Amberdata Report Correlates WLFI Plunge With BTC Collapse

- WLFI trading volume expanded 21.7 times the baseline within minutes of tariff headlines.

- Perpetual funding reached 2.87% per eight hours, implying 131% annualized stress.

- The erosion of WLFI collateral triggered market liquidations in Bitcoin and Ethereum.

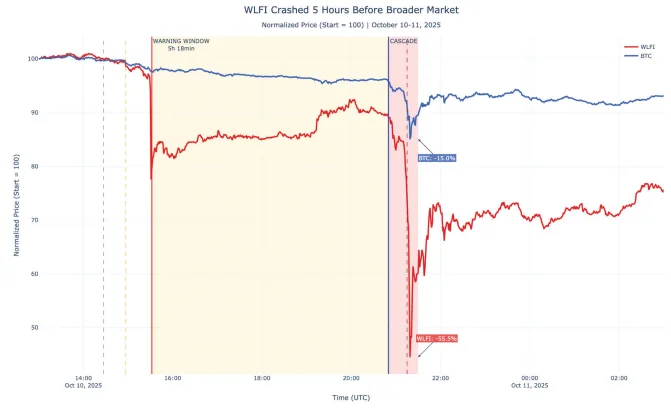

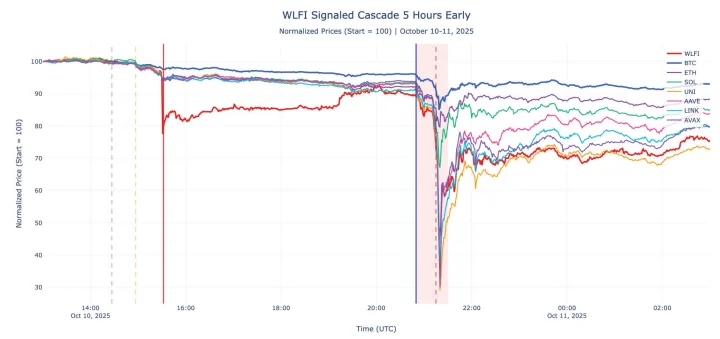

World Liberty Financial Token (WLFI) declined sharply more than five hours before a $6.93 billion crypto liquidation wave struck on Oct. 10, 2025, according to a new Amberdata report. During the crash, Bitcoin fell about 15%, and Ether dropped roughly 20%, while several smaller tokens plunged up to 70%.

Amberdata said WLFI’s early divergence occurred while Bitcoin still traded near $121,000 and showed little visible stress, raising questions about whether the governance token signaled broader market strain before the cascade began.

Amberdata examined trading patterns from that day and found that WLFI’s decline started hours before the broader selloff accelerated. Mike Marshall, who authored the report, said the five-hour gap stood out. “A five-hour lead time is hard to dismiss as a coincidence,” Marshall said. He added that such a duration separates an actionable warning from a statistical anomaly.

The report does not allege insider trading. Instead, it argues that crypto market structure can amplify certain assets beyond their size.

Unusual Trading Patterns Before the Crash

Researchers identified three unusual patterns in WLFI trading before the market broke lower. First, WLFI’s hourly volume surged to about $474 million, roughly 21.7 times its typical level. That spike appeared within minutes of tariff-related political news entering the public domain.

Second, WLFI diverged sharply from Bitcoin during that period. While Bitcoin held near $121,000, WLFI began sliding. Marshall described the activity as “instrument-specific,” meaning traders focused heavily on WLFI rather than the broader crypto complex.

“If this were superior analysis, you’d expect to see that reflected more broadly,” Marshall said. “What we actually saw was concentrated activity in WLFI first.” He added that the pattern suggested targeted execution rather than general market repositioning.

Third, leverage intensified around WLFI. Funding rates on WLFI perpetual futures reached about 2.87% every eight hours. That level translated into an annualized borrowing cost near 131%, reflecting aggressive positioning.

Trading volume accelerated roughly three minutes after public tariff news broke. Marshall said that speed suggested prepared execution rather than retail traders reacting in real time.

Related: WLFI Drops 8% as Bearish Trend Deepens: What Comes Next?

How WLFI’s Drop Spread Across Markets

The report links WLFI’s early decline to the broader crash through collateral mechanics. Many crypto exchanges allow traders to post various tokens as collateral for leveraged positions. When WLFI’s price fell, the value of that collateral dropped quickly.

As collateral values shrank, traders faced margin calls. To cover positions, they sold more liquid assets such as Bitcoin and Ether. Those sales pushed prices lower and triggered further liquidations across the market.

Amberdata described WLFI as a “liquidity sponge” because of its vast supply and concentrated holder base. According to the report, politically connected participants hold a large share of the token. By contrast, Bitcoin ownership remains widely distributed.

Early selling by that concentrated group can trigger cascading reactions before the broader market adjusts. In the October event, WLFI began declining more than five hours before Bitcoin reacted to tariff headlines. That divergence, Amberdata said, created a flow-based early warning signal for traders watching price and volume shifts.

Political Catalysts and Ongoing Risks

The report also identifies a near-term catalyst: the Mar-a-Lago “World Liberty Forum” scheduled for February 18. Amberdata said such events can create narrative windows that amplify price action around politically sensitive tokens.

Recently, WLFI rose about 12% within 24 hours ahead of that forum. Amberdata noted that traders should monitor whether price action aligns with event outcomes or diverges again, potentially revealing pressure beneath the surface.

At the same time, WLFI carries what the report calls a persistent “amber alert” status. Community warnings about scams or suspicious on-chain activity can spark rapid selling. Combined with concentrated ownership and political sensitivity, those alerts add another layer of volatility.

Against that backdrop, the October 10 episode raises a central question: can a politically linked governance token continue to act as a leading indicator for broader crypto market stress?