BOJ December Rate Hike to 0.75% Puts BTC Liquidity at Risk

- BOJ eyes Dec rate hike to 0.75%, which would mark Japan’s highest level since 1995.

- Rising Japan yields could unwind yen carry trades, tightening liquidity for Bitcoin and crypto.

- The August 2024 shock is cited, with crypto market cap down $600B, BTC at $49K, and liquidations at $1.14B.

The Bank of Japan is preparing to raise interest rates at its December policy meeting, a move that would shift Japan’s benchmark rate to its highest level since 1995. Bloomberg reported that policymakers are leaning toward a 25-basis-point increase. The move depends on no major shock to global markets or Japan’s domestic outlook.

Japan’s Rate Path Shifts as Yen Carry Trade Risks Rise

The report indicated that the proposal would lift the policy rate to 0.75% at the Dec. 19 meeting. That plan remains dependent on financial stability and steady economic indicators.

The potential move extends Japan’s gradual exit from decades of ultra-loose monetary policy and signals greater confidence in the country’s inflation path. A shift of this scale carries implications beyond Japan, as global markets frequently respond to changes in the price of yen funding.

A key transmission channel is the yen-funded carry trade. For years, hedge funds and proprietary desks relied on cheap yen to finance leveraged positions in higher-yielding or higher-beta markets. This approach remained popular throughout Japan’s extended period of near-zero interest rates.

The strategy involved borrowing yen at low cost, converting it into other currencies, and deploying the capital in assets that offered more substantial returns. U.S. equities, bonds, and cryptocurrencies such as Bitcoin became common targets for this flow.

Risk of carry trade reversal puts pressure on Bitcoin liquidity

Higher Japanese interest rates or a stronger yen could quickly unwind the carry trade. Forced adjustments push investors to cut leverage and sell assets to meet funding pressure. These unwind cycles could spill into thinner markets where volatility is higher.

An episode from August 2024 illustrates the scale of potential disruption. Analyst PaulBarron

highlighted that the BOJ hike during that period coincided with a $600 billion drop in total crypto market value.

Bitcoin slid to $49,000 during the selloff, and liquidations reached $1.14 billion. Analysts noted that a similar shock could emerge if Japanese yields rise further, triggering another funding squeeze.

Related: Japan Introduces New Liability Reserves for Crypto Exchanges

A rise in Japanese rates reduces the appeal of yen-based strategies and encourages investors to reassess market exposure. Bitcoin appears vulnerable in that context because it reacts strongly to changes in leverage and sudden shifts in liquidity.

Stronger yen moves are often associated with broader de-risking. The dynamic of tightening liquidity conditions that recently influenced Bitcoin’s rebound from November’s lows. Currency and rate markets, therefore, remain central to Bitcoin’s short-term direction, especially when macro drivers dominate trading flows.

Bitcoin trading has stayed closely tied to macro signals. BTC dipped toward $86,000 earlier in the week and later rebounded above $93,000 as U.S. equities strengthened. The past month saw sharp swings driven mainly by interest-rate expectations. Crypto-specific catalysts played a minor role in that period.

Governor Kazuo Ueda added to speculation with remarks suggesting the board would make an “appropriate decision” on rates at the December meeting. That phrasing aligns with language used before earlier rate hikes.

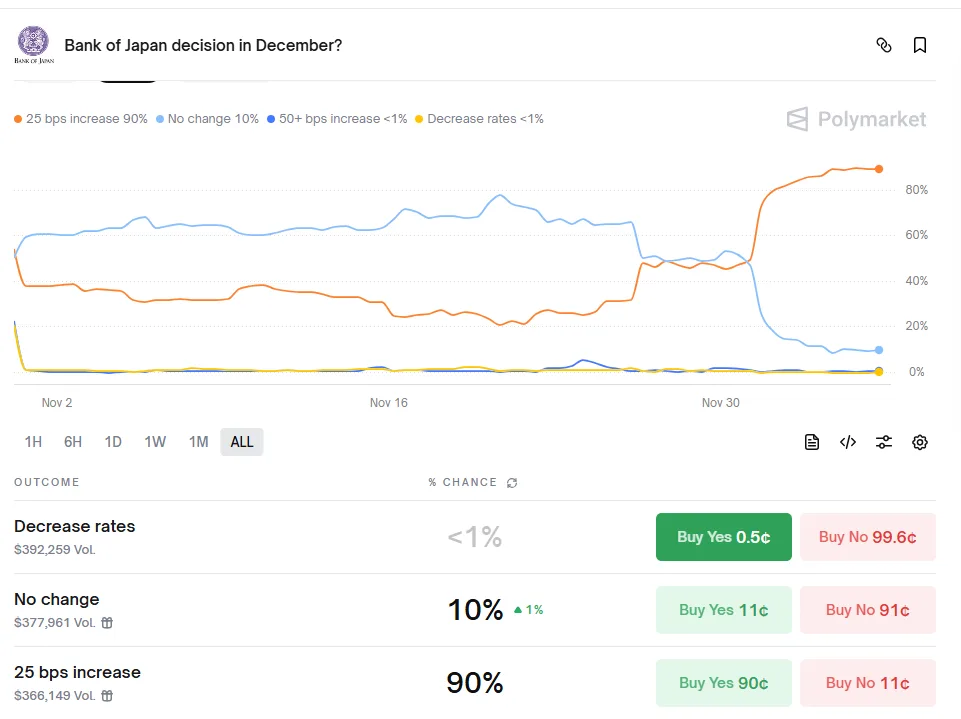

Markets are forecasting a 90% probability of a 25-basis point rate increase. Key ministers are serving under Prime Minister Sanae Takaichi, and no political resistance to the policy shift is anticipated.

Source: Polymarket

Policy makers may indicate willingness to raise rates a second time if the economy develops in line with their forecasts. The question of whether to lock in a course continues to loom large. What they say about the future could be nearly as crucial to how markets react as is the initial move.