The United States Securities and Exchange Commission (SEC) made the announcement today that it has charged a cryptocurrency lender known as Nexo with failing to register the offer and sale of its retail crypto asset lending product known as the Earn Interest Product (EIP).

In order to resolve the allegations against it, Nexo has consented to pay $22.5 million and to end its unregistered offer and sale of the EIP to investors in the United States.

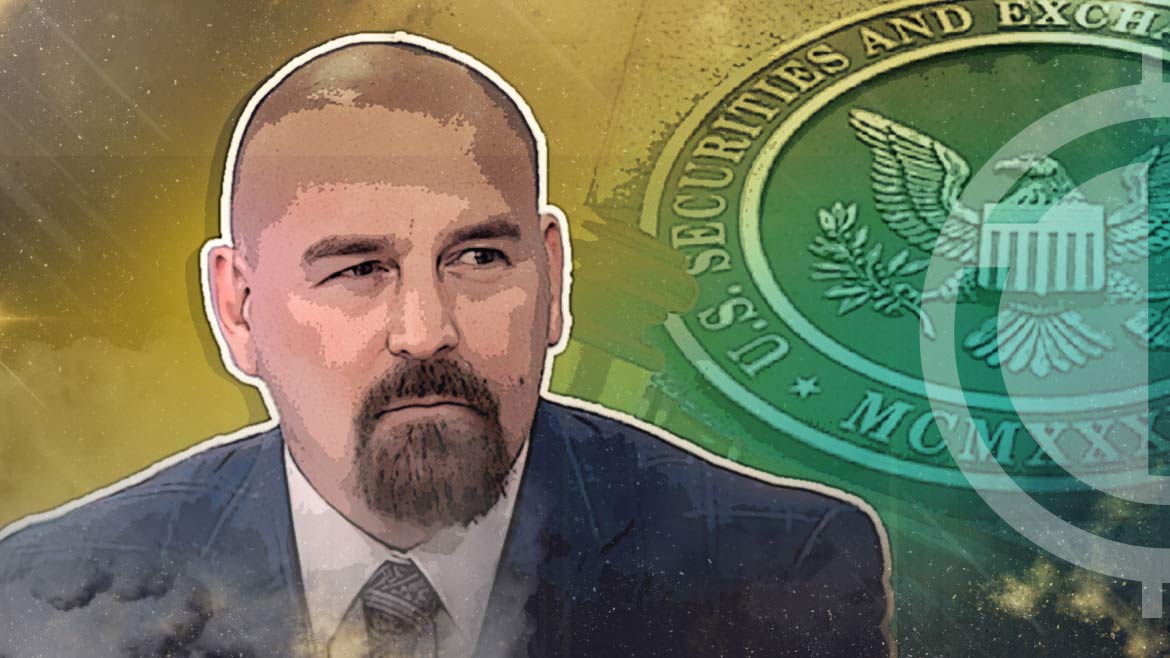

John Deaton, a prominent cryptocurrency attorney, has spoken out against the actions of the SEC. According to Deaton, the only yield products that will receive approval from the regulator are the ones that are made available by Goldman Sachs and JPMorgan, making it clear that SEC boss Gary Gensler just hates crypto.

During the course of the investigation, it was found that EIP investors were able to passively collect interest on digital assets by loaning such assets to Nexo, according to the statement made by the SEC.

The regulatory body also mentioned that the cryptocurrency lender retained complete control over the activities that brought in money and were put to use to generate returns for investors.

Through its website and various social media channels, the company sold and advertised the EIP as well as other goods to potential investors in the United States, said the SEC, adding that the company said that potential investors might get returns of up to 36% in some situations.

Gensler said:

“Compliance with our time-tested public policies isn’t a choice. Where crypto companies do not comply, we will continue to follow the facts and the law to hold them accountable.”

The SEC chair noted that they considered Nexo’s level of cooperation and the speed with which they took corrective action in the settlement negotiations.