Congress Urges SEC to Allow Bitcoin Inside 401(k) Plans Now

- Lawmakers want Bitcoin access inside 401 (k) plans to match modern investment demand.

- US retirement assets now exceed $43 trillion, creating potential crypto inflows.

- Firms prepare crypto-enabled 401(k) products while regulators review updated rules.

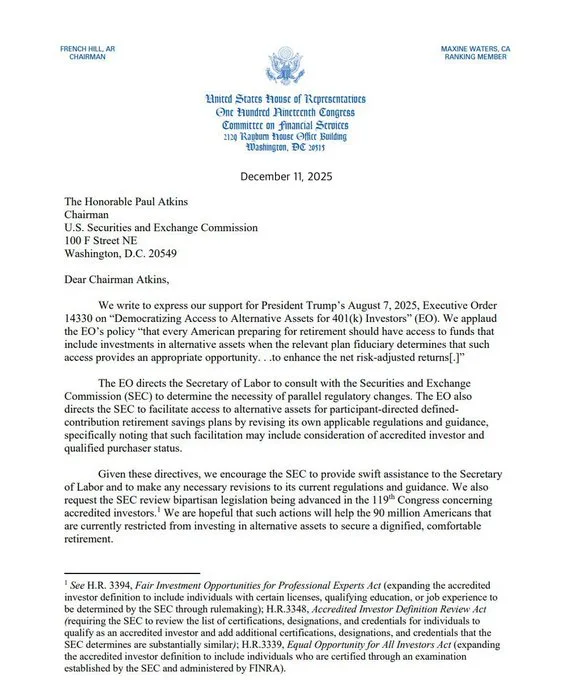

U.S. lawmakers have formally urged the Securities and Exchange Commission to allow Bitcoin and digital assets in 401(k) retirement plans. In a December 11 letter, members of the House Financial Services Committee asked SEC Chair Paul Atkins to act. The request supports President Donald Trump’s August 2025 executive order directing regulators to modernize retirement investment rules. If adopted, the shift could open trillions of dollars in retirement capital to alternative assets.

The letter targets long-standing limits that keep most retirement savers confined to stocks and bonds. Lawmakers argue that current rules block access to regulated alternatives despite market changes. They want coordinated action between the SEC and the Department of Labor. The goal is to align federal oversight with evolving investment demand.

Lawmakers Press for Regulatory Alignment

In the December 11 letter, lawmakers cited President Trump’s executive order from August 2025. The order instructs the SEC and Department of Labor to revise rules that restrict 401(k) investment options. Congress asked the agencies to provide clarity that allows plan fiduciaries to offer broader choices.

White House data shows total U.S. retirement assets reached $43.4 trillion as of March 31, 2025. Despite this scale, most savers cannot access alternative investments. Lawmakers stated that the gap reflects outdated policy rather than market reality. They want retirement strategies to reflect modern capital markets.

Supporters argue that measured allocations could improve risk-adjusted returns. They also say diversification could strengthen long-term outcomes for savers. The letter frames the effort as modernization rather than deregulation.

Trillions in Retirement Capital at Stake

U.S. 401(k) plans hold about $12.5 trillion in assets. Overall, retirement savings exceed $43 trillion. Analysts estimate that even small allocations could move markets. A 1% to 3% shift could translate into tens of billions of dollars in demand.

Market analysts say such inflows could influence Bitcoin’s price dynamics. They point to supply constraints and existing institutional demand. While no price targets appear in the letter, the potential scale draws attention. Could retirement capital become Bitcoin’s next major source of demand?

Industry experts describe the policy shift as a turning point for digital asset adoption. They view retirement plans as a bridge between crypto markets and traditional finance. The discussion now centers on structure rather than access.

Related: Congressman Dusty Johnson Says Blockchain Will Reshape All Industries

Firms Prepare as Guardrails Remain Central

Several financial services firms have begun preparing for possible rule changes. Some retirement plan providers have explored partnerships with institutional crypto custodians. These structures would allow employees to allocate up to 5% of plan contributions into digital assets, pending approval.

ForUsAll has partnered with Coinbase Institutional under a similar framework. The arrangement would let employees direct a limited portion of 401(k) savings into crypto. Coinbase’s CEO has stated that Bitcoin and other cryptocurrencies will eventually become a normal part of “everyone’s 401(k).”

At the same time, lawmakers and experts continue to stress safeguards. Bitcoin’s volatility remains a central consideration. Plan sponsors and fiduciaries would require clear rules to manage risk and investor education. SEC Chair Paul Atkins has not set a timeline. He has acknowledged the executive order and the SEC’s role alongside other regulators.