Aster Tops Perpetual DEX Fee Charts with $28M in 24 Hours

- Aster generated $28M in fees in 24 hours, surpassing Hyperliquid and other rivals.

- MrBeast and TRUTH Social wallets highlight growing celebrity interest in Aster’s token.

- A falling wedge pattern signals bullish potential despite criticism and retracement risks.

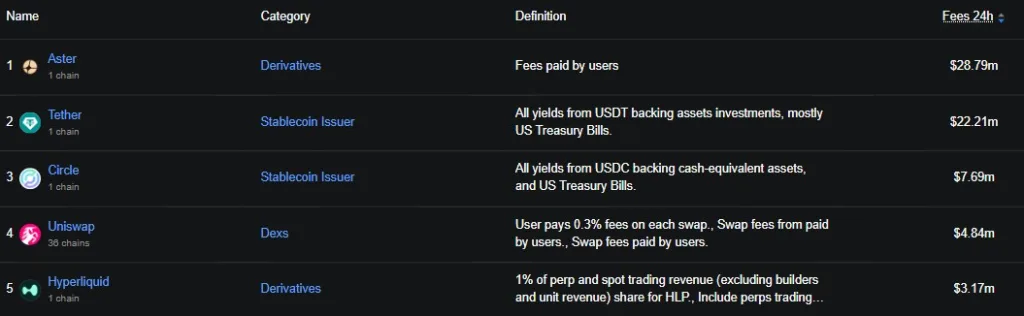

Aster, a decentralized perpetual exchange, has stormed to the top of DeFiLlama’s fee leaderboard, collecting more than $28 million in a single day. The achievement pushed it past veteran rival Hyperliquid and other competitors, highlighting its rapid ascent since launching its native token earlier this month.

Hyperliquid, by comparison, reported only $3.17 million in daily fees, placing it in fifth position. On trading volume, however, the balance shifted. Aster processed $206.92 million in spot trades, ranking 12th overall.

Hyperliquid more than tripled that figure with $639.83 million, highlighting its firmer grip on trading activity. Aster also failed to appear in DeFiLlama’s daily revenue leaderboard, underscoring the uneven distribution of returns across decentralized exchanges.

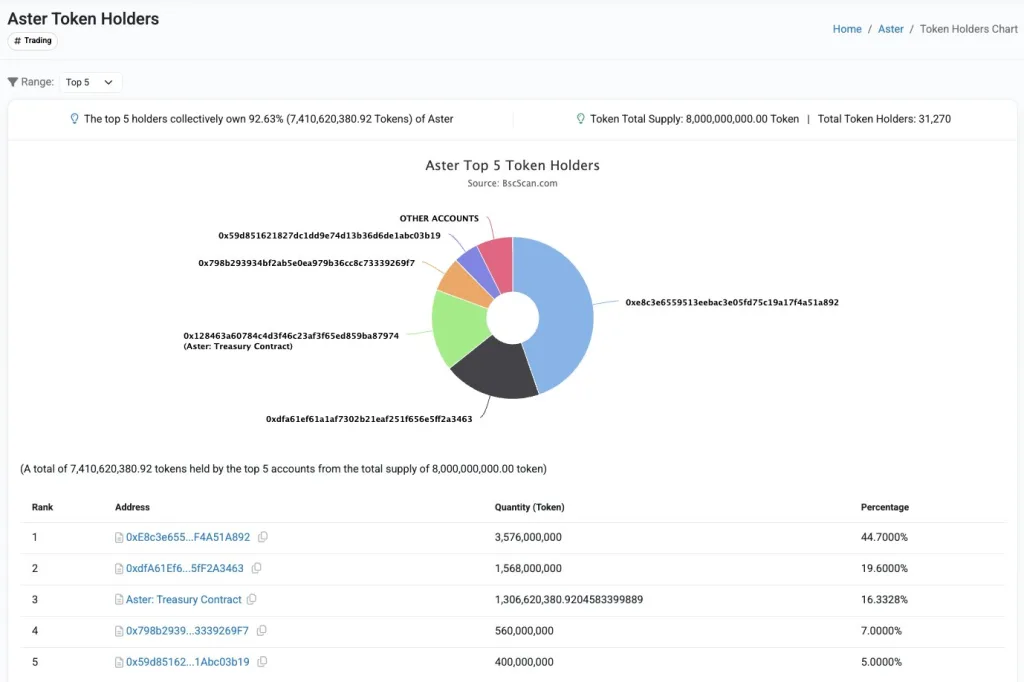

Yet Aster’s rapid climb has also drawn controversy. A post on X alleged that 96% of the token supply is concentrated in just six wallets, likely controlled by one entity.

The critic argued that despite boasting a $10 billion valuation, Aster has only $500,000 in daily BTC spot volume and no functioning product. The post labeled the setup “market manipulation” but also noted that the tightly controlled supply fuels bullish momentum, as concentrated holders can direct prices and suppress short-selling pressure.

ASTER’s Price Action: High-Profile Bets Push Token Into Focus

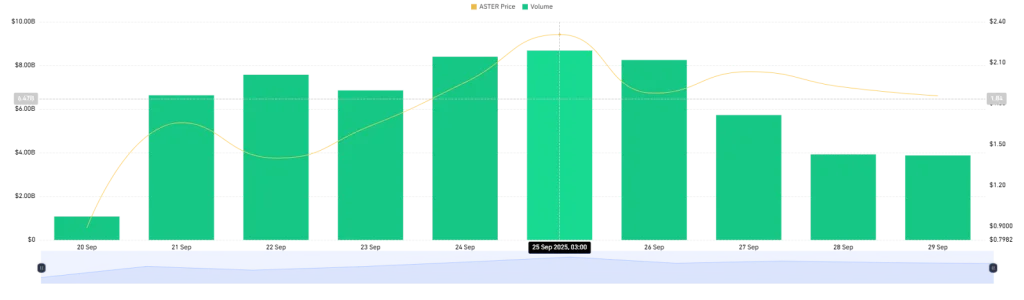

Meanwhile, the platform’s native token ASTER has extended its rally, climbing 13% in the past day to trade around $1.95. According to CoinMarketCap, gains reached 30% on the weekly chart.

The token now carries a fully diluted valuation of $15.63 billion, a decisive leap from its $560 million valuation at the token generation event. Adding fuel to the surge is high-profile interest.

On-chain data from Lookonchain shows YouTube creator MrBeast purchased another 167,436 ASTER tokens for about $320,000, raising his total holdings to more than $1.28 million. Over the last week, wallets publicly linked to him had already acquired over 538,000 tokens.

His accumulation places his average buy-in near $1.87, suggesting a deliberate strategy rather than casual speculation. Reports also point to a wallet tied to Donald Trump’s TRUTH Social, which made a $75 million purchase of ASTER. Such moves signal growing mainstream attention, as prominent figures outside traditional crypto circles place their bets on the project’s trajectory.

Technical Metrics Highlight Key Risk Zones

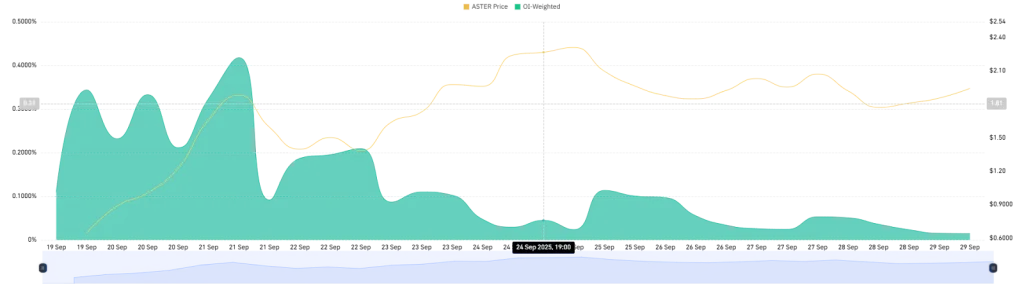

From a technical perspective, Aster’s token is shaping a falling wedge pattern, which is often seen as a bullish reversal signal. Earlier today, the price touched a high of $1.99 before retreating at the wedge’s resistance trendline.

That rejection pulled the token down by 6% to around $1.87, a level that aligns with the 23.60% Fibonacci retracement and now serves as short-term support. Should bearish pressure deepen, analysts point to the $1.74–$1.70 range as the next likely test.

This zone has historically acted as strong support and could present new entry opportunities for long positions. Still, a clean break below that level would undermine the broader bullish setup, shifting momentum in favor of sellers.

Related: XPL Rockets Over 100% as Plasma Mainnet Goes Live, $2 Ahead?

On-chain metrics echo this caution. The OI-weighted funding rate has fallen from 0.4177% to 0.0146%, reflecting cooling bullish enthusiasm. Yet it remains positive, suggesting long holders are still prepared to pay a premium to short sellers, reinforcing a bias toward eventual upside.

Derivatives activity further underscores the trend. Trading volumes have slid to $3.88 billion from a peak of $8.68 billion, a drop that points to profit-taking and near-term sentiment shifts. The slowdown may also reduce volatility, leaving room for consolidation until the market commits to a decisive direction.

Conclusion

Aster’s swift rise to the top of DeFi’s fee charts underscores its growing dominance in revenue generation despite lower trading volumes. While criticism and concentrated supply concerns continue, high-profile backing and strong fee metrics highlight its expanding influence. A possible short-term retracement remains on the table, but as long as key support holds, the broader bullish thesis around Aster’s long-term trajectory appears intact.