- SEC Chair Gary Gensler reinforces a call for crypto regulation, emphasizing compliance with federal securities laws.

- Recent SEC rule extends oversight to DeFi platforms, signaling increased regulatory control.

- Gensler’s commitment to strict crypto regulation persists despite criticism on rulemaking pace.

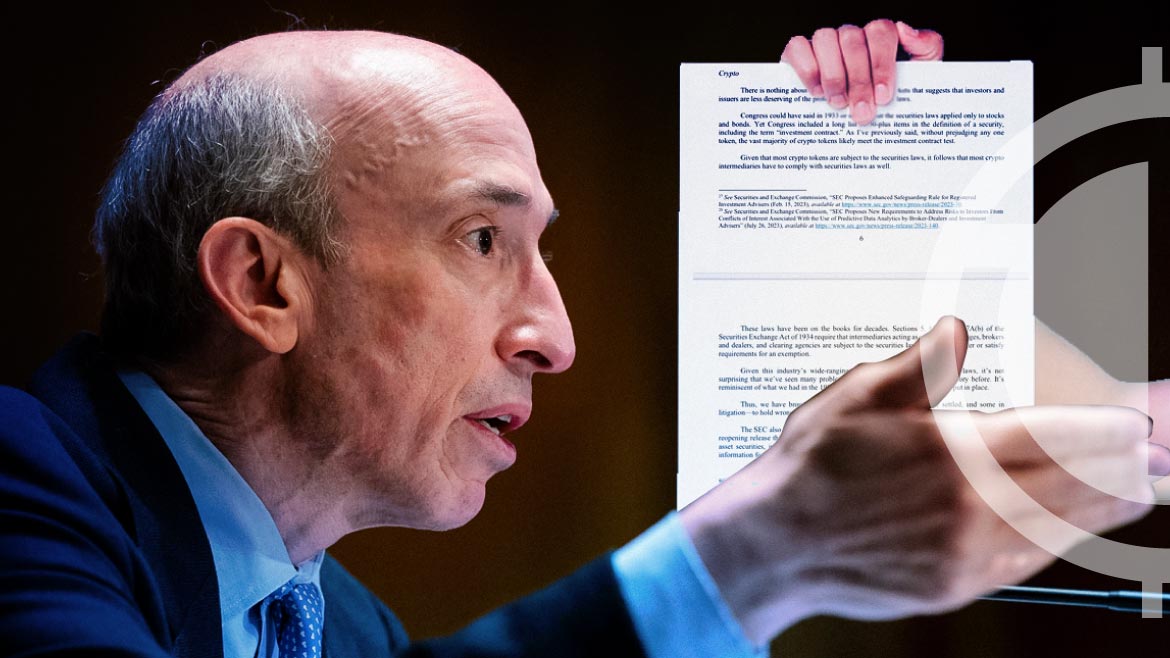

In a recent appearance before the House Financial Services Committee, SEC Chair Gary Gensler reiterated his unwavering position that cryptocurrencies and the entities operating within the crypto sector must be subject to federal securities laws. Fox Business journalist Eleanor Terrett shared a thread on X with Gensler’s testimony, adding to the anticipation surrounding his testimony.

🚨NEW: @SECGov Chairman @GaryGensler’s testimony for tomorrow’s House Financial Services hearing has been released.

— Eleanor Terrett (@EleanorTerrett) September 26, 2023

Here are his comments on #crypto 👇🏼 pic.twitter.com/Ne0NaK3n6x

Gensler’s testimony shed light on the pervasive noncompliance with securities regulations within the cryptocurrency industry, underscoring the challenges and issues that have arisen as a consequence. He emphasized the critical need for compliance, asserting that the majority of crypto tokens should adhere to the existing securities laws. Gensler went a step further, stressing that this compliance obligation extends to crypto intermediaries, reaffirming his commitment to imposing rigorous regulations within the crypto space.

Of notable mention was the SEC’s recent rulemaking initiatives, with Gensler highlighting an April release. This release expanded the definition of exchanges to encompass crypto platforms, including those in the decentralized finance (DeFi) sector. This strategic move signifies the SEC’s intent to assert its authority over the growing DeFi sector, subjecting it to the same regulatory framework as traditional exchanges.

Turning to specific cases, Gensler confirmed the ongoing evaluation of a court’s decision related to Grayscale Investments’ pursuit of a spot Bitcoin exchange-traded fund (ETF). Additionally, the SEC’s decision to delay approval for Ark Invest and 21Shares’ spot Bitcoin ETF application on the Cboe BZX Exchange, rescheduling the approval date for January 10, 2024, was noted.

During the House hearing, Gensler faced criticism regarding the SEC’s rulemaking pace and the duration of comment periods. While cryptocurrency took a relatively smaller role in this hearing compared to prior sessions, Gensler’s steadfast commitment to stricter crypto regulation remained a central theme.

Gensler’s determination to subject crypto trading platforms to comprehensive U.S. securities regulations and his assertion that most crypto tokens should meet the criteria for investment contracts underscores the SEC’s ongoing endeavors to fortify oversight and regulatory control in the cryptocurrency sector. The introduction of the term crypto securities underscores the agency’s intention to expand its jurisdiction, ensuring that the cryptocurrency industry aligns with established regulatory rules.