Avalanche (AVAX) Tests Key $8–$11 Support Zone: Is a Rally Next?

- AVAX revisits its long-term $8–$11 support zone after a deep multi-month price decline.

- Avalanche’s charts show cooling momentum, while exchange outflows hint at steady accumulation.

- VanEck’s new Avalanche ETF adds a fresh institutional channel for market exposure.

Avalanche’s native token, AVAX, has slipped back into a price band that has shaped much of its chart over the past two years. At roughly $11.68, the token is leaning once again on the $8–$11 support zone after a long descent from the $26 region seen in late September.

The slide came in waves rather than a single washout, carving out a 75% drawdown that pushed the token to its weakest level since 2023. The retreat fits into a broader cooling across the asset.

CoinMarketCap data shows losses of 6% to 8% over the past week and month, with a year-on-year decline of about 65%. Those figures underline how long the downtrend has persisted and why sentiment remains cautious even at support.

Bearish Structure Still Dominates Price Action

Weekly charts continue to reflect that pressure. At press time, AVAX’s price remains below its 50-week and 200-week moving averages, now hovering near $20 and $24, respectively. Those levels acted as resistance during each recovery attempt last year, and their position above the spot price underscores how much control sellers still maintain.

However, trading activity in AVAX’s market has quieted as well. Per CoinMarketCap, its daily volume slipped roughly 25% to around $250 million, which traders interpret less as capitulation and more as a wait-and-see lull. With the token resting on an area that has repeatedly anchored prior rebounds, participants appear content to watch rather than chase.

Technical Signals and Levels in Focus

From a pattern perspective, a falling wedge continues to take shape on AVAX’s higher time frames, though its relevance depends on whether price can hold the lower boundary. AVAX is drifting close to that line now, where previous declines have eased as sellers ran low on conviction.

Source: TradingView

Besides, momentum readings echo that cooling effect. The RSI sits near the mid-30s, a region that has previously marked exhaustion without necessarily promising a clean reversal. Still, if the market steadies, the first practical checkpoint sits near $14.93, a level last tested in mid-January.

Only above that zone do the major moving averages and broader retracement levels come back into view. The 38.2% Fibonacci mark near $30, stacked against resistance in the $33 to $36 corridor, remains distant and carries more weight as a medium-term obstacle than a near-term target.

Analyst Views and Market Positioning

Market watchers are focused on the same narrow band around $11. One such analyst, Ali Martinez, noted that holding this line could open a path toward $13.10 or even $15.01, though he framed it as a structural checkpoint rather than a directional call.

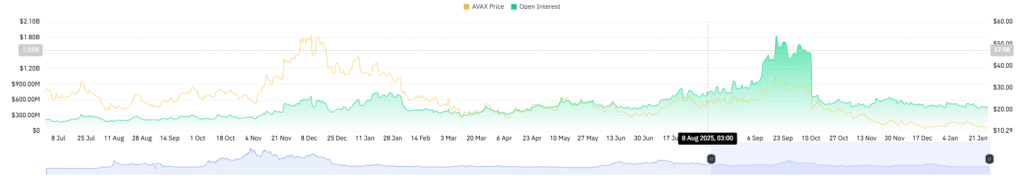

On the derivatives side, open interest stands near $468 million and has barely budged despite an 8% uptick in the past day. This kind of sideways positioning often points to reduced appetite for aggressive leverage, a pattern that tends to calm volatility rather than stoke it.

Source: CoinGlass

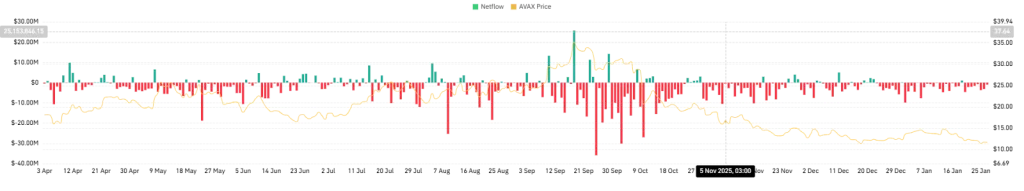

Meanwhile, flows in the spot market offer a more telling signal. Since December 25, exchange outflows have been steady, with more than $3 million worth of tokens moved to cold storage in a single recent session.

Source: CoinGlass

That shift suggests accumulation rather than active trading, reducing the amount of circulating supply available to sell into weakness.

Related: DOGE Price Signals Buy Near Key Support as Oversold Pressure Grows

Institutional Context Adds a New Layer

Fundamentally, the AVAX market received an additional variable yesterday when VanEck listed its Avalanche ETF under ticker VAVX on Nasdaq. The fund offers direct exposure to AVAX’s price while incorporating staking rewards, and fees on the first $500 million in assets are waived until late February.

For institutions that avoid hands-on validator work, the product simplifies access to the network and may ultimately lock away a portion of supply if inflows arrive. Whether that backdrop is enough to counter a firmly bearish trend remains unclear.

But with technical compression tightening and spot holders pulling supply off exchanges, Avalanche now faces another pivotal test at a level that has defined its direction more than once.