BNB Hits New Peak as CZ Pushes Banks to Embrace Crypto

- Binance Coin (BNB) reaches an all-time high, solidifying its status in the crypto market.

- CZ urges banks to adopt BNB, bridging traditional finance with the growing crypto ecosystem.

- BNB’s surge is fueled by strong market momentum, rising trading volumes, and technical gains.

Binance Coin (BNB) has surged to an all-time high, solidifying its position among the leading digital assets. This latest price surge pushes BNB to new heights, reflecting growing interest in the cryptocurrency market. Following the push, Binance founder Changpeng Zhao (CZ) has urged banks to integrate BNB, signaling an important step towards bridging traditional finance with the crypto world.

Exceeding expectations, BNB topped over $940, following several peaks in the price, and is a significant milestone for the cryptocurrency. CZ’s BNB appeal to banks highlights the growing mass appeal of crypto.

BNB Surge Driven by Strong Market Momentum

According to market data, there is strong momentum behind BNB’s price rally. BNB’s futures contracts saw a 24-hour trading volume of $1.57 billion. Open interest (OI) stands at $1.76 billion, a sign of high market activity.

Source: Coinglass

In addition, $6.05 million of shorts were liquidated, versus $148.83 million of longs. The disparity indicates that a short squeeze was one factor driving the price spike.

Source: Coinglass

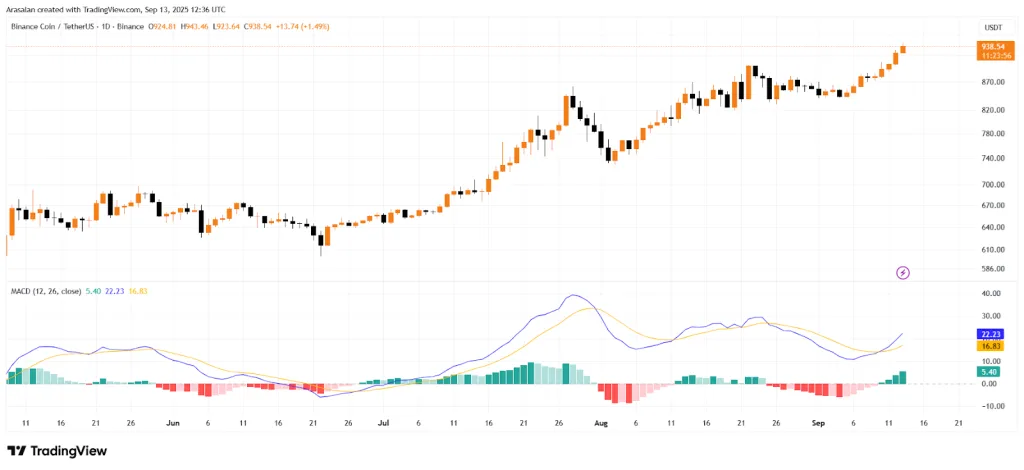

The digital currency has sustained growth over some months on the back of increased demands and market conditions. At the time of writing, BNB is trading at $939.76, marking a 3.47% gain. Technical indicators such as the MACD also paint a bullish picture, suggesting that BNB could see more gains.

The MACD line is presently 5.40, while the signal line is 22.23. The histogram is turning green with more bars coming in, a sign that bullish momentum is picking up. This technical pattern indicates that BNB could now also see to continue upwards, leaning towards breaking higher resistance levels.

Source: TradingView

Activity in BNB’s network accompanied the rally, with Bitcoin also pumping in recent days heading towards its all-time highs and lifting market sentiment across the board. Institutional demand continues to increase for digital assets as well, and CZ’s sway is clearly felt in the industry. His work as a consultant in regard to the government of Pakistan and Kazakhstan also highlights his significance within the worldwide crypto horizon.

BNB Whale’s $300 Investment Highlights Crypto’s Massive Potential

Furthermore, in light of the recent price rally, CZ replied to a X post of an interesting story about a sleeping BNB whale. He only put $300 in BNB during the ICO back in 2017 and today his portfolio is worth more than $25 million.

The mind-boggling return of 8,599,660% is a classic example of the kind of returns early investors in cryptocurrencies could make. CZ’s brief comment, “Which address?” caught crypto traders’ eye.

The more BNB grows in price, the more useful it becomes as part of a financial ecosystem. Banks’ penetration of BNB could facilitate the cryptocurrency becoming more useful in payments, trading and financial services infrastructure. The possibility that it would plug into mainstream banking also underscores the increasing overlap of crypto and conventional finance.

Related: Bitcoin Could Hit $190K as CZ Warns of Institutional Risks

The success of BNB reflects crypto’s growing respectability. Growth of the cryptocurrency is being fueled by institutional and retail investors alike. With the proliferation of blockchain-related technologies and cryptocurrencies, Binance has cemented its place as a major contender in the space.

With CZ’s call for banks implementing BNB into their system the cryptocurrency could enter an even deeper mainstream use phase over the next few months. This transition could actually transform the banking sector making BNB one of the most important things in global finance.