Bitcoin Drop Deepens With Heavy ETF Outflows and Market Fear

- Bitcoin dropped below $90K after a month of steep losses and a $1.2T market wipeout.

- ETF outflows passed $2.5B as institutional demand weakened across major products.

- Fear & Greed Index hit 10 while rising exchange reserves signaled sustained sell pressure.

Bitcoin fell under $90,000 on Tuesday morning after a month of accelerating losses. The slide extended a severe downturn that erased more than $1.2 trillion from global cryptocurrency valuations. The decline pushed Bitcoin nearly 30% below its October peak of $126,000. Traders faced growing pressure as market signals turned increasingly negative and selling activity gained momentum.

Bitcoin ETFs recorded continued redemptions. SoSoValue reported $254.51 million in outflows on Monday. November’s cumulative withdrawal now exceeds $2.5 billion. This marked the fourth straight day of redemptions since November 12. Last week, the total withdrawals reached $1.11 billion. The pattern added further pressure to prices.

Analysts noted that the steady removal of capital from these products signaled reduced participation from large market players. As of press time, BTC is trading at $91,329, down by 4.5% over the past 24 hours.

Sharp Shift in Bitcoin Sentiment After Recent Peak

Analytical platform Santiment highlighted that Bitcoin is down 4.4% since the start of 2025. The shift occurred only weeks after the asset reached its all-time high. The rapid reversal created a sharp change in retail sentiment. Market watchers pointed to a clear drop in confidence across public channels.

Derivatives markets reflected rising risk. Coinglass estimated that a fall below $88,000 would trigger $829 million in long liquidations across major centralized exchanges. A move above $91,000 would force around $702 million in short liquidations. These thresholds highlighted the scale of leveraged positioning.

On-chain activity pointed to more downside. Average Bitcoin deposit volume climbed above 0.9 on Tuesday. Historically, elevated deposit flows aligned with selling pressure. Analysts noted that rising exchange deposits often signal intent to exit positions.

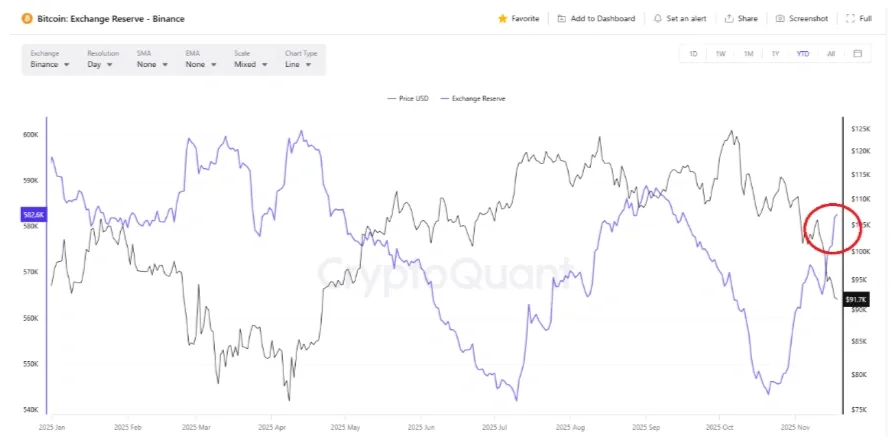

Exchange reserves added to this picture. Binance reserves rose above 580,000 BTC. A buildup of assets on exchanges generally suggests growing sell interest. Weak demand combined with higher supply has reinforced price pressure in recent weeks.

CryptoQuant analyst JA Maartun reported that the Fear & Greed Index dropped to 10. This level indicates “Extreme Fear.” It was the lowest reading since July 2022. Analysts viewed this as a sign of heightened anxiety across the market.

Market Voices Diverge on Bitcoin’s Recovery

Some industry figures offered different interpretations. Cameron Winklevoss wrote on X that prices below $90,000 may not persist. His remark referenced previous periods when Bitcoin recovered after similar declines. He did not comment on short-term trading conditions.

Other analysts noted signals of potential stabilization. Tom Lee, chairman of BitMine, told CNBC that traders were still processing the liquidation wave from October 10. He said uncertainty around possible Federal Reserve rate decisions in December continued to influence markets. He added that several technical indicators suggested that a bottom may be near.

Related: Bitcoin Drops Below $90K as Schiff and Winklevoss Clash Again

Lee cited analysis from Demar Analytics. The firm noted signs of exhaustion within the recent selling pattern. These signals indicated that downward momentum could slow.

The current environment might provide long-term value, said Bitwise CIO Matt Hougan. He said the pullback was an opportunity for investors with longer time horizons. He said uncertainty around the economy, AI sector valuations, and President Donald Trump’s tariff policies are influencing broader market behavior.

While there was some talk of recovery, the overall trend turned bearish. Bitcoin’s drop below $90,000, coupled with robust ETF outflows and growing exchange deposits, continued to stress traders. Participants in the market are still monitoring critical support levels for signs of steadiness.