcoin Rises Above $90K While USDT Outflows Shape Market Trends

- BTC climbs above $90K as the price rebounds from $80K and holds the key $89K Fib level.

- USDT outflows stay heavy as liquidity thins, and BTC reacts to deep exchange drains.

- Institutional remarks grow as digital asset adoption expands with rising global wallet value.

Bitcoin climbed above the $90,000 region after rebounding from the low of around $80,685 as traders observed a recovery attempt from a descending channel that formed after the rejection near the $108,757 Fibonacci level. The asset reached an intraday high of $91,950. Price reclaimed the 0.236 Fibonacci level at $89,114 and positioned itself for a potential move toward the $92,000 zone.

Price Recovers as Key Technical Levels Activate

Bitcoin moved higher within a structure defined by several compression zones. The chart placed “Resistance 1” near the 0.618 Fibonacci level at $102,757.19, which acted as a ceiling during multiple rallies. Another resistance cluster sat between $98,542.92, at the 0.5 Fibonacci level, and $94,328.65 at the 0.382 level.

Price continued to trade below the broader ceiling that extended toward $116,400. This level marked the upper barrier of the macrostructure. The lower range near $80,000–$82,000 formed the dominant support and aligned with the base of the descending channel. The recent wick at $80,685 confirmed the zone as the cycle’s strongest support.

Momentum improved gradually as the daily RSI rose from oversold levels below 30 to 40.49 after several weeks. This shift suggested growing buyer strength as Bitcoin tried to form a higher low inside the channel. The next critical area sat between $92,000 and the 0.382 Fibonacci level at $94,328. A break above the region could open the path toward $98,542 and then $102,757.

Liquidity Thins as USDT Outflows Pressure Market Conditions

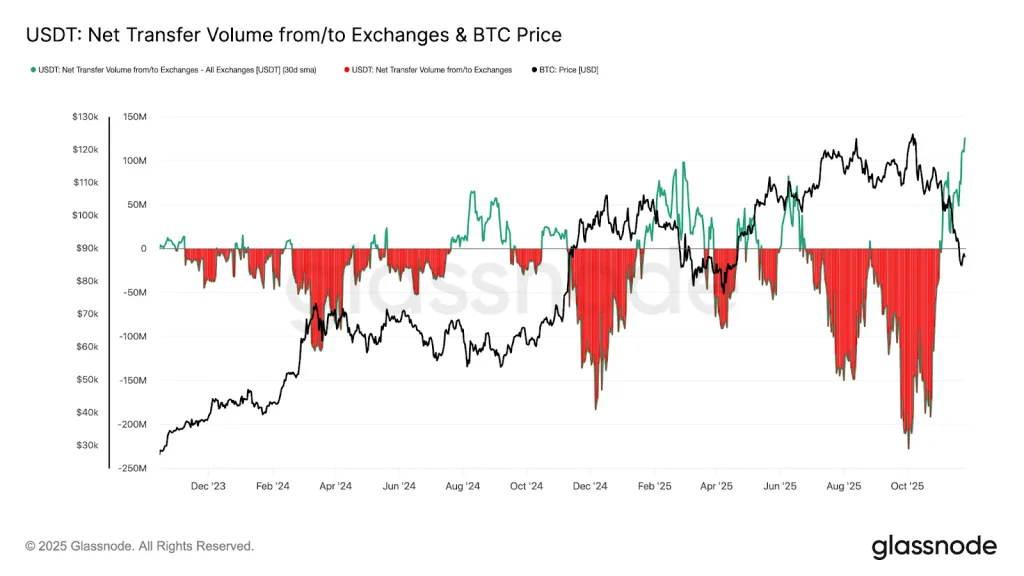

Glassnode reported that Bitcoin traded inside a fragile liquidity pocket. The graph depicts USDT net outflows over the exchanges, which were the most prominent during certain periods. Between the months of March 2024 and October 2025, the outflows showed more than -$200 million in several instances. Inflows in the early part of 2024 and mid-2025 exceeded $50M; however, each recovery period lost momentum as outflows returned.

The USDT outflows were accompanied by corresponding BTC price declines. The decrease in BTC price to below $70K in late 2024 was preceded by the outflows of more than -$150M. The latest transactions brought the total net USDT volume to above $100M while the BTC price remained steady at above $80K.

Bitcoin attempted a recovery inside the $81K–$89K liquidity trap as USDT pressure eased slightly. This set the stage for a potential shift in short-term momentum. Traders monitored whether reduced outflows could support a more durable rebound.

Related: Cardano Founder Blames Institutional Schemes for Crypto Crash

Institutional Remarks Add Context as Adoption Trends Expand

The maturing of the institutional sector, among other factors, shaped market sentiment. According to Larry Fink, the CEO of BlackRock, a positive outlook for Bitcoin and other digital assets has been suggested.

He also pointed out that the figure of $1.4 trillion in global digital wallets is real and that almost the entire amount consists of digital currencies. The statement signified more and more institutions coming on board and users migrating to the digital asset economy, too fast for the market to react positively. Thus, the question is whether institutions returning to Bitcoin can be a factor in its stabilization while the liquidity shrinks.