Chainlink Targets $30 as Whale Activity and OI Hit Records

- Chainlink whale transactions surge to a 3-month high, signaling stronger bullish sentiment.

- Analysts project a major barrier forming near the $30 price level in the coming sessions.

- Open interest in LINK futures hit $1.42 billion, up 26.37 percent in just the last 24 hours.

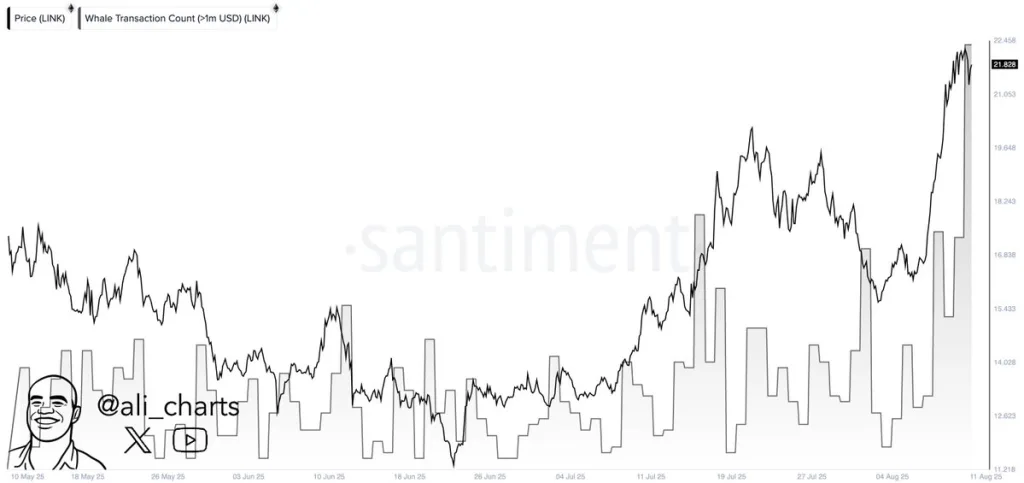

Chainlink (LINK) may be entering a stronger bullish phase as large-holder activity climbs to its highest point in three months. Market analyst Ali, citing data from on-chain analytics provider Santiment, noted a sharp rise in whale transactions valued above $1 million.

The increase comes as LINK breached the $21 zone, marking its highest price since early February. The rally, which has been unfolding since mid-June, appears to be closely linked to these high-value transactions.

The recurrent spikes in whale activity are indicative of further build-up by large holders, which in the past has been a catalyst to greater liquidity in the market and robust upward momentum. Statistics indicate that such big trades tend to converge around important breakout points, which enhances the trust of the market players.

With LINK maintaining a steady pattern of higher lows, the current structure points to sustained buyer control. In past market cycles, the increased activity of whales around key price breakouts has been an indicator of the long-term rallies.

If this pace of accumulation persists, analysts project LINK could test the next resistance zone near $30 in the coming sessions. Nevertheless, traders are monitoring the $15 level as short-term support.

This zone may be tested again in case of a change in the overall market conditions, but at the moment, the sentiment is slanted towards further increases. With whale activity surging alongside price, LINK’s market trajectory may be poised for another leg higher.

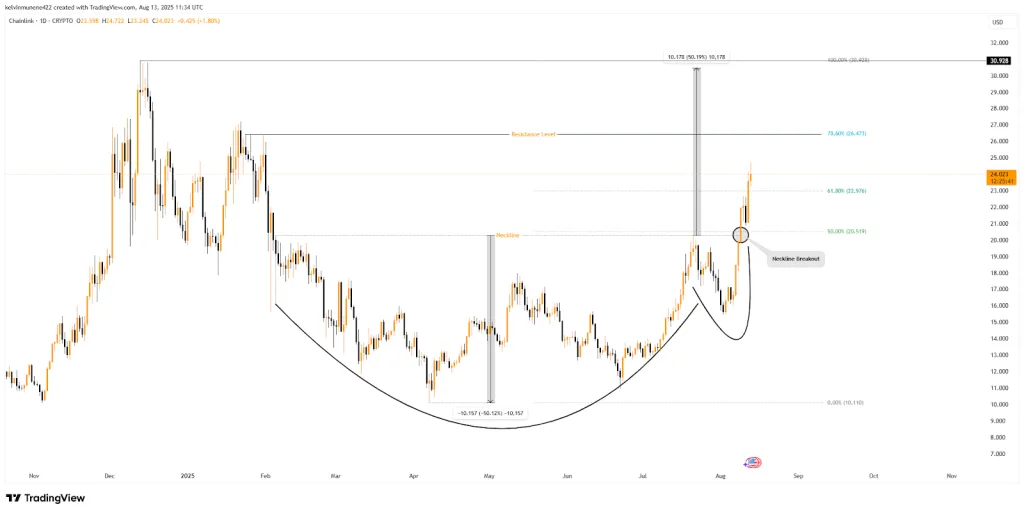

LINK Clears Cup & Handle Neckline, Sets Sights on $30

Zooming out on the daily chart, Chainlink’s price has completed a textbook cup-and-handle formation, a pattern that often precedes strong upward moves. The structure commenced in early February 2025, chiseling a rounded bottom that gradually rose to $20.26 by late July.

This move formed the cup, followed by a minor consolidation period in late July and early August, which created the handle with a minor pullback to about $15.43. However, the decisive move came on August 9, when LINK broke through the neckline at $20.26 — a level also marking the 50% Fibonacci retracement from the prior swing high.

Momentum drove the token up, breaking the 61.8% retracement mark of $22.97 and reaching about $24.02. This continued ascent has been supported by increasing market participation, which has been on an upward trend since late June.

Technically, the next significant test is at $26.47, which coincides with the 78.6 percent Fibonacci retracement. A clear break above this level could open the door to the measured target of $30.93, calculated by adding the cup’s depth of $10.11 to the breakout point.

The $30 level is more than a technical milestone — it is also a psychological barrier and a previous resistance from December 2024, making it a zone of heightened interest for traders. On the downside, immediate support rests at $22.97, with the neckline at $20.26, which coincides with the 50% fib level and serves as the key structural floor.

Holding above these levels keeps the bullish framework intact and maintains the potential for further gains. In the meantime, the token’s Relative Strength Index (RSI) is currently at 73.17, which places it in the overbought area.

This reading suggests that, despite high momentum, the market may be approaching a stage where a short-term pullback could occur if buying pressure decreases. As a result, traders ought to monitor momentum closely, as any slowdown could trigger a corrective phase before the next leg higher.

Related: Build on Bitcoin Joins Chainlink Scale for BTCFi Expansion

On-Chain Data Shows Decisive Bullish Rally Intact

Chainlink’s market activity is accelerating at a remarkable pace, with both derivatives and spot trading surging to record levels. As of the latest session, open interest in LINK futures has reached an all-time high of $1.42 billion, up +26.37% in the past 24 hours.

This drastic increase is indicative of a new wave of leveraged positions, as traders become more convinced and speculative after the token’s recent breakout. The spot market is showing similar strength.

Daily trading volume has climbed to $3.98 billion, the highest level of 2025. Such a surge underscores robust market participation and deep liquidity, often serving as confirmation of sustained price momentum.

Conclusion

The Chainlink rally is gaining speed as whale activity increases, open interest hits an all-time high, and trading volumes skyrocket. As a result, technical pointers now target the next critical levels at $26.47 and $30, while an overbought RSI indicates a potential short-term consolidation.

By holding above key breakout points, LINK maintains its bullish formation, making it well primed to continue its uptrend and keeping both short-term traders and long-term investors on their toes.