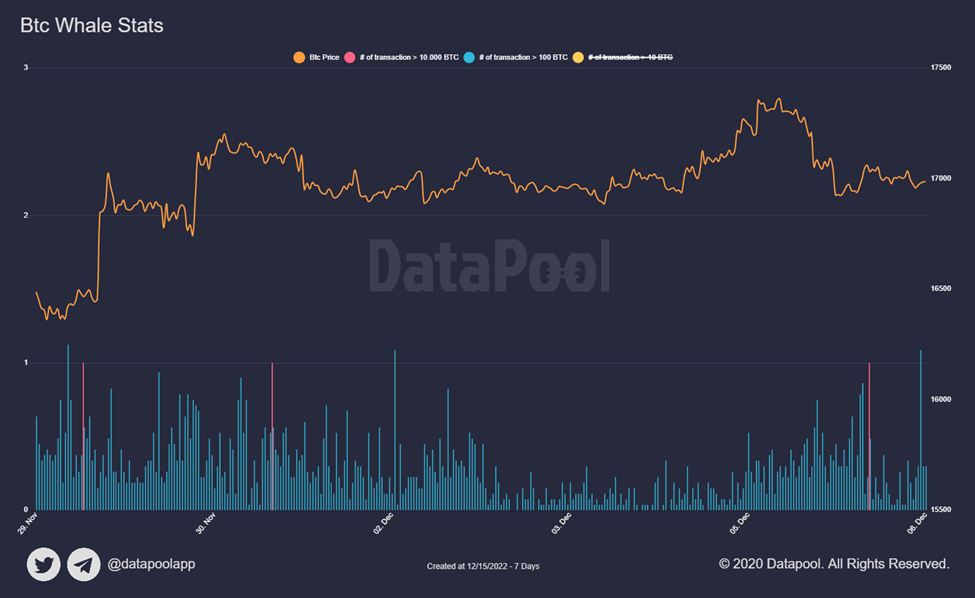

Bitcoin price has been on an upward trajectory over the past nine days, buoyed by strong buying pressure from holders of addresses holding between 100 to 10,000 BTC. These addresses have purchased a stunning $726 million worth of BTC in this period – indicative of strong bullish sentiment.

Not only Bitcoin but stablecoin asset classes such as USDT, BUSD, and DAI are also being bought quickly during this bullish run. This is a recipe for good things as the buying pressure from these two markets has caused the price of Bitcoin to skyrocket.

Santiment’s supply distribution data, we can confidently say that the Bitcoin price movement is being substantially influenced by these key whale addresses. Although they only make up 0.0364% of all BTC addresses, they hold a substantial portion of the total Bitcoin circulating and are responsible for much of the buying pressure in this period.

In short, the Bitcoin price movement is being heavily influenced by the actions of these key addresses, demonstrating just how powerful they can be. It will be interesting to see if this trend continues or not in the coming days as more investors jump on board this bullish bandwagon.

Given the current market sentiment and the power of these key whale addresses, it looks like Bitcoin is here for the long-haul. All we can do now is watch and wait with bated breath!

With all that said, it’s important to remember that there are still a significant number of other smaller holders who also have just as much influence on the Bitcoin market and that no single group is solely responsible for price movements.

At the time of writing, Bitcoin is trading at $17,657, representing a 4.94% increase in the last 24 hours. It looks as though Bitcoin is continuing on its bullish run and that these key whale addresses are playing a major role in driving up prices. It will be interesting to see if this trend continues or not in the coming days, but one thing is for sure – the Bitcoin market is definitely heating up!

Therefore, it’s important to continue to keep an eye on the overall sentiment of the market and identify which key addresses are causing major buying and selling activity – this will give us a better idea of where Bitcoin may be headed in the coming days

It remains to be seen whether this surge in activity will drive prices even higher and significantly improve investor sentiment towards cryptocurrency. However, with so much buying pressure and investor enthusiasm, it is safe to say those good things are in store.

Conclusion

Bitcoin price movement over the past nine days is largely a result of wallets holding between 100 to 10,000 BTC. By comparison with other asset classes, they are holding a disproportionate amount of power in this bullish run and should be taken into account when trying to understand what’s driving Bitcoin prices.