CLARITY Act Gains Momentum as Coinbase CEO Signals Win-Win-Win Outcome

- CLARITY Act talks resume as Coinbase CEO signals three-way policy compromise path.

- Stablecoin reward dispute narrows as banks and crypto companies return to talks.

- Polymarket odds swing sharply to 90% as CLARITY Act momentum rebuilds in Washington.

Momentum is building in Washington around the CLARITY Act after weeks of tense negotiations between crypto firms, banks, and lawmakers. However, fresh optimism emerged today when Coinbase CEO Brian Armstrong signaled that talks had returned to a constructive phase, describing progress toward what he called a “win-win-win” outcome for the industry, traditional financial institutions, and U.S. consumers.

Armstrong spoke alongside Senator Bernie Moreno (R-OH) at the World Liberty Forum in Mar-a-Lago before reiterating his remarks on X following a CNBC interview. His comments marked a shift from earlier gridlock that stalled advancement of the CLARITY Act and briefly strained relations between crypto executives and the White House.

Negotiations Reopen After Draft Dispute

The breakthrough follows weeks of disagreement over draft language that sought to restrict stablecoin rewards. Industry leaders, including the Coinbase CEO, opposed provisions that would ban interest-bearing stablecoins and position the U.S. Securities and Exchange Commission as the primary regulator of the crypto sector.

Armstrong stated during his CNBC appearance that Coinbase could not support the previous draft due to those provisions. He noted that concerns raised by the exchange and other industry participants prompted lawmakers and stakeholders to return to the negotiating table.

According to Armstrong, discussions now point toward a structure that satisfies crypto firms, protects banking interests, and advances President Donald Trump’s digital asset agenda. Initially, the White House had reportedly expressed disappointment when Coinbase withdrew support, describing the move as unilateral.

Regardless, renewed dialogue suggests alignment may be forming around revised language. Senator Moreno acknowledged that negotiations had stalled after lawmakers became “hung up” on stablecoin rewards, adding that such rewards shouldn’t be part of this equation.

Timeline and Political Outlook

Moreno projected April as a potential approval timeline for the CLARITY Act, stating, “We are going to get this across the finish line, hopefully by April.” His remarks signal confidence among Republican lawmakers that outstanding issues can be resolved within weeks.

When asked whether a Democratic shift in Congress could derail the measure, Moreno dismissed the possibility. He said neither the House nor the Senate would flip, framing the legislation as aligned with voter priorities. He cited concerns over inflation and government overreach as factors that shaped the current political environment.

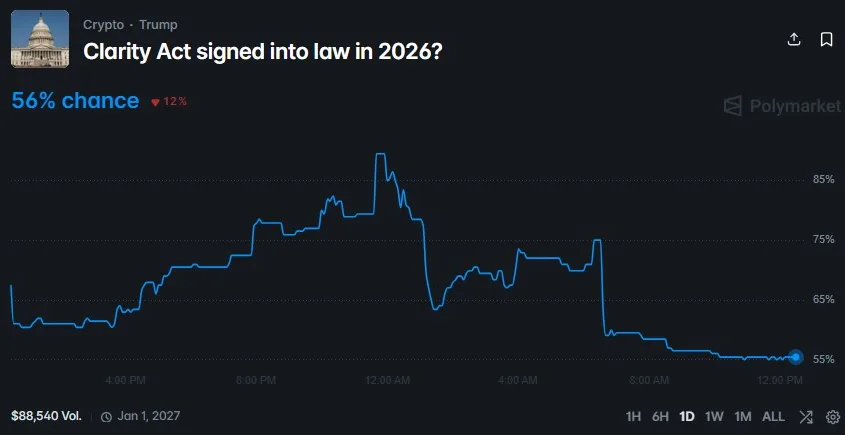

Source: Polymarket

Meanwhile, prediction markets reflected fluctuating expectations. At press time, Polymarket odds of the CLARITY Act passing in 2026 briefly climbed to 90% before retreating to 56% at publication time. The rapid shift underscored both heightened interest and lingering uncertainty.

Related: U.S. CFTC Chair Selig Warns States Over Prediction Markets

Final Meetings Before Deadline

Meanwhile, industry representatives and banking executives are scheduled to reconvene today to address the remaining impasse over stablecoin yields. According to journalist Eleanor Terrett, another meeting could take place on February 19, though confirmation remains pending. Patrick Witt, executive director of the White House Crypto Council, also indicated that discussions may resume as early as this week without specifying a date.

Only slightly more than one week remains before an end-of-month deadline that would require banking and crypto stakeholders to finalize terms. That timeline has increased pressure on negotiators to reach a consensus.Overall, the renewed momentum surrounding the CLARITY Act reflects a recalibrated approach after public friction between crypto firms and regulators. With the Coinbase CEO signaling progress and lawmakers pointing to an April target, attention now shifts to whether revised language can bridge divisions over stablecoin policy and regulatory oversight.