Bitcoin’s Uptober Frenzy: Are New Highs Just Days Away?

- Bitcoin rises 14% this week, maintaining strong momentum after breaking key resistance.

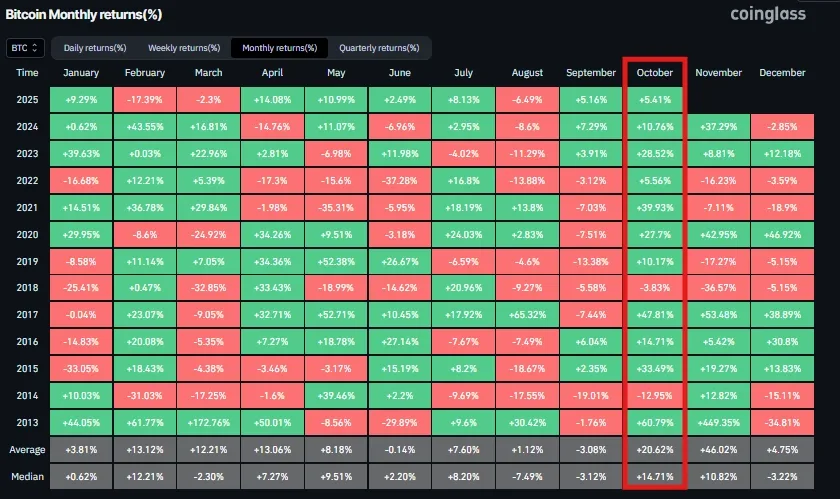

- October delivers 20.62% average gains for Bitcoin, reinforcing its historic “Uptober” trend.

- Institutional inflows of $2.25B boost optimism for continued growth through Q4 2025.

Bitcoin has risen by more than 14% in the past week and is moving closer to its record high of $124,500. The cryptocurrency is now trading at $122,555, showing strong momentum after breaking through key resistance levels. Traders and analysts believe that October’s historic pattern of gains may once again support upward movement in the market.

Analyst Altcoin Sherpa explained that Bitcoin maintains very strong market structure after its recent surge. However, he cautioned traders to remain defensive while the price approaches resistance levels.

He added that temporary support in the short-term lies around $119,909 and a further pullback could take the price to $116k. An upsurge above $123,259 may encourage an increase towards $125,550 and even $128,000.

Source: X

Bitcoin’s “Uptober” Trend Signals Strong Seasonal Growth

Historical data shows that October has often delivered high returns for Bitcoin. Over the past eleven years, from 2013 to 2024, Bitcoin recorded positive performance in October. The average return during this month stands at 20.62%. The consistent pattern of growth during this period has led the crypto community to nickname it “Uptober.”

Source: Coinglass

The Q4 has also been Bitcoin’s best performing period. Average gains during Q4 have reached 79.14%, showing a tendency for the cryptocurrency to strengthen toward the end of the year. If this seasonal behavior continues in 2025, the market can expect that Bitcoin could reach new record levels before the year ends.

The current daily chart supports the bullish outlook. Bitcoin is trading well above its major moving averages. The 50-day moving average stands at $113,743, the 100-day at $114,460, and the 200-day at $105,521. These levels now serve as layered support zones. The $118,000 level, once a resistance, has turned into a firm support area following this week’s rally.

Momentum signals indicate that the bullish power is still under control. The value of MACD (12,26,9) is 1,125 and is above the signal line of 517 showing a bullish trend. This structure indicates a continuation to the upside as long as our MACD remains above the signal line.

Source: TradingView

Institutional Inflows and Derivatives Activity

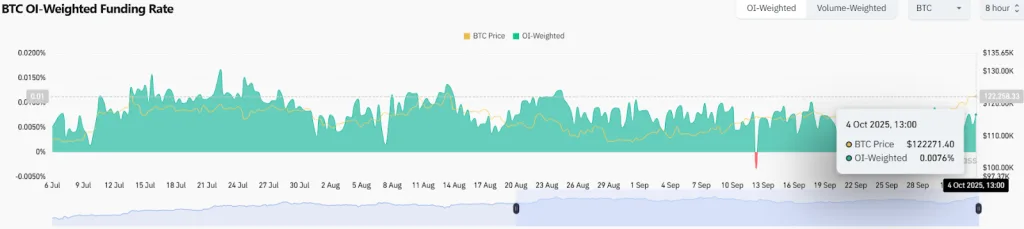

Derivatives data show rising activity across exchanges. Open interest has increased by 1.54% to reach the value of $89.88 billion. Trading volume rose by 17.4% to stand at $114.72 billion.

The funding rate is 0.0076%, suggesting a balanced market between buyers and sellers. In the past 24 hours, total liquidations reached $202.54 million. Long positions lost $51.07 million, while short positions lost $151.47 million.

Source: Coinglass

Institutional participation remains strong. Bitcoin spot exchange-traded funds recorded inflows of $3.24 billion this week, according to SoSoValue data. This marks the largest weekly inflow since mid-September and offsets last week’s outflows of $902.5 million. Increased demand from United States investors also reflects on the Coinbase Premium Gap, which rose by $113 compared with other exchanges.

Related: Bitcoin’s Uptober Rally: Liquidation Zones Tighten as Bulls Hold Momentum

Investor interest has been partly driven by delayed US economic data.The delay of the September jobs report amid the U.S. government shutdown shifted investor focus toward crypto assets. As a result, more investors have turned to digital assets like Bitcoin for short-term hedging.

The strength of Bitcoin is based around growing institutional inflows, great technicals and stable trading volumes. If these remain throughout October and Q4, the uptrend could hold up bringing the asset closer to fresh peaks. This “Uptober” rally flattening has led many analysts to believe that it may serve as a turning point for Bitcoin and give shape to the entire market phase in the near-term.