Crypto Market Drops As Dip Buyers Target Key Support Levels

- Bitcoin hit its lowest zone since May as over $1 billion in leveraged positions were liquidated.

- Long-term holders raised spending from 12500 BTC daily to about 26500 BTC, fueling pressure.

- Rate cut uncertainty increased risk-off sentiment, driving declines across crypto & stocks.

Bitcoin and major cryptocurrencies extended sharp losses over the past 24 hours as traders cut risk and reassessed the odds of a December U.S. rate cut. Yet some investors now frame this selloff as a chance to build spot positions in both crypto and growth stocks at what they view as late-cycle, discounted levels.

Bitcoin traded near $97,000 on Friday, down almost 7% on the day and about 24% below its record high near $126,000 set in early October.

Crypto Panic and Bitcoin Price Crash

The global cryptocurrency market cap dropped around 6% in the past 24 hours to roughly $3.25 trillion, while 87 of the top 100 coins traded lower. Trading volume rose more than 40% as forced liquidations and defensive selling accelerated. Bitcoin led the decline, falling below $95,550 psychological level and hitting its lowest zone since May as risk-off sentiment spread from equities into digital assets.

Ethereum suffered even steeper percentage losses. Exchange data showed ETH sliding below $3,200 and even breaking $3,100 intraday, marking one of its worst daily drops since October. XRP, Solana, Dogecoin, and other large-cap tokens also fell, with many recording single-day declines of 7–12%.

Liquidations added to the pressure. According to Coinglass data, more than $1 billion in leveraged crypto positions were wiped out over 24 hours, with the majority coming from long traders who had bet on continued upside. At the same time, U.S.-listed spot Bitcoin ETFs saw hefty net outflows, reaching $869.9 million on Thursday alone, as some institutional holders took profits or cut exposure.

Source: Sosovalue

Safe-haven assets performed in contrast. Gold and silver extended their gains amid fears of high government debt and world fiscal risks. This trend strengthened the perception that most traders at the moment like traditional hedges compared to volatile digital assets.

Fed Rate-Cut Doubts and Risk-Off Mood Hit Crypto and Tech Stocks

Macro factors drove much of the risk aversion. Fed officials signaled growing hesitation about a third rate cut this year, as inflation sits near 3% and the labor market shows only limited softening. Minneapolis Fed President Neel Kashkari revealed that he opposed the last cut and remains undecided on December, while Boston Fed President Susan Collins described a “high bar” for further easing in the near term.

Futures traders now price the odds of a December rate cut at around 45–50%, down from roughly 95% a month ago. That shift has pressured growth-sensitive assets, including high-valuation technology stocks and crypto. Nasdaq futures dropped more than 1% in early Friday trading, while major U.S. indices looked set to extend their steepest slide in over a month.

Crypto-related equities moved in line with the broader selloff. Premarket quotes showed weakness in Coinbase, MicroStrategy, Robinhood, and listed miners such as Riot Platforms, Marathon and Hut 8, which all track Bitcoin’s performance closely. The combination of falling token prices, ETF outflows and stock declines reinforced a single narrative: investors currently step back from leveraged and speculative exposure while they reassess the Fed’s path.

Related: Markets Bet Big on Fed Rate Cut as Traders Eye Liquidity Shift

Buying the Dip

Despite the sharp drawdown, some investors see the current panic as an attractive entry point. According to Liquid Capital founder Yi Lihua, the 3,000–3,300 range in Ethereum is a strategic accumulation zone, not a signal to exit. He views this band as a strong support area within a late-stage cycle, even if near-term volatility remains high.

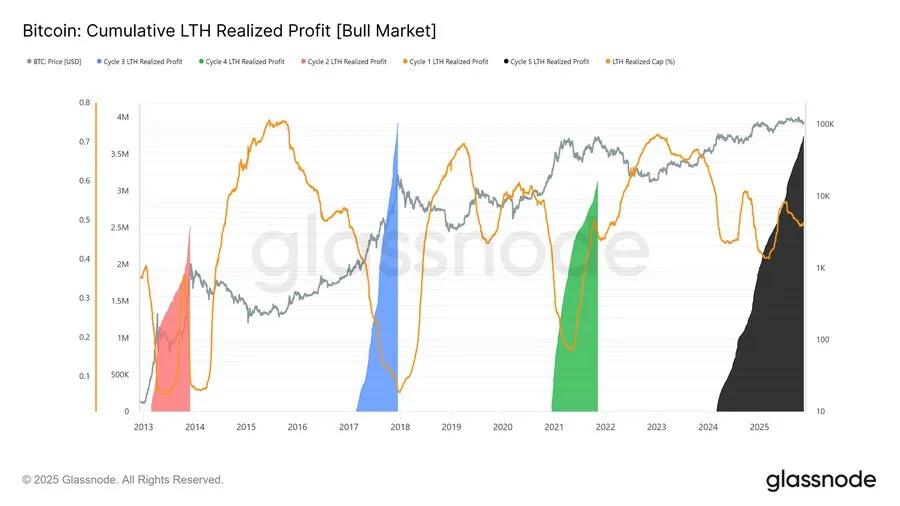

On-chain research supports a late-cycle interpretation. Analysis from Glassnode shows that long-term Bitcoin holders increased their spending from about 12,500 BTC per day in early July to around 26,500 BTC per day.

Source: X

Analysts describe this pattern as steady profit-taking and distribution, typical near cycle peaks, rather than a sudden wave of panic selling by “whales.”