Bitcoin Weakens, But Signs Of A Silent Accumulation Grow

- BTC and ETH ETFs see steady inflows as crypto markets face renewed downside pressure.

- Altcoins like Token H and VIRTUAL post major gains despite overall market weakness.

- Japan’s TIS teams with Ava Labs to launch a blockchain-based Multi-Token financial platform.

Crypto markets continued to fall following a risk-off turn by traders and negative funding rates for the perpetual. Institutional interest stayed strong with Bitcoin and Ethereum ETFs recording a second straight day of inflows. As of press time, Bitcoin is trading at $113,080, down 1.23%, while Ethereum slid 2.9% to $4,002.

According to the analytical platform CryptoRank, the market capitalization of the global crypto market is at $4.05 trillion, and there are liquidations worth $506 million, while the Fear and Greed Index is at 51, indicating neutral sentiment. Bitcoin domination was at 60% but certain altcoins were strong.

Altcoins Surge as New ETFs Hit Wall Street

Token H jumped 97% after completing its integration with Sui and receiving support from Delphi Digital. Virtual rose 93% as rising activity on the Base network fueled momentum. CODEC advanced 55%, PHL gained 37%, one moved up 34%, RICE increased 33%, and MDT added 33%. The Altcoin Index stood at 29 out of 100.

The first-ever spot ETFs for Solana, Litecoin, and Hedera began trading on Wall Street. The listings marked a significant expansion for digital assets beyond Bitcoin and Ethereum.

In the first 30 minutes, Bitwise’s Solana ETF recorded over $10 million in trading volume. Hedera’s ETF traded $4 million, while Litecoin’s ETF registered $400,000. Analysts said the debut highlights growing institutional confidence in broader blockchain ecosystems.

Japan’s TIS and Ava Labs Launch Blockchain Payment Platform

Japan’s TIS, a major payment infrastructure provider, announced a blockchain partnership with Ava Labs, the team behind Avalanche. The firm plans to launch a Multi-Token Platform using AvaCloud, Avalanche’s enterprise-focused blockchain builder.

The platform would cater to Issuance, settlement, and management of digital tokens, including but not limited to “stablecoins” under Japan’s Payment Services Act. TIS plans to develop the system for global implementation in partnership with banks, companies, and public institutions.

The news comes as Japan’s interest in stablecoins and tokenized assets has been growing. JPYC became the first regulated yen-pegged stablecoin originating from fiat currency. It is backed by Japanese bank deposits and Japanese Government Bonds, and was launched earlier this week.

TIS processes around half of Japan’s credit card transactions and handles more than ¥300 trillion, approximately $2 trillion, annually. The new platform aims to bring this transaction scale onto blockchain rails and modernize traditional payment infrastructure.

Polymarket Set to Relaunch in the U.S. After Regulatory Settlement

Crypto prediction platform Polymarket is preparing to relaunch in the United States after resolving regulatory issues. The company plans to start operations in November with limited access, focusing first on sports-related prediction markets.

Polymarket had halted U.S. access in 2022 after settling charges with the Commodity Futures Trading Commission. The regulator fined the company $1.4 million for operating an unregistered derivatives platform and required it to block American users.

The relaunch marks Polymarket’s cautious return under compliance guidelines. Its focus on regulated access and narrower product offerings suggests a more structured approach to growth.

Related: CPI Slows to 3%, Fueling Bitcoin Optimism and Fed Cut Bets

Markets Await Fed Decision as Traders Eye Powell’s Next Move

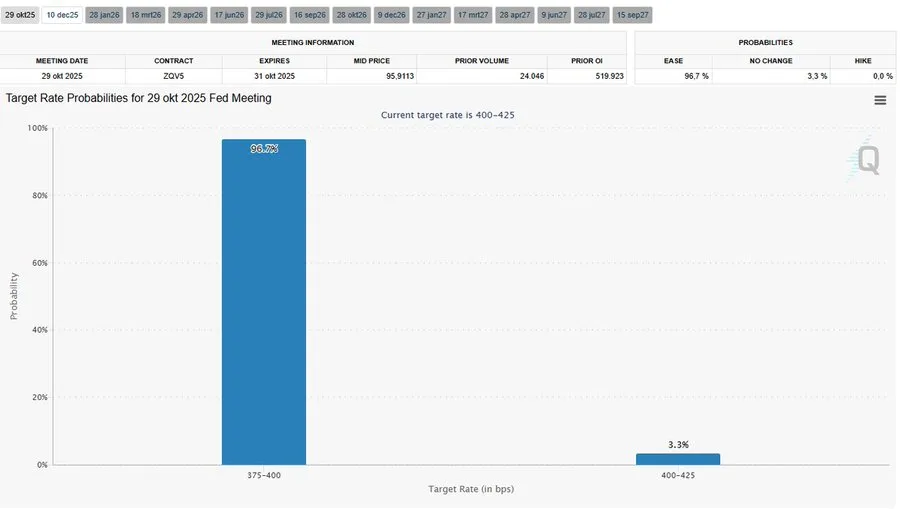

Market attention shifted to the Federal Open Market Committee meeting scheduled for today. Analysts, including Daan Crypto Trades, expect the Federal Reserve to cut interest rates by 25 basis points.

Short-term volatility could follow as leveraged positions get liquidated. Investors would focus on comments from Chair Jerome Powell about future policy direction and quantitative tightening plans.

According to analysts, another cut is expected in December, with the probability for that move at over 95%. Traders are awaiting any mention of possible new quantitative easing in 2026, but few expect to receive confirmation yet.

In the meantime, Powell’s comments on liquidity and the economic outlook would provide direction in the near term. Nonetheless, while the current retracement plays out, ongoing ETF inflows and growing blockchain utilization demonstrate that digital assets are indeed maturing.