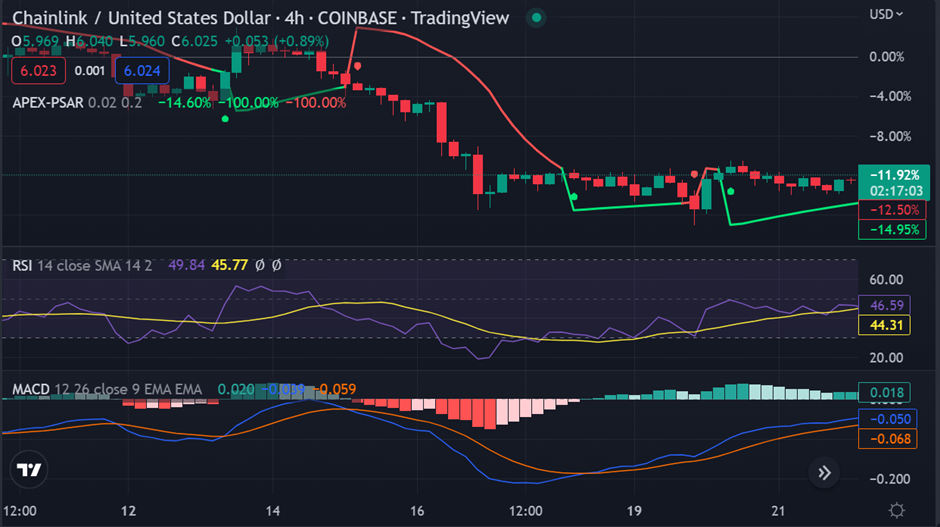

Recent Chainlink price analysis shows LINK is starting to gather momentum after hitting an intraday low at around $5.9013.The price action has stayed above the 20 & 50-day simple moving averages (SMA). This bullish reversal pattern was accompanied by breakouts on the volume and RSI indicators.

The MACD has also formed a bullish divergence with the price, indicating that there could be further appreciation to come. In addition, the Parabolic SAR indicator is trending above the price action, hinting at potential gains in the near term.

Chainlink is trading at $6.02, with a trading volume of $135,803,517.Chainlink price has been fluctuating in the range of $5.8 to $6.2 over the past week, with a surge in buying pressure pushing prices toward the top of this range.

LINK trades above MA 50 and MA 200, upside potential likely?

Chainlink price analysis indicates LINK has been able to climb above the 50 and 200-day SMAs, forming a bullish divergence on the 4-hour chart. This suggests that there is potential for an increase in buying pressure over the coming days.

Furthermore, with increased trading volume and a strong RSI reading, investors may be optimistic that LINK could continue to appreciate in value.

The market volatility for the LINK/USD pair is currently neutral, with prices likely to be gathering strength for a further upside move.

If the bulls can sustain their momentum, LINK could potentially break past the current resistance of $6.2 and reach higher levels in the near term.

However, if the buying pressure wanes and prices start to retrace, support can be expected around $5.8 and $5.9.

At the time of writing, LINK/USD is up by a small figure of 0.86%, with a market capitalization of $3,055,425,541.Link is set to breach the Fibonacci extension levels of $6.2 if it continues on its current trajectory, with potential upside targets at $7 and beyond. On the downside,the retracement levels of $5.8 and $5.9 should provide support in case of a pullback.

Overall, Chainlink’s recent bullish reversal pattern suggests that the cryptocurrency could be in for some further price appreciation over the coming days. That said, investors should also keep an eye on market volatility as LINK/USD could see some retracement in the short term.