Conflux CFX Targets 30%–50% Upside as Bullish Pennant Forms

- CFX forms a bullish pennant pattern with a breakout targeting a 30% to 50% price surge.

- MACD crossover and rising RSI confirm signals of a bullish resurgence building in the near term.

- Derivatives data highlights bullish traders as momentum strengthens in CFX’s short-term outlook.

Conflux’s CFX token is demonstrating renewed strength after emerging from a consolidation zone between $0.177 and $0.167, which limited its movement earlier this week. Following the breakout, the altcoin has increased by over 4% in the last 24 hours and is trading at around $0.1831 at press time.

It has a market cap of $940.23 million, fueled by a 73% surge in daily trading volume to a peak of $100.52 million. Despite the recovery, the token has not yet reversed its larger downtrend, as monthly performance shows a 6.67% decline.

Even so, market spectators note a bullish pennant on the daily chart, a classic continuation pattern generally indicating some degree of continued upside. With analysts’ estimations of about 30%—50% upside in the short term, CFX stands as a strong candidate for short-term gains.

CXF Bullish Case: Is a 30%-50% Surge Possible?

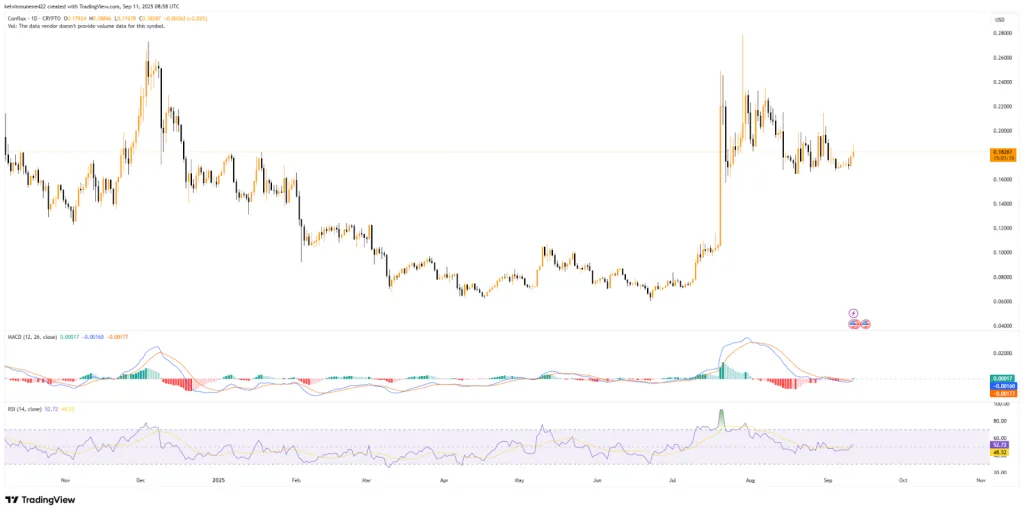

CFX is coiling inside a bullish pennant that has formed its price action since late July and is setting up a move that will define the next phase of its trend. The token now trades above $0.18, moving toward breakout levels following the build-up that occurred during recent trading sessions.

The first resistance rests at $0.19, the 23.6% Fibonacci retracement. A move above this zone would trigger interest for the upper border of the pennant and place the bulls on higher terrain. Taking control, the bulls could then push CFX further to the $0.22-$0.23 area, corresponding to the 50% and 61.8% Fibonacci retracements.

That would represent roughly a 30% climb from current prices. A more dramatic upward thrust may push the token near this year’s high of $0.27, which also proposes an upside of around 50%. In this setup, though, the risk element remains.

If the sentiment evaporates, CFX may fall toward the lower boundary of the pennant, where it might attempt to re-establish a base. Yet, a clean break beneath the 0% Fibonacci level at $0.16 would disregard the bullish setup entirely and open up the token to deeper downside risks.

Technical Setup Hints at Bullish Resurgence

From a technical perspective, momentum is tilting in favor of the buyers, as indicators are flashing encouraging signs for the token’s near-term trajectory. For example, the MACD, positioned at -0.00160, has just crossed above its signal line at -0.00177.

Although the gap is narrow, such crossovers can often represent the first step in a potential bullish phase. The move also coincides with expanding green bars on the MACD histogram, which indicates growing buying pressure returning to the market.

The RSI is at 52.72, representing a neutral trend, meaning it is neither bullish nor bearish. However, the indicator is moving upward from previous bearish levels, signaling growing buying pressure. If this momentum continues, the RSI could push above 60, a level often associated with the start of a bullish trend.

Related: MYX Finance Soars 1,400% in a Week but Risk Signals Flash Red

Sentiment Indicators Support Upward Potential Ahead

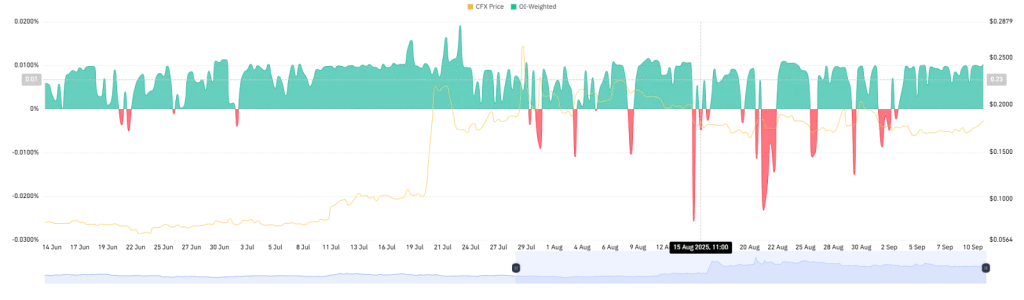

Not to leave out, the derivatives market is also tilting in favor of Conflux (CFX) bulls as the OI-weighted funding rate holds firm in positive territory, now at +0.0102%. A green-zone reading like this signals that long positions are more dominant, reinforcing the potential for sustained bullish momentum.

Liquidation figures tell the same story. At press time, the market had cleared about $61.85K in short positions against $16.02K in longs. Though relatively small in scope, the imbalance does highlight the fact that bearish trades are being short-squeezed while bullish traders tighten their grips. This shift implies a growing confidence in CFX’s short-term trajectory, hinting at room for further price appreciation.

Conclusion

Conflux’s outlook is trending bullish, with technical patterns, sentiment, and momentum indicators aligning in favor of a strong case for further gains. Still, caution must be taken, as any change in the market mood might challenge the setup. For now, optimism is dominating, but traders will need to balance the opportunity with a degree of understanding of the risk.