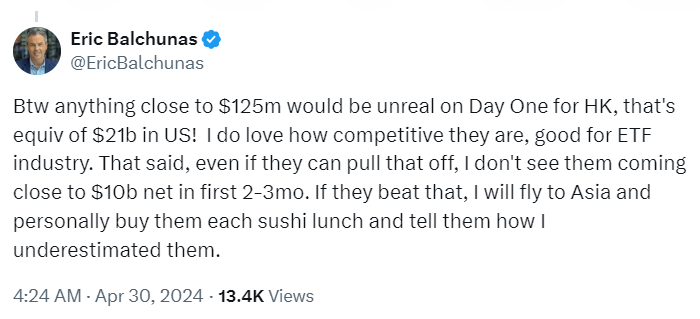

Bloomberg’s senior ETF analyst Eric Balchunas has responded to the enthusiasm surrounding the launch of spot bitcoin and ethereum exchange-traded funds (ETFs) in Hong Kong with a mix of skepticism and anticipation. Balchunas remarked that achieving inflows “close to $125m would be unreal on Day One for HK, that’s equivalent of $21b in US.”

The analyst underscored the industry’s competitive nature, lauding its potential to reinvigorate the ETF market. Despite his optimistic tone, he remained cautious, noting, “even if they can pull that off, I don’t see them coming close to $10b net in the first 2-3mo.”

Balchunas’s comments came in response to optimistic projections from Zhu Haokang of China Asset Management (ChinaAMC), who anticipated that initial trading volumes could exceed those in the U.S. China AMC is expected to lead among the new ETF issuers in terms of fund size, with further details to be revealed in an upcoming announcement at HKEX, as confirmed by Wayne Huang, Head of ETF and custody business at OSL.

Zhu Haokang detailed the unique aspects of their ETF, noting that, unlike the U.S. Bitcoin spot ETFs, theirs supports both spot and physical subscription and redemption, setting it apart in the Hong Kong market. Additionally, the Huaxia Fund’s Hong Kong spot ETF is the only one that offers counters in three different currencies: Hong Kong dollars, U.S. dollars, and renminbi. It also includes both listed and unlisted shares, features that Haokang believes will distinguish its offering from competitors.

Wayne Huang further explained the process of physical subscription, which initially requires the brokerage company to “upgrade its license” to be able to handle virtual asset transactions. This process involves investors sending coins to OSL through this broker, facilitating a transfer of equity back into the fund’s custody account, and completing the subscription.

Additionally, the ETFs have been made accessible to non-Hong Kong residents who meet the city’s regulatory standards, including customer due diligence requirements. Executives from Hashkey Capital and Bosera have indicated that this opens the ETFs to significant investment from mainland China.

Reflecting on the broader implications of these developments, Singapore-based crypto services provider Matrixport had previously suggested that the likely approval of these ETFs could attract several billion dollars of capital through the Southbound Connect program. This sentiment aligns with the high expectations and competitive nature observed by Balchunas and others in the industry.