LIT Price Retraces After 14% Weekly Rally: Can Bulls Hold Support?

- LIT Price cools after a strong rally as sellers push back near a major resistance zone.

- Lighter’s open interest stays high, which shows rising activity even as the market retraces.

- Bulls now hold the line at $2.80 as this key support guides the next price direction.

LIT price slipped back to roughly $2.95 in the past day after a rapid climb that lifted it more than 14% over the week. The pullback arrived not long after the token brushed the $3.20 area, where upside momentum ran into a wall of supply that has capped rallies before.

Part of last week’s strong move came from a fresh round of protocol buybacks. Public records show the treasury acquired close to 180,700 LIT, with the Assistance Fund adding another 165,790 tokens.

That activity trimmed the circulating supply, about 250 million in total, while making price action more closely tied to platform revenue. The transparency of those on-chain purchases added weight to the rally, but the market paused once the token hit familiar resistance.

Pressure Mounts at the Top of the Range

Once the LIT price reached the $3.26–$3.20 pocket, sellers stepped in quickly. The token pulled back toward the lower edge of an ascending wedge, a pattern that often signals fading strength when buyers start to run short of conviction. The wedge support trendline sits near $2.90, almost exactly where the 61.8% Fib retracement converges.

A clean break below that area would turn attention to the band between $2.80 and $2.83, a level that has switched roles many times. The zone lines up with the 50% retracement and the 50-period moving average, giving it the weight of multiple indicators at once.

Source: TradingView

Traders see it as the final layer of support before the chart opens toward $2.70. If this support holds, though, the structure remains intact, and the LIT price would have a path back above $3.00 without needing a major shift in volume.

Technical Momentum and On-Chain Data Paint a Mixed Picture

The RSI, on the other hand, sits near 48, far from overheated, far from distressed. Nothing about that level hints at exhaustion. What does stand out, however, is the slight downward lean, a sign that sellers have controlled the last few candles. Meanwhile, derivatives data tell a different story.

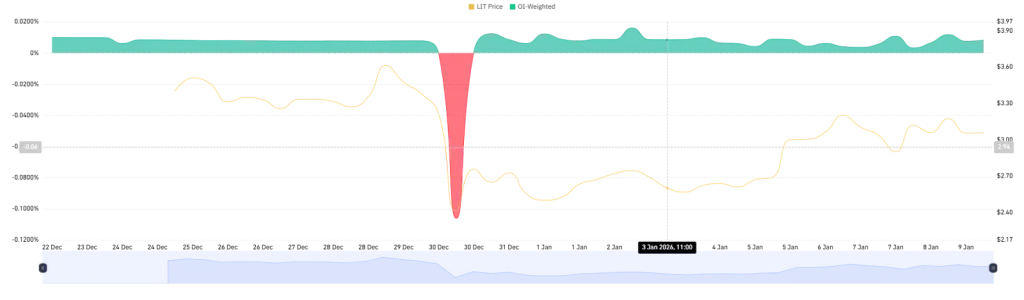

The funding rate has stayed positive since launch, dipping into negative territory only once at the end of December. The current reading near 0.0082% suggests that long buyers are still paying a premium to maintain their positions, hinting at ongoing confidence in the market’s longer-term trajectory.

Source: CoinGlass

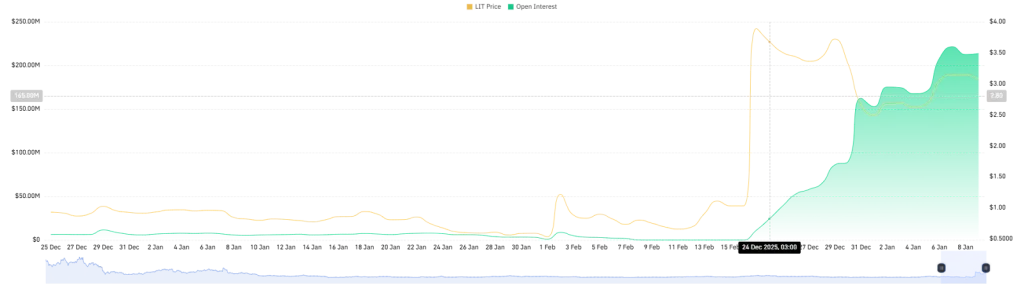

Besides, open interest gives another clue about sentiment. After weeks of quiet movement, open interest exploded to roughly $221 million on January 7. Since then, it has cooled slightly but remains high, hovering around $213 million. Elevated levels like this often lead to sharper swings as larger positions react more violently to technical breaks.

Source: CoinGlass

With the LIT price now sitting directly on a critical support cluster, any decisive move could carry more force than usual simply because the market is busier than it has been in recent weeks.

Related: River Rips 12% Higher as Bulls Shrug Off Overbought RSI

Supply Structure Still Shapes Sentiment

Half of the token’s total supply is allocated to team members and investors, locked until 2027. Although no unlocks are scheduled for the near term, the structure continues to raise questions among traders about long-term concentration. That conversation intensified after reports that wallets linked to prominent market figures accumulated roughly 5% of the circulating supply.

There is no sign of imminent selling, but the clustering of large holdings tends to keep retail traders cautious, even when broader price action looks healthy. For now, everything hinges on one thing: whether the LIT price can hold the $2.80 area.

The buybacks, derivatives data, and recent surge in open interest lean supportive, while resistance overhead and supply concentration pull the other way. The next move depends on which of those forces wins the standoff at support.