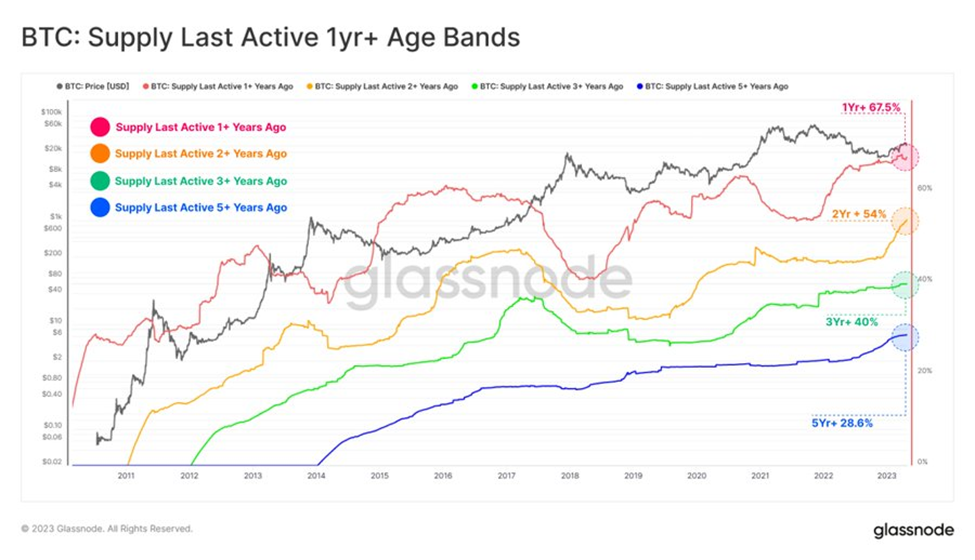

According to a recent analysis by Glassnode, a platform for on-chain data intelligence, the last active age bands of Bitcoin supply indicate an increase in “values across all age cohorts” which has been attributed to the growing number of mature coins.

The data suggests that longer-term investors are primarily holding onto their investments, and further price volatility may be necessary to entice them into spending. This insight sheds light on the current behavior of Bitcoin investors and the potential drivers of future price movements in the cryptocurrency market.

A recent analysis by Glassnode shows that Bitcoin HODLing remains strong among long-term investors, indicating a high degree of faith in the asset’s future:

Assessing the #Bitcoin: Supply Last Active Age Bands, we note that the values across all age cohorts are increasing as large swathes of coins continue to mature.

— glassnode (@glassnode) May 1, 2023

This suggests that HODLing remains the primary dynamic amongst longer-term investors, insinuating that further… pic.twitter.com/YuLUCHCo5m

Significantly, the analysis indicates a larger trend in the cryptocurrency market, which has seen a high degree of HODLing behavior amongst investors since the inception of Bitcoin. HODLing, the practice of holding onto a digital asset for a prolonged period of time, could be seen as a bullish indicator as the long-term hold of the coins proves the investor’s faith in the long-term viability of Bitcoin.

However, this behavior also suggests that Bitcoin might experience periods of volatility as old hands remain steadfast in their HODLing strategies. It might take significant market movements to entice these investors to sell or spend their Bitcoin, leading to cascading effects in the market and price swings.

Despite this, there are still opportunities for traders and investors to profit from the market. By staying up to date on market trends and developments, individuals could make informed decisions about when to buy or sell Bitcoin. Additionally, the technical analysis could provide valuable insights into market sentiment and price movements, allowing traders to make strategic trades based on data-driven analysis.