Bitcoin Sentiment Turns Neutral as BTC Surges Past $115K

- Bitcoin sentiment turns neutral as the Fear & Greed Index rises to 51, showing market calm.

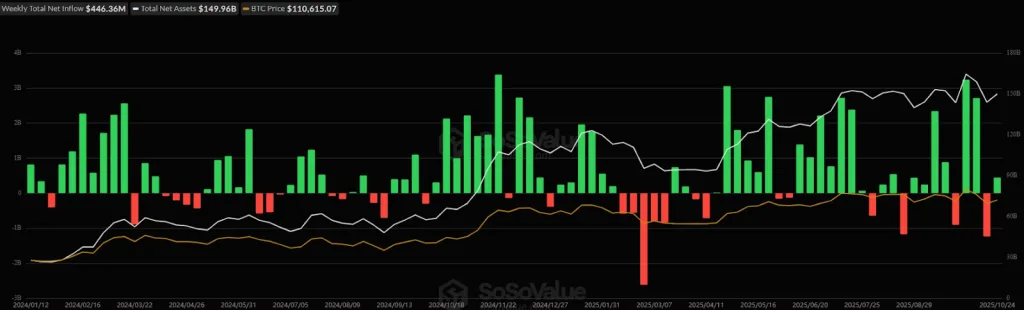

- Spot Bitcoin ETFs pull in $446M as institutional demand strengthens across major issuers.

- Bitcoin tests resistance at $116K while traders anticipate a potential breakout toward $120K.

For the first time since the last major crash, Bitcoin’s mood has shifted. The Fear & Greed Index, a long-trusted pulse check on investor emotion, has finally climbed out of the “fear” zone and now sits at a neutral 51. The move hints at calmer waters ahead as BTC holds steady above the $115k mark.

The change comes just days before the U.S. Federal Reserve’s rate meeting on October 29. Markets are widely expecting another 25-basis-point cut, trimming the policy rate from 4.25% to 4.00%. It would follow September’s earlier reduction and signal a gentler stance from policymakers keen to keep credit flowing through the economy.

When rates drop, the dollar often loses some strength, a shift that typically sends fresh money into higher-risk assets like Bitcoin. This trend has revived appetite among traders who spent much of the year sitting on the sidelines.

Analysts say a steady neutral reading could be the start of a new accumulation phase if global conditions continue to ease. Traders are not calling it a bull run yet, but the mood has shifted. For many, this return to balance feels like the first real sign that confidence, and perhaps opportunity, is back.

Institutional Flows Strengthen Bitcoin’s Market Base

Institutional demand for Bitcoin is showing no signs of cooling. Between October 20 and October 27, spot Bitcoin exchange-traded funds (ETFs) drew approximately $446 million in new capital, according to data from SoSoValue. The week’s movement reflects a steady return of confidence across professional trading desks.

BlackRock’s iShares Bitcoin Trust led the charge, adding $324 million. Fidelity’s FBTC followed with close to $58 million in fresh capital, while Bitwise, VanEck, and Valkyrie held their positions with steady inflows. The numbers indicate a clear pattern: large investors are maintaining their exposure despite global markets moving cautiously.

Cumulative inflows across all spot Bitcoin ETFs now stand at nearly $62 billion, backed by daily trading volumes of around $3.3 billion. For fund managers balancing risk and yield, Bitcoin has become a practical tool rather than a speculative play. Analysts say the persistence of these inflows demonstrates the market’s significant maturity.

Related: Zcash Surges Hours After Arthur Hayes’ Bullish Prediction

Technical Outlook Signals Cautious Consolidation

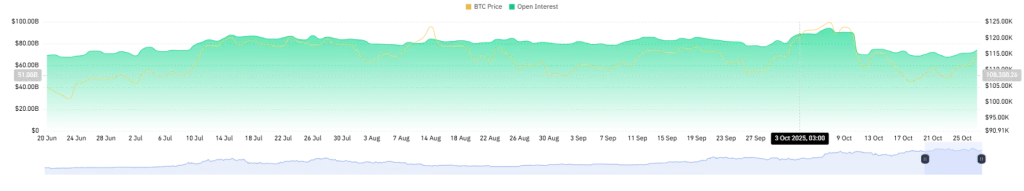

From a technical stance, BTC appears to be catching its breath after weeks of strong movement. The price has settled into a calm zone, hinting at quiet accumulation rather than speculation. Steady funding rates and moderate leverage suggest traders are preparing for a larger swing ahead.

Market data supports that view. The token’s Open Interest has climbed past $74 billion, up from around $69 billion in mid-October. The increase suggests renewed participation from large traders, who appear confident enough to rebuild positions but cautious enough to avoid excessive risk.

Momentum signals are also showing the first hints of recovery. The MACD line, sitting near –823.17, has crossed above its signal, and the histogram shows green bars are widening. Although the reading stays below zero, that crossover often precedes a slow shift in tone.

Similarly, the RSI has risen to about 55, moving clear of oversold territory. It suggests that buyers are gradually taking control across most major exchanges. Still, there’s a ceiling ahead: The zone between $115k and $116k remains a wall of resistance.

Earlier this month, the same range triggered a ten-percent drop, pushing the price to a low of $103k. Sellers have defended this level each time the market has approached it, thereby containing momentum.

Suppose buyers manage to clear that barrier, the next target sits around $120k, a mark not seen since October 10. Failure to break through could send prices back toward $111k, where demand has previously stabilized.

In summary, Bitcoin’s market shows renewed balance as sentiment steadies, institutional inflows rise, and traders prepare for direction. With resistance levels in focus, the asset’s next move will likely define whether consolidation turns into sustained growth or another correction phase.