Bitcoin and Ethereum Harshest Monthly and Quarterly Losses Since 2018

- Bitcoin and Ethereum have seen their lowest monthly and quarterly returns since 2018.

- The $300 billion market crash ended six years of October strength in the crypto market.

- Investors are eager to know if it will be a rebound or a more extended cyclical downturn.

October—historically known as “Uptober” for its bullish streak—ended with sharp losses for the world’s two largest cryptocurrencies. According to Coinglass on-chain data, Bitcoin fell 3.6%, while Ethereum dropped 7%, marking their weakest October since 2018. The downturn followed a mid-month crash that erased over $300 billion from the total crypto market capitalization.

The selloff triggered widespread liquidations, breaking a six-year pattern of October gains and signaling a shift in investor sentiment heading into November.

Bitcoin’s Monthly and Quarterly Returns Reveal Shifting Momentum

The year 2025 for Bitcoin was a rollercoaster ride, with some months showing extreme price changes and others indicating a weak recovery. The currency’s slow but positive start was reversed in February, when the price declined by 17.39%, followed by a 2.3% loss in March.

April brought a quick but short upward movement, with a gain of 14.08%; succeeding that were May’s and June’s smaller gains of 10.99% and 2.49%, respectively. The increase continued through July (+8.13%) until losses came again in August (-6.49%) and October (-3.69%); thus, the negative aspect was confirmed.

Source: Coinglass

Historically, the monthly return of Bitcoin, on average, was +3.81%, while the median return was +0.62%, indicating a moderate but stable power of compounding. October is typically the month that yields the best result, with an average of +19.92%, leading to the conclusion that the dip in 2025 is quite an anomaly compared to the past. Furthermore, the statistics indicate that after the drop in November and December, the price would have been steadier at the end of the year if trends were to repeat.

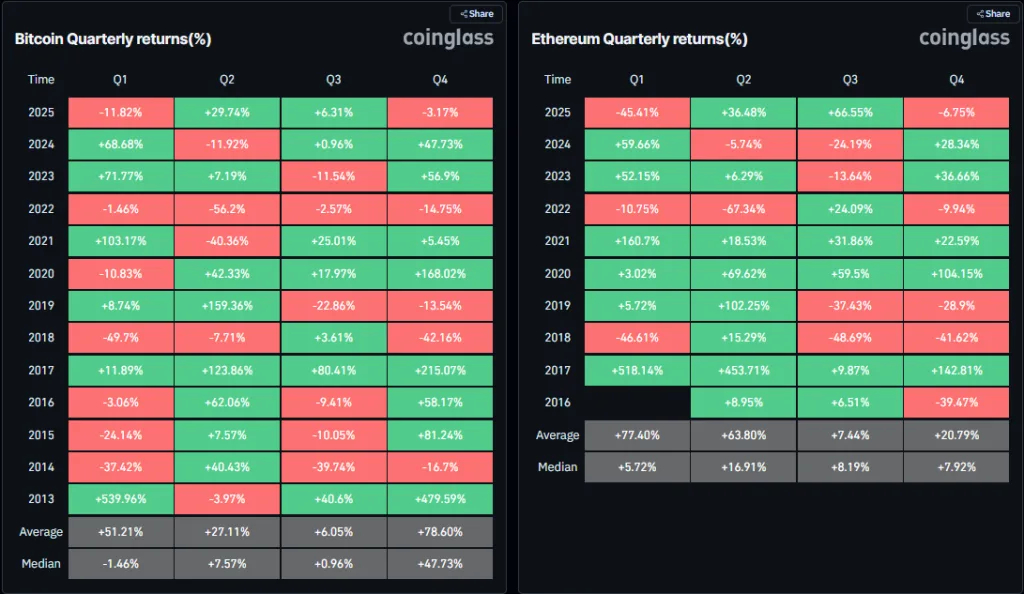

Data from Coinglass, presented on a quarterly basis, reveal a similar trend. Bitcoin experienced a decrease of 11.82% in Q1, increased to 29.74% in Q2, continued with a 6.31% increase in Q3, and ended with a slight decline of 3.17% in Q4.

Source: Coinglass

This is similar to the price movements in 2018 when declines were followed by long periods of consolidation. Over the long term, the average quarterly return of one bitcoin remains at +51.21%, but its median of -1.46% indicates the constant presence of structural corrections.

Ethereum Mirrors Bitcoin’s Downtrend With Sharper Swings

Like a rollercoaster ride, the monthly performance of Ethereum in 2025 has been very uneven. The new year began with a decline of 1.28%, followed by a major drop of 31.95% in February and a further decline of 18.69% in March. Momentum mid-year returned with a bang, thanks to the strong 40.84% surge in May, with gains of July (+48.77%) and August (+18.78%) being the icing on the cake. However, by October (-7.02%), Ethereum’s gains had almost evaporated, as the large-cap assets experienced pressure again.

Source: Coinglass

The examination of the long-term averages shows that January (+20.63%), May (+31.28%), and November (+7.12%) are the months when Ethereum performs best, indicating a pattern of consistent early-year rallies but weaker finishes throughout the year. The quarterly data from Coinglass supports this cycle: in Q1, Ethereum lost 45.41%; in Q2, it bounced back by 36.48%; in Q3, it rocketed up by 66.55%; and in Q4, it fell by 6.75%.

Related: Bitcoin Eyes Rebound After Fed’s Rate Cut and Liquidity Plan

A Turning Point for Crypto Market Cycles

Based on Coinglass’ data, it can be inferred that a bigger change in the market structure is taking place. The cycle of yearly price increases in the first quarter, followed by decreases in the last quarter, reflects not only liquidity withdrawal but also the cooling of investors’ confidence. November was the worst month for both Bitcoin and Ethereum and their decreasing market caps are a sign of a reversal in the long-standing trend of digital assets being bullish.