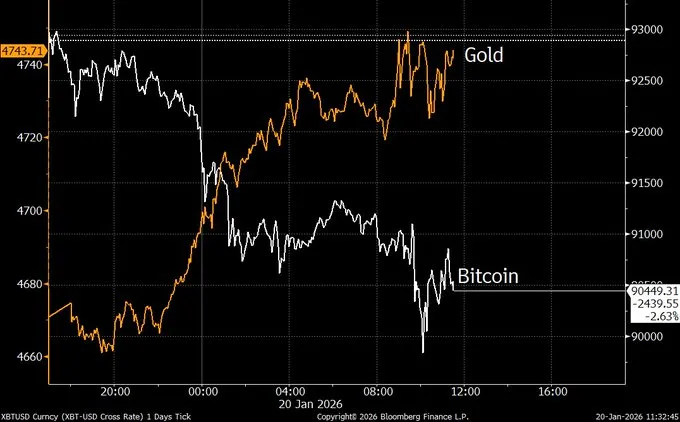

BTC Crash Triggers $150B Crypto Wipeout as Gold Hits Record

- Bitcoin slid as a leverage unwind erased $150B from the total crypto market value overall.

- Over 182K traders were liquidated in 24 hours, with longs taking most of the damage.

- Gold surged above $4,800 to a record high as safe-haven demand jumped on tensions.

The crypto market lost about $150 billion in value as Bitcoin fell below $88,000 during a sharp leverage unwind. The selloff erased bullish positions across major exchanges and dragged the wider market lower. At the same time, gold surged past $4,800 per ounce for the first time, signaling strong demand for defensive assets.

Bitcoin slid around 9% in 48 hours and traded near $87,800 after a steep move late Monday. Liquidations accelerated in a short window as the price broke key support levels. The sharp decline triggered forced selling in thin trading conditions, which made the drop faster and more disorderly.

CoinGlass Liquidations Rise as Short-Term Losses Hold

CoinGlass data showed over 182,000 traders were liquidated over 24 hours. Long positions made up the majority of the damage, with $759.33 million in longs liquidated versus $108.59

million in shorts. Bitcoin accounted for $358.98 million in liquidations, while Ethereum recorded $299.62 million.

The liquidation wave hit the market during late hours and intensified volatility. Bitcoin alone saw $358.98 million in leveraged long positions wiped out in a single hour. That burst of forced selling pushed the price below $88,000 and deepened the downturn across large-cap tokens.

Glassnode data highlighted continued stress among short-term holders. The cohort defined as buyers within the last 155 days has remained underwater for eight straight weeks. The data showed the group would need Bitcoin above $98,000 to return to profit on average.

Sentiment in crypto circles worsened as traders compared Bitcoin’s weakness to the strength in metals. Analyst Rex said crypto interest has dried up and that many long-time participants have shifted attention to stocks and commodities. He said the sentiment is worse than past stress periods, including the COVID crash bottom.

Another analyst, TheGreekGod11, blamed the industry for damaging its own credibility. He pointed to a market crash taking place despite a political environment described as more supportive of crypto. The comments reflected frustration about how quickly confidence has faded.

Related: BTC Hashrate Slides 15% as Ongoing Miner Capitulation Pulls Price to $89K

Mike Novogratz linked the rally in gold to broader doubts about the US dollar’s role. He said the gold price action suggests reserve currency confidence is weakening. He also said Bitcoin has faced persistent selling pressure and needs to clear the $100,000 to $103,000 range to restore its uptrend.

Gold Extends Rally as Bitcoin Follows Risk Assets

Other traders took a different view of the divergence. Joe Consorti said Bitcoin falling on geopolitical escalation, instead of rising with gold and silver, shows that the market is still early. He framed it as evidence of an information gap still present in global markets.

Source: X

Gold extended its rally to $4,870.68 as of press time and rose about 2.31% in the latest move. The metal has gained for three straight sessions and pushed closer to $4,900. The surge highlighted defensive demand during rising political and trade uncertainty.

Goldman Sachs commodity researcher Daan Struyven described gold as the bank’s highest conviction call. He repeated a base case view of gold rising to $4,900 per ounce. He also noted risks remain tilted to the upside.

However, analyst Ted Pillows warned that Bitcoin must hold above $89,000. He said losing that zone would end the short-term uptrend. The level has become a key line watched by traders.

Source: X

The market drop followed renewed tension linked to Trump’s Greenland stance. Trump reiterated there would be no retreat and threatened 10% tariffs on eight European nations beginning in February. The move was tied to objections over US annexation efforts.

French President Emmanuel Macron rebuked the approach at Davos. Reports said the EU prepared emergency countermeasures, including retaliatory tariffs worth €93 billion on US imports. No agreement has been confirmed so far.

For now, Bitcoin’s decline alongside risk assets, instead of tracking gold, remains the central story. The move underlined that Bitcoin is still treated as a speculative asset during crisis periods. The gap between gold and crypto widened as fear rose in global markets.