Bitcoin Falls as Trump Tariffs Trigger Risk-Off Trade

- Bitcoin fell with equities as tariff fears drove investors away from risk and into gold.

- Heavy long liquidations showed Bitcoin trading as a speculative asset, not a safe haven.

- Gold hit record highs while crypto mirrored stocks during heightened geopolitical stress.

Bitcoin came under sharp pressure on Monday as global markets recoiled from renewed trade tensions between the United States and Europe. The selloff unfolded quickly, cutting across equities and digital assets alike, while investors moved decisively into traditional safe havens.

As a result, gold futures surged to record highs, offering a stark contrast to the slide in risk-linked markets. The catalyst was a fresh escalation in tariff rhetoric from U.S. President Donald Trump over the weekend.

His comments landed during thin holiday trading, when liquidity was already strained. However, the timing amplified market moves. Instead of acting as a shield, Bitcoin moved in step with stocks, reinforcing its current positioning as a speculative asset rather than a geopolitical hedge.

According to TradingView data, Bitcoin fell nearly 4% in a matter of hours, sliding from around $95,450 to around $92K. The decline coincided with broader weakness across crypto markets, as traders cut exposure and volatility rippled through derivatives.

Crypto Prices Slide as Risk Is Cut

The pullback spread fast. Ethereum dropped as much as 3.92% at its worst point, briefly touching $3,178 before recovering toward $3,212. XRP fell about 4.32% to $1.97, while Solana slid roughly 10% to $133 before clawing back much of the loss.

Within 24 hours, the total cryptocurrency market capitalization fell nearly 3%, settling near $3.14 trillion. Traditional markets showed similar stress. U.S. equity futures pointed lower, with the S&P 500 down 0.7% and the Nasdaq off 1%.

European equity futures fell around 1.1%. In contrast, gold surged 1.5% as investors sought safety. Futures climbed to a record $4,679 per ounce, while silver rose above $94 per ounce, also an all-time high. The U.S. dollar weakened modestly against the yen, adding to the defensive tone.

Liquidations Reveal Leverage Imbalance

The speed of the move exposed crowded positioning in crypto derivatives. Data from CoinGlass showed $872 million in liquidations over 24 hours. About $788 million came from long positions, compared with just $84 million from shorts, indicating traders had been leaning heavily toward further gains before the tariff news broke.

Source: CoinGlass

Hyperliquid recorded the largest share of forced closures at $262 million, with the single biggest liquidation being a BTC-USDT position valued at $25.83 million. Bybit followed with $239 million, while Binance saw $172 million. Across major platforms, more than 90% of liquidations were tied to long exposure.

Source: X

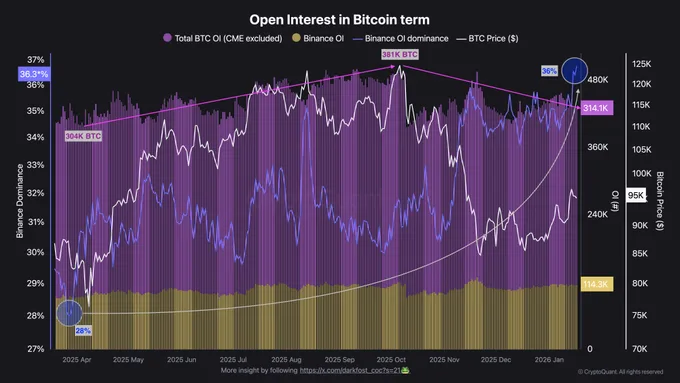

Besides, Bitcoin futures open interest, which had rebounded roughly 13% from early January lows, began to come under renewed strain. Analysts noted that some deleveraging had already occurred, but the tariff shock disrupted a tentative recovery in positioning.

Tariff Threats Jolt Transatlantic Ties

Trump said eight European countries would face 10% tariffs starting February 1, rising to 25% by June 1, unless a deal is reached over Greenland. The list included Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland.

In response to this decision, European leaders reacted with unusually unified criticism. France pushed for activation of the EU’s anti-coercion instrument, the UK described tariffs on allies as unjustified, and Sweden rejected what it called pressure tactics.

Moreover, the European Parliament moved to halt ratification of a recent EU-US trade agreement, and officials signaled readiness to revive €93 billion in retaliatory tariffs paused last summer.

Related: Bitcoin Becomes Reserve As Crypto Leaves Trump-Era Optimism

A Clear Divide Between Risk and Refuge

Banks warned that the bigger risk may lie beyond trade itself. Deutsche Bank highlighted the possibility of capital flows becoming a pressure point, noting European investors hold about $8 trillion in U.S. bonds and equities.

Goldman Sachs estimated a 10% tariff could shave two to three percentage points off European earnings growth, while ING projected a 0.25-point hit to GDP. Against that backdrop, Monday’s session drew a clear line. Gold rallied as expected.

Bitcoin did not. Instead, it tracked equities lower, underscoring how, in moments of geopolitical stress, the asset still behaves like a levered risk trade rather than a defensive store of value.