Altcoins Market Cap Retests 2021 Levels, Is a Breakout Imminent?

- Altcoins retest $1.71T resistance, sparking intense market anticipation of a breakout.

- Analysts warn that only a decisive close above 2021 levels can confirm sustained momentum.

- Technical strength and ETF buzz ignite hopes of a powerful new phase in altcoin growth.

The altcoin market is pressing against familiar walls, revisiting levels last touched in 2021 and stirring anticipation across crypto circles. Valued at $1.66 trillion, the market now sits just below the historic $1.71 trillion peak, a line that many see as the gateway to a new phase of momentum.

Fueling this renewed energy is October’s powerful rally, coupled with anticipation over upcoming ETF deadlines tied to several altcoins. These developments have injected optimism that the market may finally be gearing up for its next significant breakout.

Still, not everyone is convinced. While sentiment has shifted toward hope, analysts caution against prematurely calling this the start of a full-blown “altcoin season.”

Experts Weigh In on Altseason Momentum and Market Risks

According to analyst Daan Crypto Trades,only a strong weekly close above the 2021 barrier would confirm a genuine breakout.

Source: X

Another analyst, CryptoJack, declared that altseason is underway, citing a classic “cup and handle” breakout pattern. The move has lifted the market cap beyond $1.13 trillion, a level often viewed as the launch point for stronger rallies.

Source: X

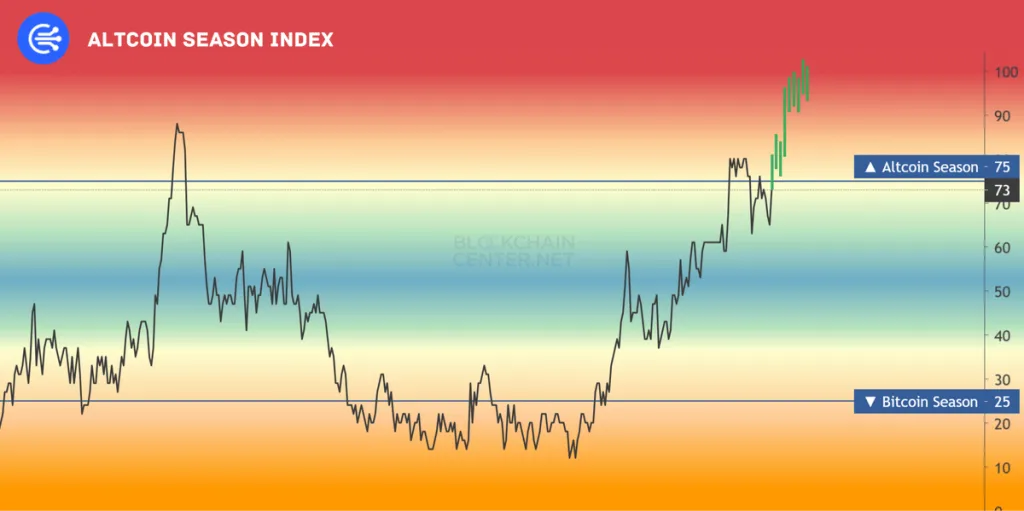

If sustained, this breakout could pave the way toward targets above $2 trillion, signaling a extended cycle for altcoins. Echoing this, analyst Wimar.X noted that the Altcoin Season Index has surged to 73, edging close to the official altseason threshold of 75.

Source: X

He argued that once the index climbs into the 85–100 zone, altcoins typically deliver explosive rallies, often outperforming Bitcoin significantly. “We’re so close to the real altseason,” he remarked, stressing how momentum is building across the market.

Related: Altcoins Lead Q3 2025 Crypto Performance, Outpacing Bitcoin

Trend Indicators Show Buyers Firmly in Control

From a technical lens, the altcoin market cap is flashing clear bullish signals. The Directional Movement Index (DMI) indicates a +DI of 28.94, significantly higher than the -DI of 10.90, suggesting that buyers are firmly in control of the market.

The ADX reading at 32.57 reinforces this outlook, indicating that the current trend is not only positive but also strong enough to sustain in the near term. Momentum indicators echo the same sentiment.

Source: X

The MACD line, at 188.8B, is comfortably positioned above the signal line at 145.03B, a configuration that traditionally signals growing bullish momentum. Supporting this view, the MACD histogram continues to print expanding green bars above the zero line, indicating an increase in upward movement strength.

The market structure itself is trading within an ascending triangle pattern, a formation often associated with breakout potential. If this setup holds, it could mark the beginning of another significant leg higher, reinforcing the narrative that altcoins remain positioned for further gains.

The altcoin market stands at a decisive moment, testing levels not seen since 2021 and attracting widespread attention. Momentum indicators lean bullish, yet analysts caution that a confirmed breakout above resistance is needed to validate sustained growth.

As optimism builds around technical strength, ETF catalysts, and market sentiment, investors remain alert. Whether this surge marks the dawn of a new cycle or another rejection remains the pressing question ahead.