Coinbase Survey Shows Bitcoin Undervalued by Institutions

- Coinbase data shows 71% of institutions view Bitcoin as undervalued at current price levels.

- Most institutions plan to hold or add Bitcoin even if the market drops another 10%.

- Gold and silver outperform Bitcoin as institutions position for rate cuts in 2026.

Around 70% of institutional investors believe Bitcoin remains undervalued when priced between $85,000 and $95,000, according to a new report from Coinbase. The finding comes as Bitcoin continues to trail gains in precious metals and the stock market during elevated geopolitical and macroeconomic uncertainty.

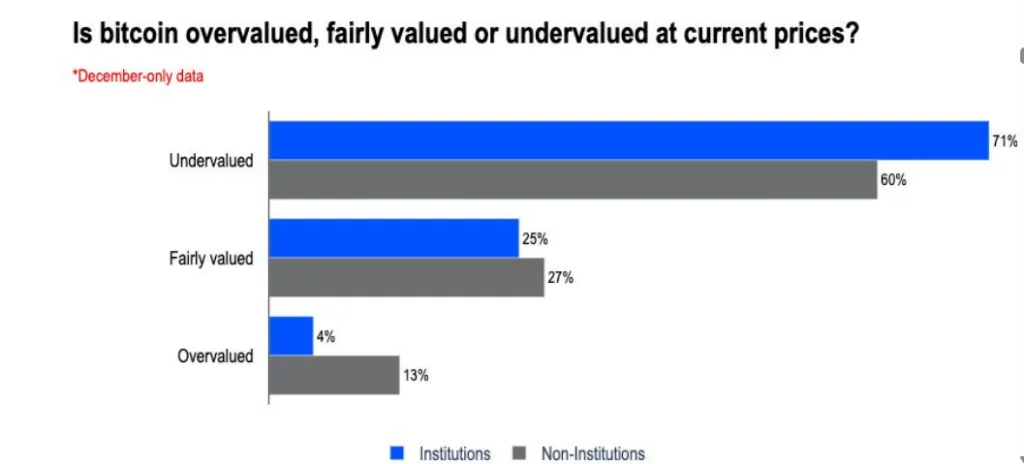

Coinbase said in its Charting Crypto Q1 2026 report that a survey of 75 institutional investors and 73 independent investors ran from early December to early January. The results showed that 71% of institutions and 60% of independent investors felt Bitcoin was undervalued during that period.

A further 25% of institutional investors described Bitcoin as fairly valued, while just 4% said the asset appeared overvalued. Bitcoin prices remained within the $85,000 to $95,000 range throughout the survey window.

The survey period followed a phase of price weakness after Bitcoin peaked above $126,000 in late 2025. Bitcoin now trades at approximately $87,600, reflecting a 30% decline from its October all-time high of $126,080.

Market Weakness Persists as Macro Pressures Build

Crypto prices have mostly moved sideways or lower since a sharp market crash on Oct. 10 erased more than $19 billion in leveraged positions. Since then, market sentiment has struggled to recover. Renewed tariff threats from the Trump administration and rising tensions between the United States and the Middle East have weighed on risk assets. These factors have limited momentum across the digital asset market.

Coinbase said geopolitical risks could continue to pressure sentiment. The firm warned that escalating unrest, especially events that disrupt energy markets, could negatively affect investor confidence. Traditional safe havens provide better performance. Gold reached a record high above $5,000, while silver has doubled its market value since October.

The Standard & Poor’s 500 has increased approximately 3% during the same time frame. The divergence shows how Bitcoin has performed worse than metals and equities during the recent period.

Institutions Signal Long-Term Commitment to Crypto

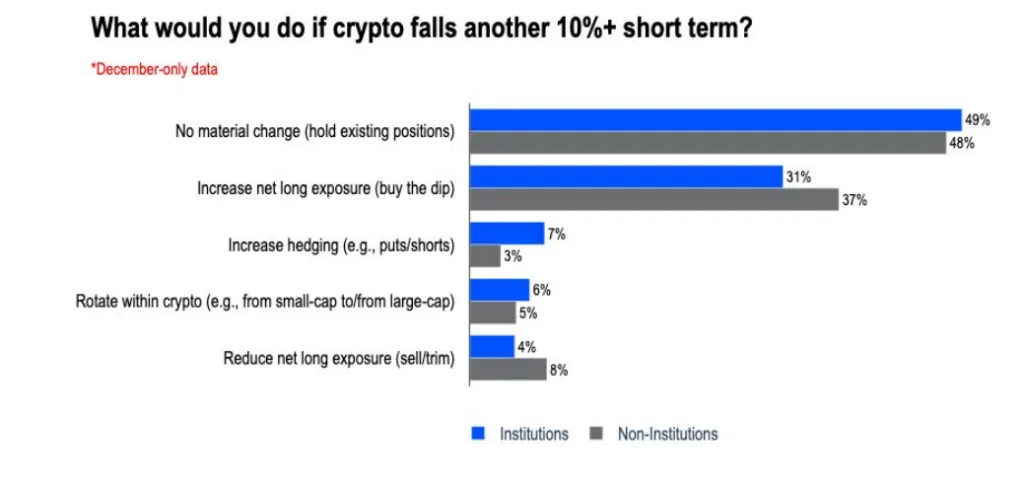

Despite near-term price pressure, institutional investors have conviction. About 80% said they would hold or increase their crypto positions if prices fell another 10%. More than 60% of surveyed institutions reported that they maintained or expanded crypto allocations since October 2025.

The current position stands in opposition to the recent withdrawal of funds from Bitcoin investment products. Market data shows roughly $483.4 million exited spot Bitcoin ETFs in recent weeks, led by the Greyscale Bitcoin Trust.

Related: White House Advisor Slams Coinbase Over Crypto Bill Exit

Why do institutions remain committed while prices lag other asset classes? Institutions also see potential opportunity ahead. About 54% described the current crypto cycle as either an accumulation phase or a bear market. Coinbase expects monetary conditions to improve. The firm anticipates two interest rate cuts from the Federal Reserve in 2026, which could support risk assets.

Coinbase added that the broader economy appears stable. Consumer inflation stood at 2.7% in December, while real GDP grew above 5% in the fourth quarter. The survey builds on earlier research from Coinbase and EY-Parthenon. That research showed institutional digital asset allocations rose in 2024, with many firms planning further increases through 2025.