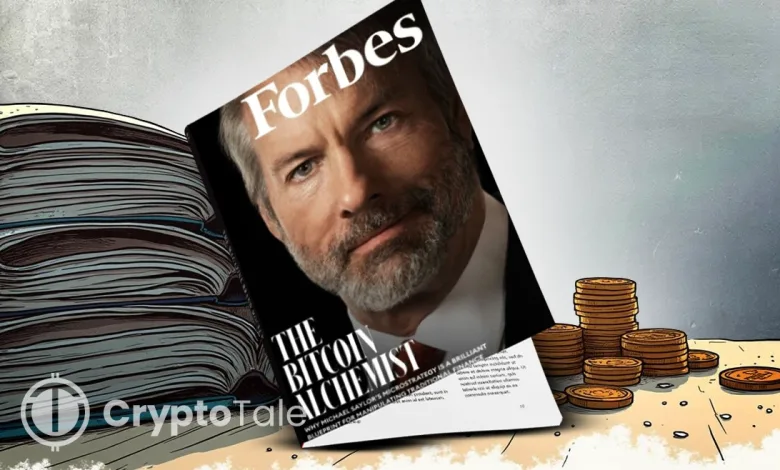

Is Michael Saylor the Next Target in Forbes Crypto Scandals?

- Michael Saylor, CEO of Microstrategy got featured on Forbes as “The Bitcoin Alchemist”

- Saylor has accumulated over 470,000+ Bitcoins worth around $50 billion.

- Crypto followers speculate about Michael Saylor’s downfall after being featured on Forbes.

Michael Saylor, the founder of MicroStrategy (MSTR) was featured on the Forbes cover, with the title – The Bitcoin Alchemist. Accumulating Bitcoins since 2020, Saylor has amassed over 470,000+ Bitcoins worth $50 billion to his holdings. With constant purchases, Saylor had further predicted that Bitcoin would surge to $13 million by 2025.

Big Whales and Their Scams

Just like Michael Saylor, FTX Co-founder, Sam Bankman-Fried, and Binance CEO Changpeng Zhao got featured on Forbes cover. However, they were later charged of treason and sent to prison.

Sam Bankman-Fried was sentenced to 25 years in prison for his orchestration of multiple fraudulent schemes. In his FTX scandal, he defrauded investors of 1.7 billion. Additionally, Alameda Research, the sister company of FTX, defrauded lenders of more than $1.3 billion.

On the other hand, Zhao was sentenced to 4 months in prison for violating the Bank Secrecy Act during his crypto exchange. The Department of Justice (DOJ) sought a three-year prison sentence while CZ’s lawyers requested prison. CZ pleaded guilty to DOJ and stepped down as Binance CEO. With such incidents occuring to members on Forbes cover, market observers speculated that Saylor would be the next target.

Proposal to Buy $42 Billion Bitcoin

On October 2024, in a call to Bitcoin investors, Saylor announced the next step of launching a daring $42 billion Bitcoin buying spree for the next three years. Making it up to 3% of total Bitcoin circulation could rack up Bitcoin value for years to come.

Microstrategy already has $21 billion worth of Bitcoins and aims to double the company’s current Bitcoin holdings. Saylor is determined to transform his company into what he calls the “Bitcoin Treasury Company”.

Related: Bitcoin Pushes to $105K After Fed’s Move on Interest Rates

How Does This Impact Bitcoin in 2025?

Donald Trump’s winning the US Presidential election appears to power up Bitcoin in 2025, and many crypto enthusiasts are hoping he’d pave the way for the crypto world. But Saylor’s plan to buy as much Bitcoin as much as possible, tells us that the price of Bitcoin is only going higher.

With Bitcoin yield, MicroStrategy analyzes the ratio between the company’s holdings and its assumed diluted shares. With Saylor’s growth in Bitcoin holdings, several companies have shown their interest towards buying the crypto, as it enhances their position in the financial market.

Howeve, analysts, weighing Microstrategy’s plan, stated that, if MSTR plans to raise $21 billion, there would not be any investor demand for the debt and it would blow up the Bitcoin yield and possibly strain the company’s cash flow. While Bitcoin price going above $1 million within a few years might seem unfathomable, but if every nation goes on a buying spree, it would result in a Bitcoin gold rush, just like Saylor predicted.