Crypto Funds Attract $921 Million as Rate-Cut Hopes Rise

- Overall crypto fund inflows hit $921M, signaling rising optimism across major markets.

- Bitcoin led with $931M in inflows, showing strong institutional faith in digital assets.

- Ethereum faced $169M in outflows, marking its fifth consecutive week of investor retreat.

Digital asset investment products attracted $921 million in inflows last week, according to CoinShares’ October 2025 report. The surge followed the easing of U.S. inflation data and mounting expectations of Federal Reserve rate cuts, reflecting a renewed institutional appetite for crypto exposure. Trading volumes across global exchange-traded products (ETPs) remained strong at $39 billion, exceeding the $28 billion year-to-date weekly average.

Institutional Momentum Returns as Macro Outlook Shifts

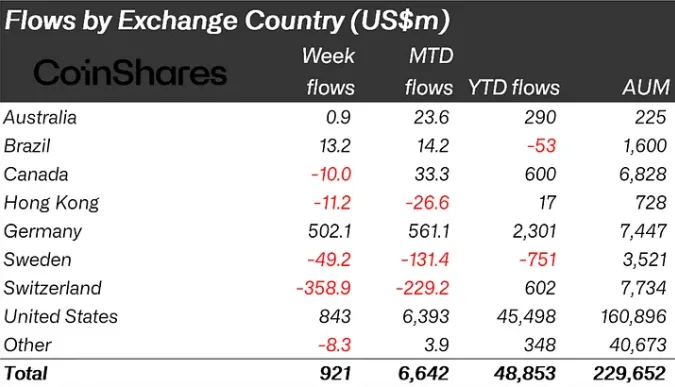

The inflows were primarily driven by the United States, which accounted for $843 million, and Germany, which added $502 million. On the other hand, Switzerland experienced an outflow of $359 million, primarily due to asset transfers within the company, rather than investor withdrawals. At the same time, Sweden and Hong Kong reported minor redemptions of $49 million and $11 million, respectively, while Brazil and Canada accounted for $13 million and $10 million, respectively.

The data shows capital rotation favoring risk assets, with crypto funds regaining momentum after weeks of uncertainty tied to the U.S. government shutdown and limited economic guidance.

Bitcoin Leads While Ethereum Extends Losses

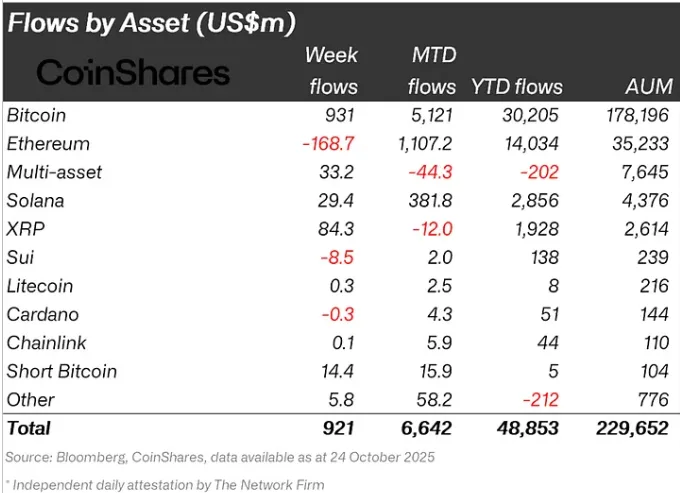

Bitcoin remains the king of cryptocurrencies, attracting $931 million in new investments in just one week. The $30.2 billion of the total inflow year-to-date and the $178.2 billion of the total assets under management were the result of the rise in the popularity of the digital currency as a haven during times of monetary uncertainty.

Ethereum, however, saw its fifth consecutive week of redemptions, losing $168.7 million. Cumulative YTD outflows now exceed $14 billion, despite upgrades improving network scalability and gas efficiency. Analysts from CoinShares said the continued withdrawals indicate investors’ preference for assets with stronger regulatory clarity and clearer ETF prospects.

Altcoins displayed mixed performance. Solana raised $29.4 million, while XRP garnered $84.3 million amid growing anticipation surrounding potential U.S. stock ETF approvals. Smaller assets showed marginal movements, Litecoin added $0.3 million, Cardano shed $0.3 million, and Sui saw a decrease of $8.5 million.

Related: Altcoin Season Index Drops from 80 to 41 in a Month: Report

Providers Reflect a Shift in Institutional Strategy

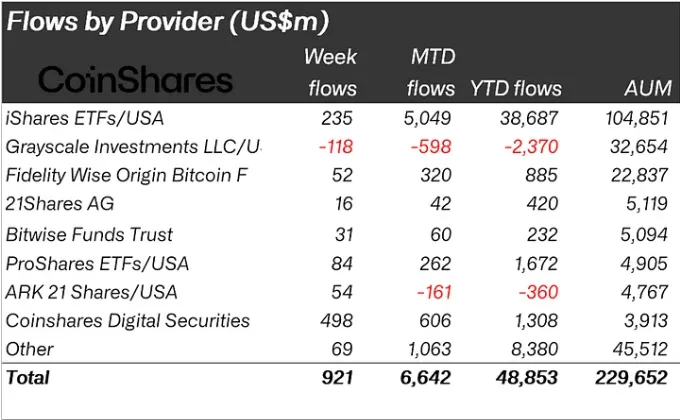

Among fund issuers, CoinShares Digital Securities led the field with $498 million in inflows. iShares USA followed with $235 million, while ProShares and Fidelity’s Wise Origin Bitcoin Fund brought in $84 million and $52 million, respectively. Grayscale, once the leader in the market, experienced $118 million in outflows, further increasing the year-to-date losses to $2.37 billion, as investors opted for ETFs with low fees and spot-based pricing over their counterparts.

Altogether, the flows for the month to date were $6.64 billion; this has increased the total assets under management for digital asset funds to $229.65 billion, up from $180 billion earlier this year. The data shows ten positive weeks out of the last fourteen, with outflows below, $1 billion failing to disrupt the broader uptrend.

The crypto market has shifted from redemptions exceeding $3 billion to inflows of over $6 billion at its peak, as reported by CoinShares data for 2025. The rebound traced in the chart indicates a reclaiming of trust as institutions adjust their positions in response to falling yields and continued demand for ETFs.

If the trends continue, analysts have suggested that the inflows in 2025, currently at $30.2 billion, could be comparable to the record $41.6 billion registered last year, thereby proving the crypto market’s strength once more as an alternative asset class.