- Bitcoin ETFs control nearly 5% of total BTC supply, reflecting growing institutional interest in cryptocurrency.

- U.S. Bitcoin ETFs bought 25,729 BTC in early June, significantly outpacing new Bitcoin mining supply.

- Bitcoin ETFs’ AUM is 60% of gold ETFs, showcasing rapid growth and rising acceptance of Bitcoin as an investment.

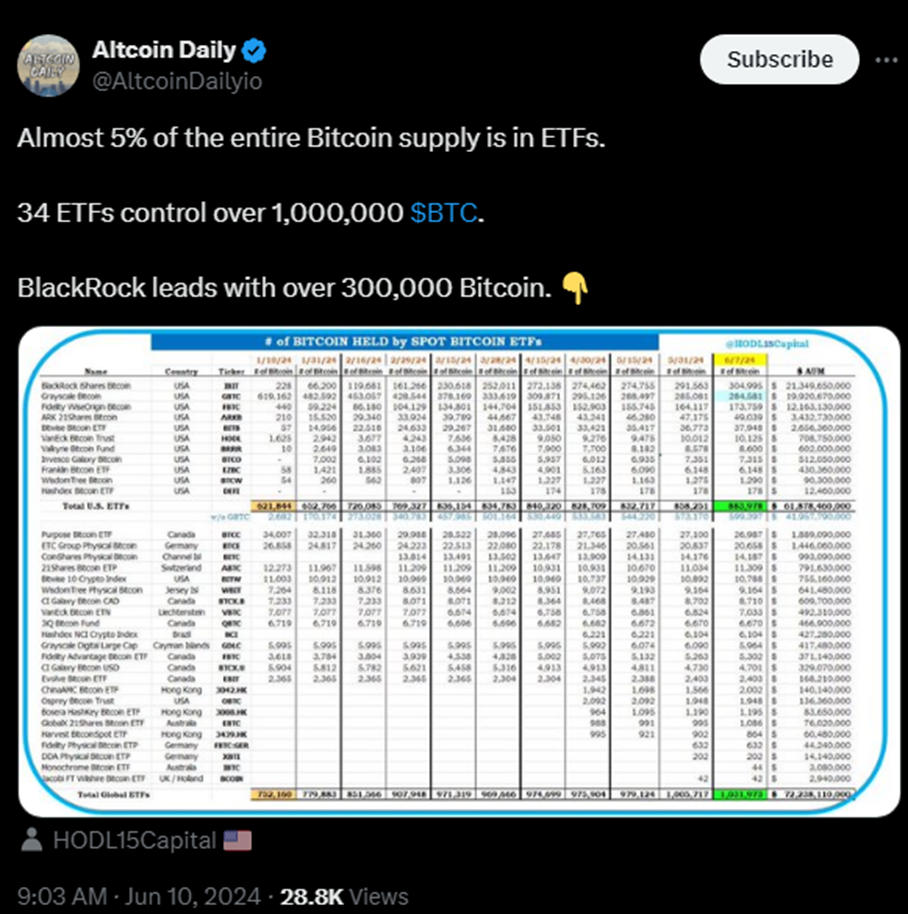

Bitcoin and Ethereum layer-2 networks are making significant strides in the cryptocurrency market, with nearly 5% of Bitcoin’s total supply now held in ETFs. As highlighted by Altcoin Daily, an analyst, currently, 34 ETFs control over 1,000,000 BTC, with BlackRock leading the pack with over 300,000 Bitcoins. In the first week of June, U.S. Bitcoin ETFs witnessed unprecedented activity. They acquired approximately two months’ worth of newly mined Bitcoin within just one week.

According to HODL15Capital, with inflows totaling around $1.83 billion, these 11 ETFs purchased 25,729 BTC between June 3 and 7. This figure is eight times the 3,150 BTC mined over the same period, highlighting a substantial demand for Bitcoin via ETFs.

Since their January launch, these 11 ETFs have seen net inflows of $15.69 billion. This is a significant figure, especially when considering the $17.93 billion in net outflows from Grayscale’s fund. The total assets under management (AUM) for these ETFs now stand at approximately $61 billion. This growth is remarkable, given the relatively short time these ETFs have been available.

Bitcoin (BTC) Surge Imminent? Analyst Predicts $83,000 RallyBitcoin proponents have long regarded the cryptocurrency as “digital gold” due to its built-in scarcity mechanism, which ensures that only 21 million BTC will ever be issued. This scarcity is a crucial factor in Bitcoin’s value proposition. The rapid accumulation of Bitcoin by ETFs highlights this characteristic and reinforces the narrative of Bitcoin as a valuable, finite asset.

Nate Geraci, president of the ETF Store, noted in a recent post that the AUM of Bitcoin ETFs is already around 60% of that of the country’s gold ETFs. This comparison is striking, considering that gold ETFs have been around for 20 years, while Bitcoin ETFs have only existed for five months. This rapid growth demonstrates the strong investor interest in Bitcoin and its increasing acceptance as a mainstream investment asset.