Criminal Crypto Funds Move From Exchanges To Chinese Channel

- Illicit crypto laundering now moves through Chinese language services beyond exchanges.

- Exchange compliance and fund freezes push criminals toward informal laundering networks.

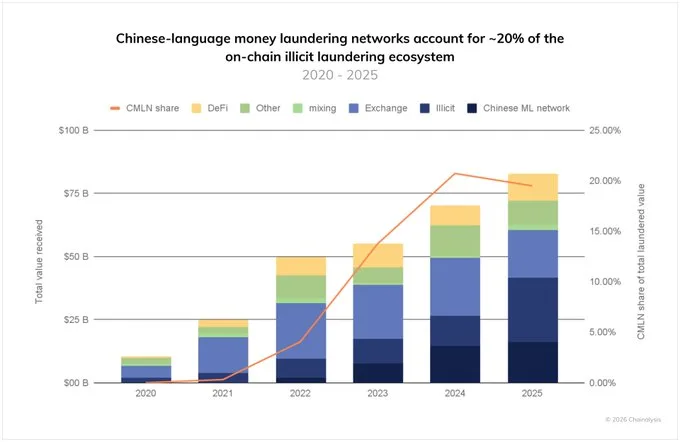

- Chinese language laundering networks handled about one-fifth of illicit crypto flows.

Illicit crypto laundering is moving away from centralized exchanges and into informal service-based networks, according to new findings from blockchain analytics firm Chainalysis.

The shift reflects tighter compliance at exchanges and growing use of Chinese-language laundering services. Criminals now prefer off-platform coordination together with money mules and informal trading channels, according to Chainalysis data.

The main exit points for criminal proceeds used to be centralized exchanges. That role continues to shrink as enforcement pressure and asset-freezing risks rise.

Source: X

Why are criminals abandoning exchanges that once dominated crypto laundering flows?

Chinese-Language Networks Take the Lead

Chainalysis reported that Chinese-language laundering networks now dominate known crypto money laundering activity. The networks function through Chinese-speaking channels to provide laundering-as-a-service operations. The networks use money mules and informal over-the-counter desks together with gambling platforms as their primary methods for transferring money. The networks first appeared during the early months of the COVID-19 pandemic in 2020.

The networks have developed into a global operation that serves users across multiple countries since their development. Chainalysis said these services allow criminals to break up, mix, and swap crypto outside regulated venues.

According to the firm, Chinese-language Telegram-based services now account for a disproportionate share of global on-chain laundering. They operate across borders and avoid formal registration. As a result, they remain harder for regulators to monitor or disrupt.

Exchange Crackdowns Reshape Laundering Routes

Centralized exchanges have strengthened customer checks and transaction monitoring in recent years. Global regulators have tightened rules to limit illicit crypto use. As a result, exchanges can now detect suspicious activity faster and freeze funds more often.

Chainalysis linked the decline in exchange-based laundering directly to these controls. The firm said criminals increasingly avoid exchanges because platforms can block withdrawals. That risk pushes illicit actors toward informal networks that operate beyond compliance frameworks.

In the last five years, Chinese-language networks processed about 20% of tracked illicit crypto funds. During the same period, use of centralized exchanges steadily declined. Chainalysis said inflows to these networks grew far faster than inflows to exchanges.

Laundering Volumes Surge as Enforcement Lags

Chainalysis’s 2026 Crypto Crime Report shows how laundering patterns changed over time. In 2025, illicit on-chain crypto laundering exceeded $82 billion. That figure rose from about $10 billion in 2020. A Reuters report identified Chinese-language networks as a key driver of this growth. The report said these networks handled about 20% of known laundering activity.

They processed roughly $16.1 billion in illicit funds during the year. Chainalysis estimated that inflows to identified Chinese-language networks grew 7,325 times faster than inflows to centralised exchanges since 2020. The firm said rising crypto liquidity and accessibility fuelled the expansion. It added that law enforcement capabilities still lag behind criminal innovation.

Related: India Tightens Crypto Oversight To Block Illicit Money Flows

Tom Keatinge, director at the Royal United Services Institute, told Chainalysis there is a widening gap between criminals and law enforcement in crypto use. He said blockchain tracing tools help, but only address part of the problem. Keatinge called for global efforts to improve skills and information sharing across jurisdictions.

Chainalysis stated that successful disruption requires all three elements of illegal business operations – their distribution channels and advertising targeted platforms. The organization warns that shutting down individual facilitators results in the rapid replacement of those same facilitators. The company expressed that countries need to work together through international partnerships because informal networks have begun operating at larger scales.