Cryptocurrency markets are always in flux, and understanding the underlying trends is key to becoming a successful crypto trader. One of the most important concepts to understand is the bull market cycle – that is, when prices start to rise after a period of low activity or falling prices. But how do you know when this happens?

Well, one way is to look at on-chain indicators. These are indicators that measure activity related to a cryptocurrency’s blockchain, such as number of transactions, hash rate, and network fees. By looking at these metrics, you can get an idea of when the market is beginning to turn around and prices may start climbing.

Here are five important on-chain indicators to look for when anticipating the start of a bull market cycle:

The first indicator is flows between spot and derivative exchanges. Bitcoin movements from spot to derivative exchanges indicate that investors have taken a risk-on approach, signaling the early signs of a new bull cycle.

Another reliable on-chain indicator is the MVRV ratio, which measures the average profit/loss of all Bitcoin holders. This ratio is currently above 1 (1.07), close to its 365-day moving average, suggesting that Bitcoin is about to start a new uptrend.

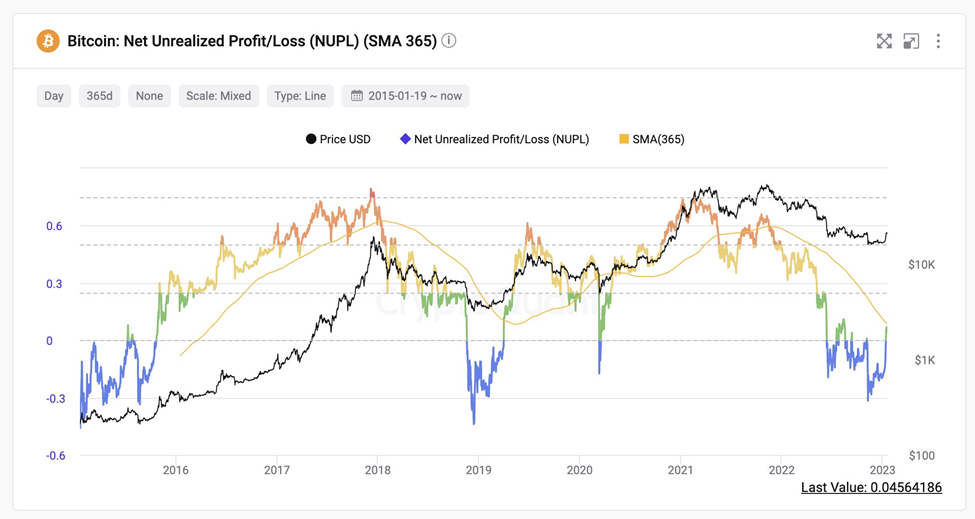

The third indicator is the Net Unrealized Profit/Loss (NUPL), which measures the average profit margin of Bitcoin holders compared to their cost basis. This ratio is currently close to its 365-day moving average, indicating that there may be increasing demand for Bitcoin and a new uptrend approaching.

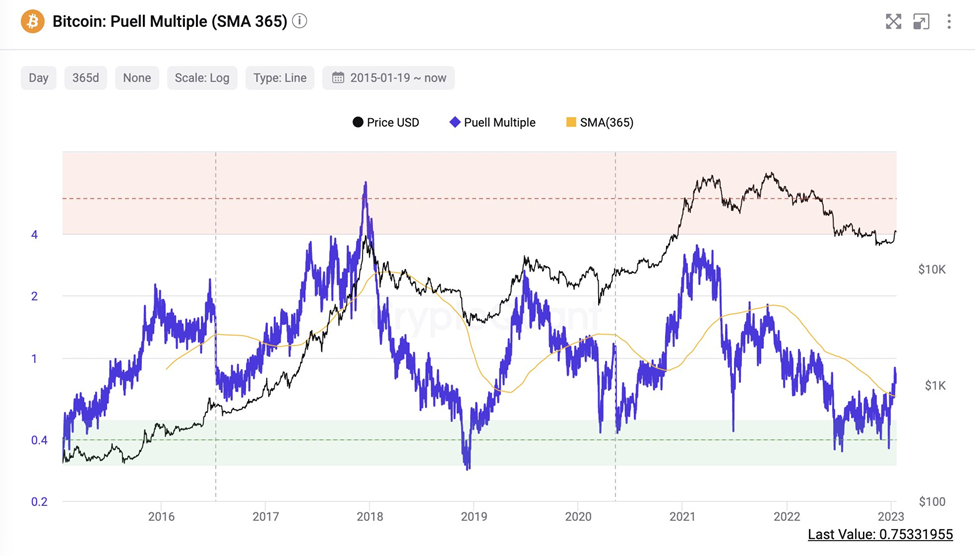

Fourthly, the Puell Multiple index is showing a shift to a positive trend because Bitcoin’s price has passed its 365-day moving average to the upside for the first time in a significant way since November 2020. The Puell Multiple measures the rate at which Bitcoin miners can cover their costs by selling mined coins and suggests that the market is entering a new positive cycle.

Lastly, CryptoQuant’s P&L Index combines the MVRV ratio, NUPL, and LTH/STH SOPR into a single bitcoin value indicator. The index is close to giving a buying signal for BTC, which happens when the index (dark purple line) crosses its 365-day moving average (light purple line).

Conclusion

On-chain indicators can be valuable tools for investors to analyze and predict market sentiment. The five on-chain indicators discussed above are all suggesting that Bitcoin is entering a new bull cycle with increasing demand, risk-on sentiment, and miner profitability. Careful analysis of these indicators can help investors catch the early wave of a new bullish trend.