PIPPIN Climbs to $0.51 Record High, Marks 4-Week Bullish Run

- PIPPIN surged to a $0.51 all-time high after breaking out from a months-long range accumulation

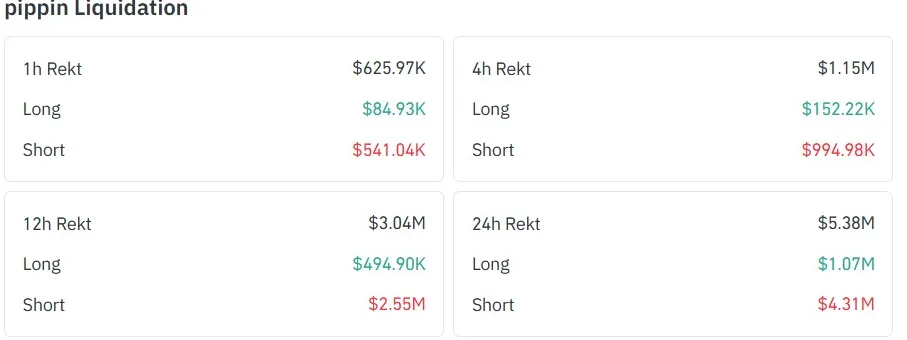

- Short liquidations above $3.7M and negative funding rates fueled upside pressure

- Exchange outflows and wallet concentration reduced supply and increased volatility

PIPPIN rose to a new record this week, trading as high as $0.51 and extending a rally that has now lasted four consecutive weeks. The move followed a clear breakout from a prolonged consolidation phase and pushed the token into the top tier of short-term market performers.

According to PIPPIN’s price analysis, the token briefly traded near $0.51 before pulling back slightly. At the time of writing, PIPPIN was changing hands at around $0.4878. Despite the pause, gains remain substantial. The token is up 38% over the last 24 hours, 165% over the past week, and about 1,535% over the past 30 days.

Market capitalization has increased to roughly $487 million. Trading activity has also picked up sharply, with 24-hour volume reaching $88 million, up nearly 69% from the previous session.

Extended Base Formation Preceded the Breakout

Technically, PIPPIN spent much of 2025 moving sideways. From early February through mid-November, the price remained largely confined between $0.010 and $0.055. During this period, volatility stayed low, and trading volumes were subdued, suggesting gradual accumulation rather than speculative churn.

That structure remained intact for several months. However, the shift came around November 24, when the price pushed decisively above the upper boundary of the range. The breakout marked a clear change in market behavior. Since then, PIPPIN has recorded weekly gains without interruption.

The advance was accompanied by expanding volume and strong follow-through. Large bullish candles dominated the chart, indicating sustained buying pressure rather than isolated trades or thin liquidity moves.

Derivatives Positioning Accelerated the Latest Move

Derivatives positioning played a key role in the latest surge. Data from December 10 to date showed that more than 72% of open PIPPIN positions were shorts, reflecting expectations that the rally would fade.

Instead, continued upside forced those positions to unwind. Over the past 24 hours, short liquidations totaled more than $4 million, while long liquidations stood near $1 million, according to Rekt data. The imbalance added further buying pressure as positions were closed.

Funding rates added more weight to the setup. Negative funding near -0.5282% across several high-volatility tokens showed that shorts were paying longs. That structure encouraged additional short exposure and increased liquidation risk as the price continued higher.

Liquidity conditions magnified the effect. PIPPIN’s largest decentralized pool on Raydium holds about $10.3 million, limiting depth. With open interest near $208 million, leverage remained high relative to available spot liquidity, allowing price to move rapidly once momentum built.

Related: ADA Near Breakdown as Bearish Signals Strengthen at Support

Exchange Outflows and Concentration Shape Risk Profile

Meanwhile, on-chain data points to a tightening supply. Around 26 wallets withdrew an estimated 44% of circulating PIPPIN from exchanges, reducing near-term sell pressure. At the same time, roughly 50 wallets linked through HTX-related routes accumulated close to $19 million worth of tokens through coordinated purchases.

However, supply concentration remains elevated. About 73% of the total supply is held by 93 addresses, increasing sensitivity to large transfers. Past activity highlights this risk. On December 1, a transfer and sale of 24.8 million PIPPIN, valued at roughly $3.74 million, coincided with a 26% intraday decline, according to Lookonchain.

Technical Levels in Focus After Vertical Move

Momentum indicators now reflect the intensity of the advance. The Relative Strength Index on higher timeframes is hovering near 95, placing PIPPIN deep in extreme overbought territory. Historically, such readings have coincided with cooling phases or consolidation following rapid price expansion.

Key Fibonacci retracement levels define areas to monitor if the token’s price stabilizes or pulls back. Support zones sit near $0.36 at the 78.60% retracement, followed by $0.28 at the 61.80% level and $0.23 around the 50% retracement.

On the upside, Fibonacci extensions highlight potential resistance levels at $0.60, $0.67, and $0.76. For now, PIPPIN remains elevated after a clean breakout, with its four-week run driven by accumulation, constrained supply, and derivatives-driven flows that reshaped near-term price dynamics.