- Crypto exchange Binance accounts for more than 30% of the global crypto market depth.

- The top 8 largest crypto platforms contributed 91.7% of depth and 89.5% of crypto trading volume.

- Bybit and Upbit are poised to overtake fellow exchanges Huobi and CoinEX in terms of spot volume.

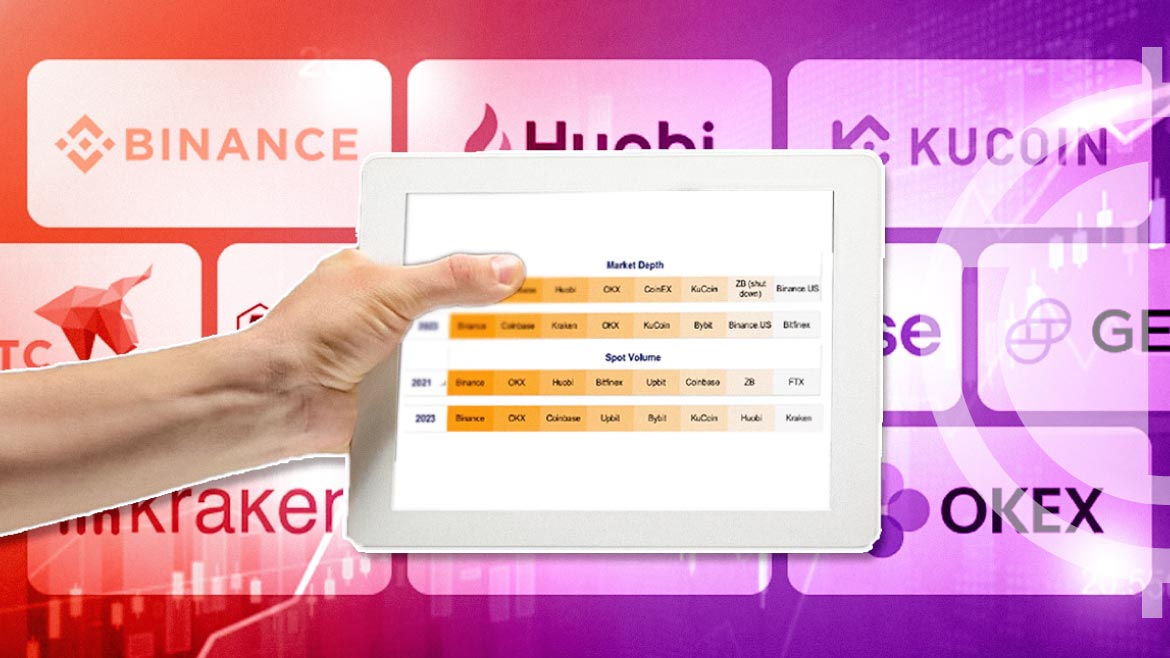

Binance, the largest crypto exchange in the world, accounted for more than 30% of the global crypto market depth in 2023. The crypto giant contributed 64.3% of the global crypto trade volume this year as well. Meanwhile, the top eight largest crypto platforms reportedly accounted for a whopping 91.7% of the crypto market depth, in addition to contributing 89.5% of the volume.

Clara Medalie, the director of research at crypto intelligence firm Kaiko, recently published The Crypto Liquidity Concentration Report, which took a closer look at the market depth and trade volumes of centralized crypto exchanges including Binance, Kraken, OKX, Bybit, etc. The report was co-authored by Kaiko research analyst Dessislava Aubert.

Kaiko gathered the data based on the average 1% market depth and cumulative trade volume for BTC, ETH, and the top 30 crypto assets by market capitalization. This target data provided an appropriate scale for measuring exchange-level liquidity since the majority of crypto trading was concentrated on those top 30 assets.

Binance’s spot volume hike from 38.3% to 64.3% between 2021 and 2023 was attributed to the crypto exchange’s zero-fee trading promotion campaign. Meanwhile, the eight largest crypto exchanges witnessed their spot volume concentration from 84.1% to 89.5% between 2021 and 2023. The top 4 exchanges also grew their spot volume concentration by 14% in two years.

While Binance’s zero-fee promotion led to a hike in the spot trading volume, it had an inverse impact on the exchange’s share of market depth concentration. The shared depth percentage went from 42% to 30.7% in two years. Kaiko concluded that both spot volumes and market depth were heavily concentrated on just 8 platforms.

The developments in the crypto market also led to a shuffling of the top crypto exchanges in terms of spot volume. While the roster was dominated by Huobi, CoinEX, and ZB in 2021, they were reportedly overtaken by fellow exchanges Upbit and Bybit this year.