- The crypto market experiences widespread selloff due to macroeconomic worries.

- Top coins on CoinMarketCap experience sharp double-digit plunges, while high volatility remains a concern.

- Altcoins have been facing increased risk and market volatility.

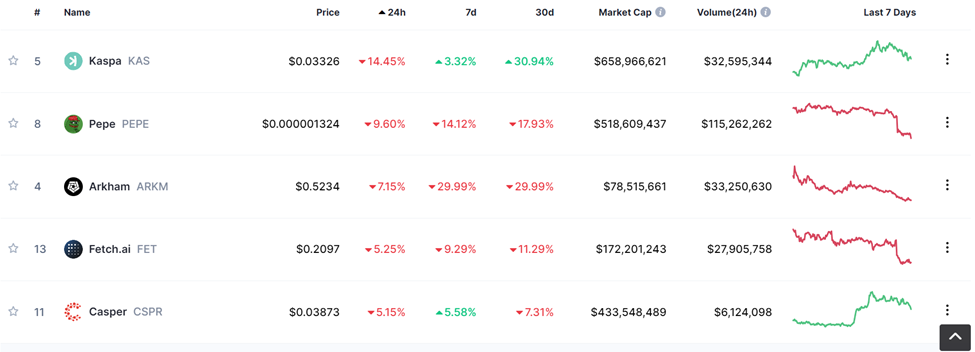

The cryptocurrency market saw a widespread selloff over the past 24 hours, with many major coins declining by double-digit percentages. This steep downturn was likely driven by broader macroeconomic concerns, as both the stock and crypto markets have been reacting to worries over impending monetary tightening and a potential recession.

Leading the way down was KASPA (KAS), a payments-focused blockchain network, which plunged nearly 15% to $0.03326. KAS has been one of the better performers in 2023, up over 33% in the past month, even after this latest drop. The selloff appears tied to profit-taking after the recent run-up, as opposed to any fundamental weakness. KASPA has strong technology but lacks the name recognition of larger cap coins.

In second place was PEPE, an NFT and meme-themed token, dropping by 9.60% to $0.00000132. PEPE rode the NFT wave in 2021 but struggled in 2022 as interest moved away from speculative niche assets. The highly volatile token tends to see amplified price movements in both directions. This latest leg down comes amid a broader cooling across NFTs and metaverse tokens.

Next was ARKHAM (ARKM), a new smart contract platform for the gaming industry. ARKM fell by 7.15% to $0.52348 as investors took a skeptical view of new altcoin projects during the risk-off sentiment. As a newly launched token, ARKM has not established a track record, making it more vulnerable to selloffs.

In the fourth spot was Fetch.ai (FET), an AI-focused blockchain for machine learning. FET slipped 5.25% to $0.20975 even as it maintained a solid 11% gain over the past month. The project has strong technology but has yet to see significant adoption. The decline appears tied to the overall market rather than weakness with FET specifically.

Rounding out the top 5 was Casper (CSPR), a public blockchain network with a permission-less mechanism, which dropped 5.15% to $0.03873. CSPR has traded sideways for most of 2022, neither participating in rallies nor seeing substantial declines. The latest dip is part of that ranging behavior rather than a breakdown. Sentiment remains cautious around smaller altcoins like CSPR despite its strong technology.

Overall, the top trending coins seeing double-digit declines were more speculative, smaller-cap assets. The selloff underscores the higher risk levels across the crypto asset class. However, the drops appear more tied to technical trading and general market conditions rather than project-specific issues. As macro uncertainty persists in the near-term, further volatility is likely across the crypto space.