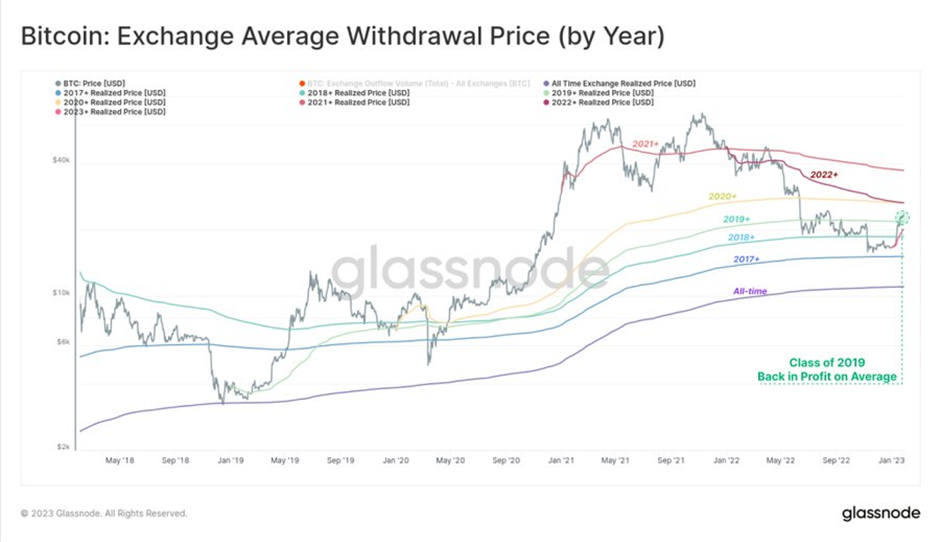

The chart of average acquisition prices shows that the price of Bitcoin has steadily increased over the years. In 2019, the average withdrawal price for investors was $21.8k, meaning they are now back in profit. This steady rise in value indicates Bitcoin’s increasing popularity and widespread use as a digital asset.

With its decentralized nature and limited supply, Bitcoin has become an attractive asset for investors looking to diversify their portfolios. As more people become aware of the potential of digital assets, the average acquisition price for Bitcoin could likely continue to rise.

Bitcoin’s recent price analysis

Bitcoin’s price broke below $23,000 during yesterday’s market closure. This move brought the price to a new area of support near $22,500 and caused some investors to see that as an opportunity to buy. The bulls can now break above the resistance at $23,000 to continue higher and reach a new all-time high above $24,000.

Bitcoin is trading at $22,910.38, down by 1.41% in the last 24 hours. If the bulls can succeed in breaking above $23,000, we could see Bitcoin reach reclaim the $23,000 level. On the other hand, if the bears manage to push it lower, we could see Bitcoin fall to its next support at $22,500.

BTC price downside volatility sees $46 million of long Bitcoin positions evaporate in a single day before the monthly close. The long liquidation resulted from a sudden drop in price, which saw BTC dipping as low as $22,600. This caused some investors to see this as an opportunity to sell their positions and take profits before the month-end close.

The average acquisition price for Bitcoin continues to be higher than its current market price, indicating that investors are still buying digital assets. This is a positive sign that Bitcoin is gaining traction, and more people are becoming aware of its potential as an investment vehicle.

Bitcoin swapped bullish gains for chop into Jan. 31 as the end of the month saw nervous price action. Bitcoin established form support at around $22500, and later a rebound saw the king coin flip $23,000 to short-term resistance and was still trading below that level at the time of writing.

Despite a relatively steady trading range, Bitcoin faced mounting liquidations as volatility lurked in the shadows. According to Bybt, $46 million worth of longs were liquidated in a single day as the price dropped below $22,600. The $22,500 plunge on Jan. 30 set off a chain reaction of liquidations worth over $46 million, according to Coinglass analytics – a fresh record for the year 2023 thus far.

On January 20th, Bitcoin skyrocketed above the $22,500 mark and has since maintained that level. In fact, within one month’s time, stocks had accumulated a staggering 40.5% gain. This rapid growth has caused the average acquisition price of Bitcoin to rise steadily, indicating that investors are continuing to enter the market.

Bitcoin is trading above the 21-day EMA and has continually gained momentum since the start of 2023. However, most of the popular technical indicators have signaled some bearishness, including the MACD, Parabolic SAR, and Relative Strength Index.

Overall, the rising average acquisition price for Bitcoin is a sign that more and more people are becoming aware of its potential. The recent surge in buying indicates that investors are still optimistic about the future of this digital asset.

In conclusion, despite some short-term volatility caused by liquidations, Bitcoin has steadily increased its average acquisition prices. This is a positive indicator of Bitcoin’s long-term success and could lead to an even larger appreciation in value as more investors enter the market.