Bitcoin Tests $91K Support Ahead Of $3.5B Options Expiry

- Bitcoin slides ahead of Dec. 5 $3.5B options expiry with $91K and $93.2K in focus.

- Deribit put-call is near 0.92, and the 24-hour ratio is 0.76 with calls leading.

- Max pain sits at $91K as miners add $220M and Glassnode flags 25% supply underwater.

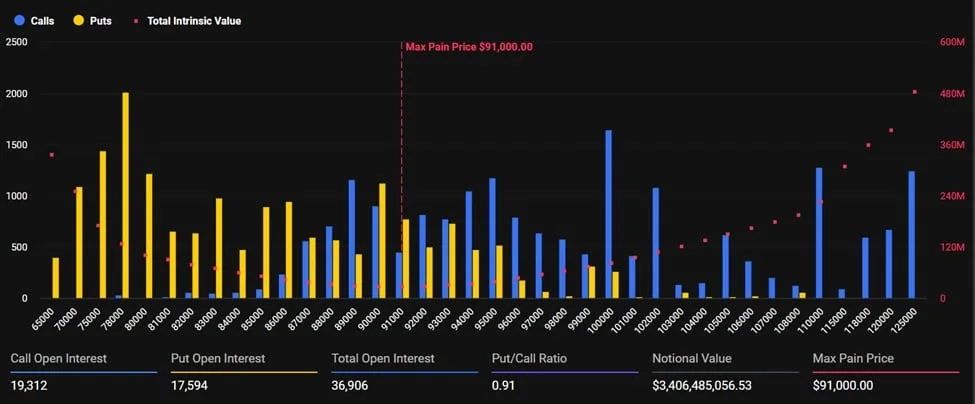

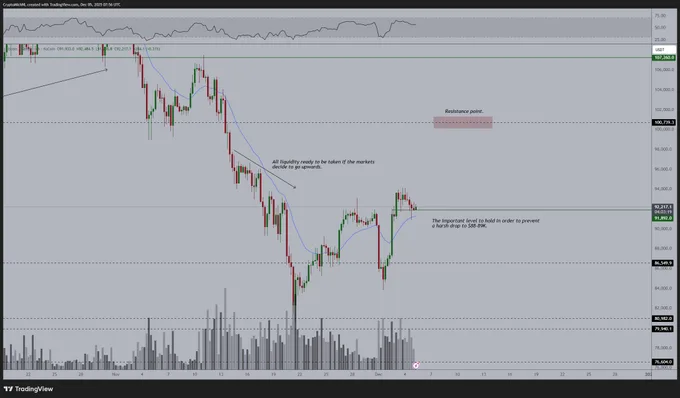

Bitcoin fell again and tested a key support zone ahead of a large options expiry. Price rebounded nearly 10% from the weekly low near $84,000. Traders now watch $91,000 and $93,200 for the next move. Deribit data shows that more than 36,000 BTC options expiring with a notional value of about $3.5 billion will expire on Dec. 5. The put-call ratio for this expiry sits near 0.92. That level signals balanced interest between puts and calls.

Bitcoin Expiry Focus: $91K Max Pain, $93.2K Breakout

The data also shows a 24-hour put-call ratio near 0.76. Call volume stayed higher than put volume in that window. The combined readings suggest no strong one-way bet. Hedging demand appears present but not dominant.

The maximum pain price is listed at $91,000. That is below the cited spot price near $92,261. This setup could increase pressure around the $91,000 area into expiry. Traders often adjust strikes and deltas as settlement approaches.

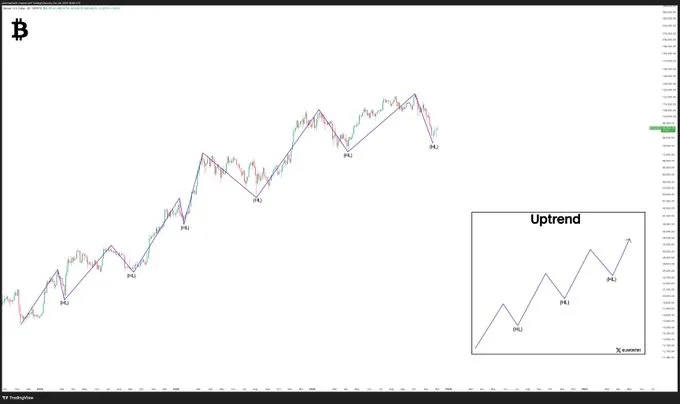

Bitcoin remains in a descending pattern on the one-month chart. The text links that structure to the move down from November highs. It also cites a major sell-off last month. The corrective phase has extended as lower highs have held.

A decisive drop below $91,000 could shift focus to $90,000 to $90,500. This range is the next support zone. If price holds above $91,000, the market stays in the current battle area. The upside trigger highlighted is a reclaim of $93,200.

A move above $93,200 would break the recent lower-high pattern. It would also weaken the near-term bearish structure described in the text. The level is framed as a confirmation point for bulls. Until then, the pattern remains intact.

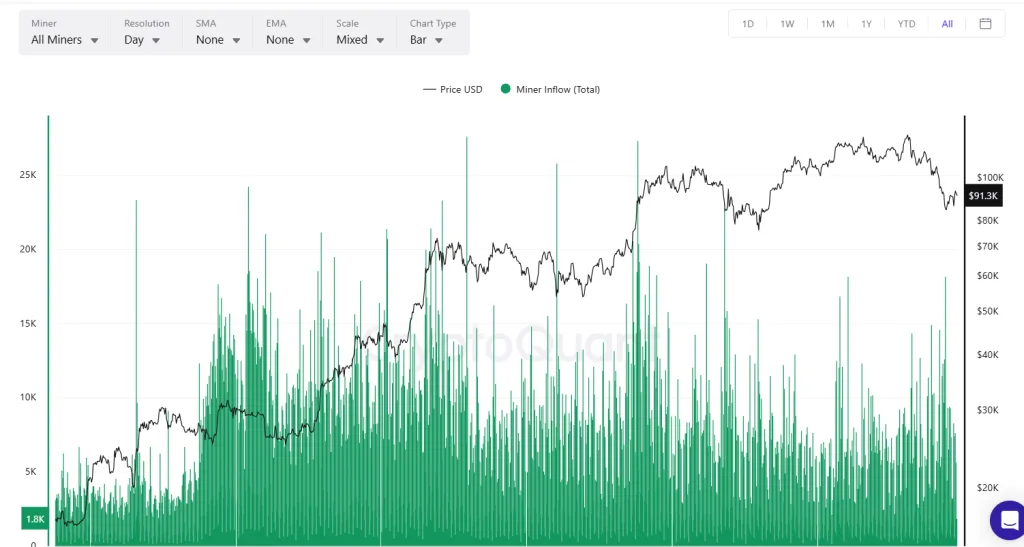

The report adds that BTC miners increased reserves by about $220 million during an 11-day period. The figure signals accumulation by miners during the period cited. It also reduces the amount of mined BTC sent out, if held.

BTC Supply Stress Meets Split Forecasts

Glassnode flagged a supply condition tied to recent declines. It stated that since mid-November, BTC fell below the 0.75 quantile. It also said this puts more than 25% of the supply underwater. That refers to coins held at a loss relative to spot.

The platform described a fragile balance in this zone. It cited capitulation risk for top buyers. It also cited a possible seller-exhaustion bottom. The note ties sensitivity to macro shocks to the $93,000 area.

It said the market would need to reclaim the 0.75 quantile near $95,800. It then pointed to the 0.85 quantile near $106,200. Those values were framed as milestones for improved stability in price behavior.

Crypto analyst Javon Marks pointed to a constructive chart setup. Bitcoin, he said, is maintaining another higher low. In his view, that keeps the broader uptrend intact despite wider market noise. Based on those price signals, Marks projected a potential move toward $126,230.

Analyst Michael van de Poppe outlined a downside risk. He wrote that losing current support could push BTC toward $85,000. He also said he still thinks the correction may be nearing an end and expects a bottom before another move toward an all-time high.

The market now heads into the option expiry with support and resistance clearly defined. Traders are watching $91,000 for defense and $93,200 for a breakout signal. Options positioning remains close to balanced based on the put-call ratios cited. Price direction may hinge on whether spot holds above the max pain level.