AlphaTON Drives New Treasury Path as TON Gains Ecosystem Support

- TON gains strong traction through wide retail use and fast-rising mini app activity.

- Venture funds add major capital that lifts the long-term strength of the TON asset base.

- AlphaTON builds a treasury plan that anchors growth within one unified TON network.

Nasdaq-listed TON token treasury firm AlphaTON Capital Corp. has filed a $420.69 million shelf registration with the U.S. Securities and Exchange Commission. In doing so, the firm expands its digital asset operations, scales GPU infrastructure for Cocoon AI, and accelerates acquisitions tied to the Telegram and TON ecosystem.

The firm states that the registration will support rapid fundraising through common shares, preferred shares, debt, warrants, or mixed units once the shelf becomes effective. CEO Brittany Kaiser states the exit from the SEC’s “baby shelf rules” gives AlphaTON room to act quickly on strategic opportunities linked to decentralized AI and Telegram-native businesses.

Regulatory Breakthrough and New Fundraising Flexibility

AlphaTON reports that the SEC’s baby shelf rules previously constrained its growth plans. These rules limit the amount of capital smaller public companies can raise through a Form S-3 shelf registration. The firm confirms that the new filing removes the limit, opening a path to larger, flexible funding windows that match market conditions.

Kaiser calls the decision “an important milestone” in AlphaTON’s effort to build a leading infrastructure footprint for decentralized AI. She notes that the new shelf lets the company “move quickly and decisively on transformational opportunities.”

The announcement states that AlphaTON aims to develop a comprehensive treasury strategy anchored by TON tokens and associated digital assets. The firm already operates validator and staking systems, which create ongoing yield and deepen its involvement in the ecosystem.

AI Expansion and Cocoon GPU Deployment

AlphaTON states that the capital will help scale advanced computing capacity for Cocoon AI, a decentralized compute network built by Telegram. Cocoon uses the TON blockchain and pays users in Toncoin for renting GPU power to process queries.

The firm confirms that it already deployed its first fleet of Nvidia B200 GPUs to Cocoon in November. This move creates a new revenue stream and aligns the company with Telegram’s push for hardware-backed AI growth. AlphaTON also reports plans to accumulate Telegram-linked bonds as part of its broader investment strategy.

Since rebranding from Portage Biotech in September 2025, the company has outlined a stronger AI-driven roadmap. It launched a $15.3 million at-the-market equity program and secured $82.5 million dedicated specifically to GPU infrastructure.

These actions raise a key question: Will telecommunications-scale user bases become the new foundation for corporate Web3 treasury strategies?

Acquisition Pipeline Linked to the Telegram and TON Ecosystem

AlphaTON says that part of the $420.69 million raise will fund mergers and acquisitions. The firm identified several high-potential targets operating within the Telegram and TON ecosystem. These include payment startups, blockchain-enabled services, fintech tools, content platforms, and gaming projects.

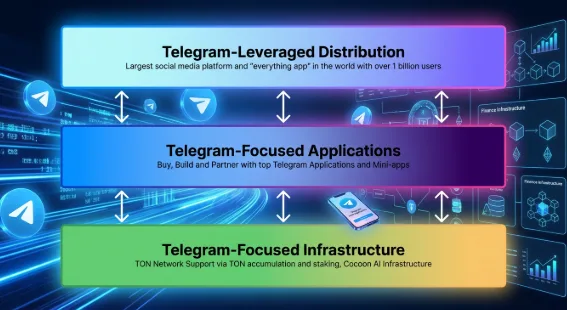

The company notes that these businesses already generate revenue and link directly to Telegram’s estimated one billion monthly active users. This integration forms the basis for AlphaTON’s concept of a “single-ecosystem treasury,” in which a public company builds its balance sheet, operations, and revenue channels around a single blockchain network.

TON Gains Ground as Retail Demand and VC Backing Surge

TON has become a strong candidate for this model due to its surge in retail penetration and the popularity of its mini-app games such as Notcoin and Hamster Kombat. The Open Network ecosystem also recorded major venture investment earlier this year, with firms including Benchmark, CoinFund, Draper Associates, Sequoia Capital, and Skybridge contributing more than $400 million to Toncoin. Coinbase Ventures is also reportedly involved.

Related: AlphaTON Capital Makes $30M Investment in Toncoin Treasury

AlphaTON believes that this demand, combined with Telegram’s scale, supports a strategy where treasury growth, operational revenue, and blockchain infrastructure are all situated within a single ecosystem.

Public records and company statements suggest that AlphaTON’s approach may represent the first large corporate treasury model built around a social-app-driven blockchain rather than a finance-native platform. The firm says that its $420.69 million shelf registration will serve as the foundation for this shift, creating capital access for acquisitions, GPU deployment, and a rapidly expanding TON treasury.