SAND Price Jumps 11% as Two-Week Bullish Streak Extends

- SAND price climbs as GameFi demand rises and volume spikes across major tokens.

- Buyers defend the $0.14–$0.10 zone while higher lows shape early recovery structure.

- Key resistance near $0.29 limits upside as broader trend signals stay cautious.

The SAND price pushed higher again today, adding nearly 11% in 24 hours and stretching a rebound that has been building for two weeks. The move comes on the back of a strong prior stretch, when the token climbed roughly 30% last week and re-entered market conversations after a period of muted trading.

Trading picked up noticeably as well. Market value now sits near $428.72 million, while volume rose almost 46% to $259.32 million. That uptick in activity hints at a market leaning back into risk after several hesitant weeks, though the trend remains fragile.

GameFi Momentum Adds Fuel

According to CoinMarketCap data, GameFi names were among the strongest performers in the latest session. Sector data showed nearly 7% growth on January 22, outpacing the broader crypto market’s steadier tone.

The shift pulled capital into familiar high-beta projects such as The Sandbox, Axie Infinity, and Decentraland. This rotation often appears when traders feel slightly more comfortable taking on volatility.

The SAND price benefited from that shift, slotting back into its role as one of the sector’s preferred liquidity hubs. Still, even with the recent rally, the token is climbing out of a deep trough rather than confirming a full trend recovery.

Structure Shows Early Stabilization

From a technical perspective, SAND’s chart remains mixed. A sharp rejection at the 20-day moving average halted earlier momentum and briefly revived selling, reinforcing a longer-term bearish backdrop.

At press time, the token continues to trade below its major moving averages, a reminder that higher-timeframe pressure has not fully cleared. Yet the lower edge of the market has held firm. The SAND price found support repeatedly in the $0.14 to $0.10 pocket, an area that has shaped trading behavior for months.

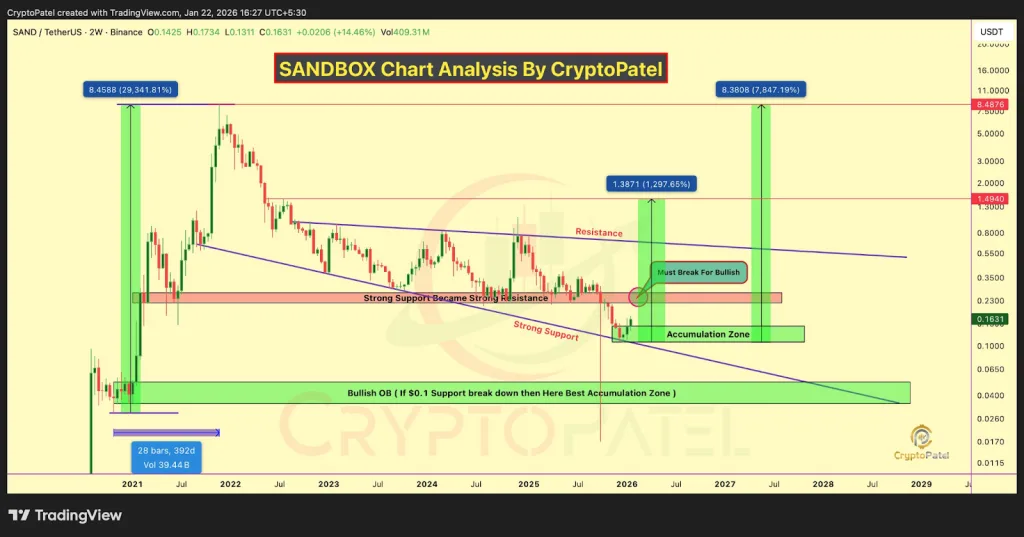

Source: TradingView

A higher low has now formed above that zone, a subtle but important sign that sellers no longer have the same control they held late last year. Besides, momentum readings tell a similar story. The RSI has worked its way back toward the low 40s after dipping into oversold territory.

It is not a clean signal, nor is it meant to be. But the lift shows buyers reappearing in enough size to cool the earlier slide. A move above the 50 mark would strengthen that case, though markets are rarely that neat.

For now, SAND remains boxed in beneath its short- and medium-term moving averages. Until those levels give way, rallies face the risk of fading as they have before. A notable ceiling sits near $0.29, overlapping with the 23.6% Fibonacci retracement. Traders point to this level as the next test for any attempt at sustained recovery.

Related: RIVER Price Hits $48 Record High Amid Rising Market Manipulation Scrutiny

Longer-Term Setup Draws Attention

A separate high-timeframe view from analyst Crypto Patel outlines a larger structure still in play after SAND’s roughly 99% slide from its peak. The token has carved out a base inside a descending channel. Reactions in the $0.14 to $0.11 band have held for months, and the setup remains intact as long as the SAND price stays above $0.10 on higher-timeframe closes.

Source: X

While longer-range projections exist, near-term focus remains on whether SAND can hold its footing and press into the next resistance cluster. For now, the market shows early signs of steadiness, enough to extend the streak, but not enough to claim a breakout.