- Arcane Research reports that Bitcoin mining businesses are selling their BTC.

- Due to falling mining profitability, companies had to sell more than 100% of their overall output in May.

- The situation has only grown worse in June, with Bitcoin falling below its 2017 high of $20,000 and establishing a new low of $17,783.

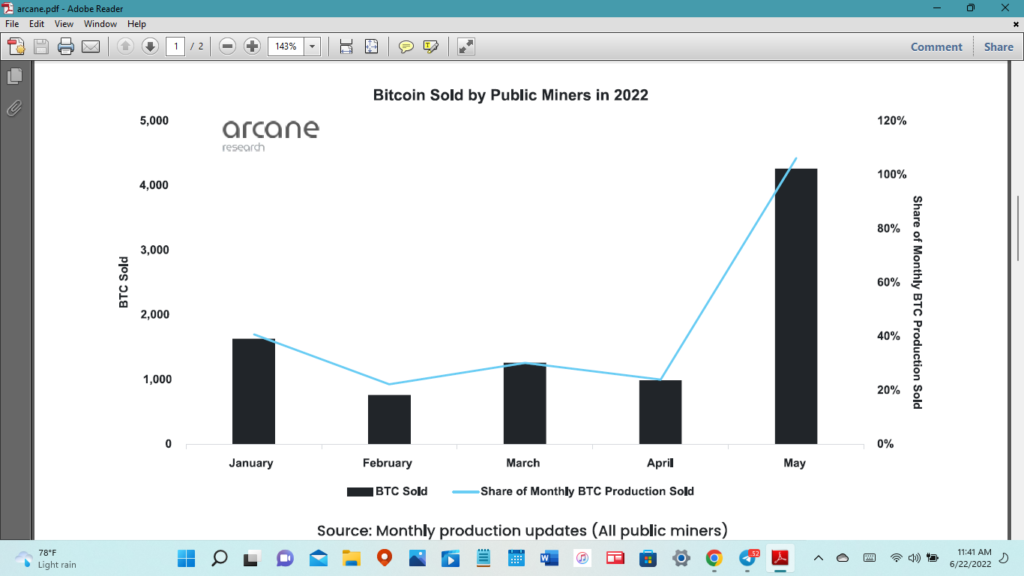

According to a recent report by analysis company, Arcane Research, Bitcoin mining companies are starting to dump off their BTC holdings. According to Arcane Research’s findings, public bitcoin mining businesses sold thirty percent of their bitcoin output in the first four months of 2022, as stated in the study. And because of the precipitous drop in profits from mining, producers were obliged to raise their sale rate in May to more than 100 percent of their total production.

Even though public Bitcoin miners only contribute up to 20% of the entire network hashrate, their actions often mirror the feelings of private Bitcoin miners.

Miners as a group have possession of 800,000 BTC, which places them among the largest whales on the market. The public miners own 46,000 BTC, and their selling frenzy might drive the price of bitcoin further lower in the future.

According to the report, the situation has only gotten worse in June, with the price of Bitcoin going below the peak point it reached in 2017, which was $20,000, and setting a new low point for the last four years, which was $17,783.

Miner’s to exchange flow, a data measure that displays the amount of Bitcoin (BTC) supplied by miners onto exchanges, achieved a new high in June, reaching a level that had not been seen since January 2021. This level had not been seen since January 2021.

Bitcoin’s price is closely monitored by miners since mining devices have a significant association with its movements. Consequently, mining gear costs have declined as bitcoin’s dollar-denominated value has fallen rapidly this month.