Bitcoin Allocation Gains Backing as Itaú Targets 2026 Plans

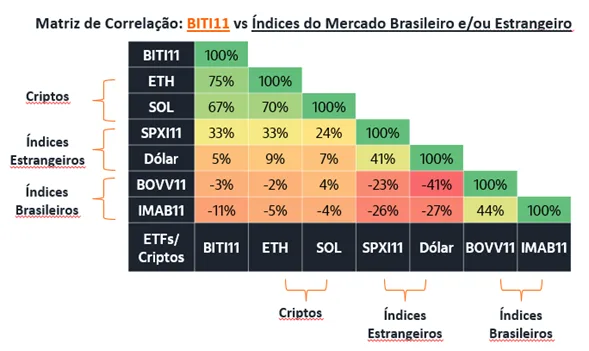

- Itaú data show that Bitcoin ETF BITI11 has a low correlation with core assets today.

- Bitcoin price swings stayed sharp in 2025, yet Itaú kept a long view intact through.

- Itaú built a cryptocurrency unit and expanded its products from ETFs to staking plans.

Itaú advised investors this week to allocate between 1% and 3% to Bitcoin in 2026, despite the cryptocurrency’s sharp price swings this year. Brazil’s largest private bank released the guidance in a detailed portfolio analysis focused on diversification and currency protection. The report positions Bitcoin as a relevant component for portfolios exposed to economic uncertainty and rising geopolitical tensions.

The analysis, signed by Itaú strategist Renato Eid, explains that Bitcoin behaves differently from stocks, fixed income, and domestic assets. Because of its global and decentralized structure, the asset offers exposure that traditional markets often fail to provide during periods of stress.

Itaú stated that volatility remains high, yet long-term appreciation potential persists.

Bitcoin started 2025 near $95,000, fell toward $80,000 during the tariff crisis, then rallied to a record $125,000. After that surge, prices retreated and stabilized around $95,000, reflecting a turbulent year for investors. Against this backdrop, Itaú maintained its allocation guidance for long-term portfolios.

Low Correlation Supports Portfolio Diversification

Renato Eid described Bitcoin as “an asset distinct from fixed income, traditional stocks, or domestic markets, with its own dynamics and return potential.” He also noted that Bitcoin offers a currency-hedging function due to its global and decentralized nature. The bank linked these traits to diversification benefits inside multi-asset portfolios.

Itaú’s internal data reveal that BITI11, the Bitcoin ETF traded in Brazil, has a very low correlation with the major asset classes, which means that, in the same context, Bitcoin can be included in small amounts to improve portfolio diversification. The bank mentioned that the low correlation eliminates dependence on conventional assets during market stress.

According to the study, a distribution of 1% to 3% is sufficient to allow investors to enjoy the benefits of diversification with minimal risk. Itaú presented this strategy as cautious rather than aggressive. Will a small Bitcoin investment be enough to make the portfolios strong enough to withstand the breakdown of traditional correlations?

Local Currency Effects and Strategic Discipline

In 2025, Brazilian investors experienced Bitcoin’s high volatility more than traders worldwide. The Brazilian real’s appreciation by around 15% for the year made it harder for the local holders of Bitcoin to liquidate their investments without losing some money.

Hence, the currency movement created an even more difficult scenario for the local portfolios. Nevertheless, Eid believed that adjusting the percentage of vintage stocks could help manage risks that other assets would not cover.

He stated that short-term forecasts rarely succeed for risky assets like Bitcoin. Instead, the bank recommends a long-term horizon supported by periodic portfolio rebalancing. The report described BITI11 as offering dual exposure to international diversification and currency protection.

At the same time, Itaú warned against reacting to short-term price fluctuations. The strategy focuses on discipline, moderation, and maintaining predefined allocation limits.

Related: Brazil Tightens Crypto Rules With New Central Bank Framework

Itaú Expands Its Crypto Offering: What’s Next?

In September, Itaú Asset created a standalone crypto division to expand its digital-asset operations. The bank appointed former Hashdex executive João Marco Braga da Cunha to lead the new unit.

This move built on Itaú’s existing Bitcoin ETF and a retirement fund with crypto exposure. Itaú intends to enlarge its crypto product offering in gradual steps. The plan integrates the creation of fixed-income-like products with more adventurous approaches, such as derivatives and staking.

The whole purpose of these products is to cater to various risk-taking investors through regulated structures. The study determined that Bitcoin should be part of, not the leading player in, a balanced portfolio. Itaú stated that the 1% to 3% allocation aligns with most investor profiles under uncertain global conditions.