Aster Struggles Below $1 After CZ Sell-Off Rumors Hit Market

- Aster plunged sharply after CZ-linked sell-off rumors sparked mass panic among investors.

- Lookonchain denied CZ’s involvement, confirming the $34M transfer was between Binance wallets.

- Despite recovery signs, Aster remains bearish with key resistance at $1 and support at $0.85.

Aster prices fell sharply this week after rumors about Binance founder Changpeng Zhao sent shockwaves through the market. The token plummeted sharply from $1.15 to $0.85 before rising above $0.95. As of press time, Aster is exchanging at $0.9824, down by 12.36% over the past week.

According to reports, a total of 35 million Aster tokens, valued at $30.42 million, were sold by a wallet linked to CZ, according to analyst Farzad. The claim spread like wildfire on social media, prompting massive emotional responses from investors. As a result, many holders raced to the liquidation, and the listing across various exchanges collapsed.

Aster Struggles to Recover Despite On-Chain Clarifications

However, blockchain tracking platform Lookonchain later contested these reports. It explained that the $34.53 million transaction was the transfer of 31.84 million Aster tokens between Binance hot wallets. As a result, the transaction had no connection with CZ’s personal holdings. This clarification failed to ease selling pressure, as traders remained cautious.

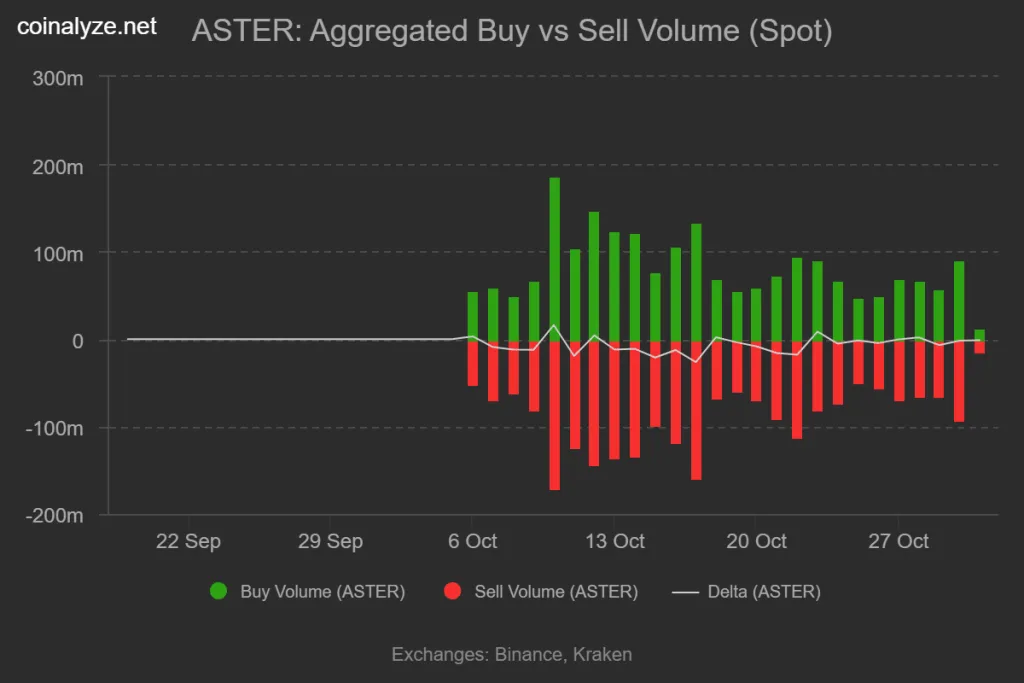

According to data from Coinalyze, Aster recorded a 24-hour sell volume of $107 million and a buy volume of $103 million. This resulted in a 4 million negative buy-sell delta, indicating that selling pressure remains dominant.

Historically, such widespread selling from top holders signals longer bearish phases. The broader market followed the same trend as fear spread. Many traders opted to cut exposure, while others moved funds to stable assets. Liquidity across exchanges declined slightly as sentiment turned defensive.

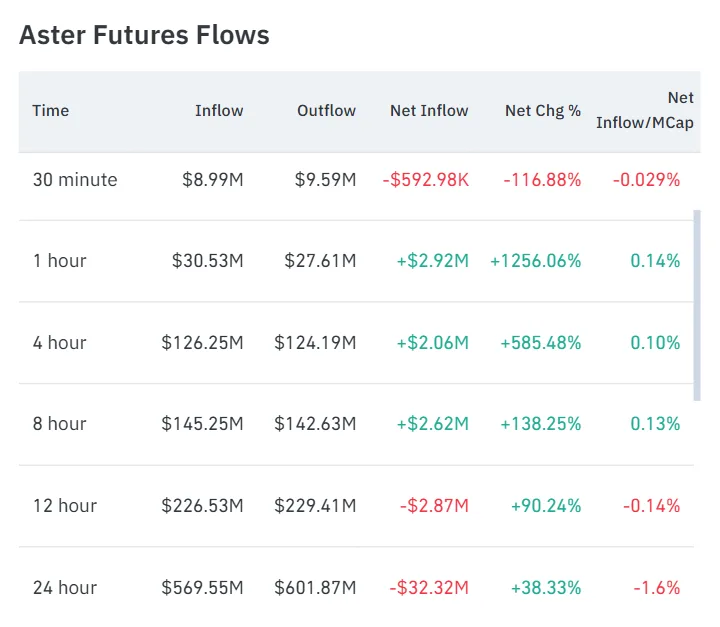

Future flows data highlighted further distress. According to CoinGlass, futures outflows rose sharply to $601 million compared with $569 million in inflows. This shift drove netflow into negative territory at –$32.32 million. Analysts interpreted the movement as a sign of profit-taking and loss of confidence in short-term recovery.

Related: ASTER’s Price Dips After Stage 2 Airdrop Launch, Rebound or More Pain?

Bearish Setup Persists as Aster Struggles Below $1

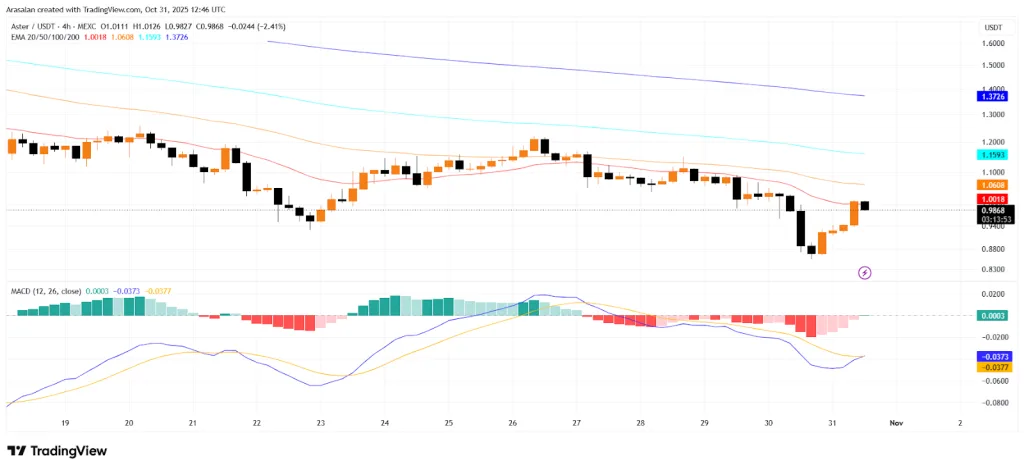

ASTER tried to rebound but encountered some resistance at around $1.0020, which is in line with the 20-day Exponential Moving Average (EMA). The 50-day EMA was around $1.0609, and the 100-day EMA was $1.1593. With all important EMAs above the current price, the bearish setup remained intact. The token maintained temporary support between $0.83 and $0.8.

The MACD line at -0371 has crossed above the signal line at -0.0376, indicating a bullish crossover, and the histogram shows a green bar at 0.0005, suggesting buying momentum. However, with key resistance levels still looming above $1.00 and major EMAs trending downward, Aster’s upside could remain limited in the near term.

According to DeFiLlama, the TVL is at $1.602 billion. The network earned $131.33 million in fees over the last month. The Trading data also indicated Aster was in good condition. Namely, over the past week, it recorded $71.38 billion in perpetual trading volume and $618 million in spot.

The latest dip shows how quickly rumors can sway crypto markets. While clarifications eased panic, confidence hasn’t fully returned. Aster now battles resistance near $1.00, with $0.85 acting as its key support.