CZ-Backed YZi Labs Moves to Seize Control of BNB Treasury Giant

- YZi Labs blames slow filings and poor updates for BNC’s sharp slide and weak investor trust.

- BNC holds 515k BNB yet trades at a wide discount that intensifies calls for leadership change.

- A consent victory lets YZi Labs expand the board and quickly push a full governance reset.

An aggressive governance battle has erupted inside CEA Industries, now rebranded as BNB Network (ticker BNC), after Changpeng Zhao–backed YZi Labs launched a formal push to take control of the publicly traded BNB treasury company. The move marks a dramatic escalation only months after YZi helped fund the firm’s $500 million PIPE that transformed it into the world’s largest public BNB asset holder.

According to reports, YZi Labs filed a preliminary Schedule 14A with the U.S. Securities and Exchange Commission on Monday seeking to unwind recent bylaw changes, expand the company’s board, and install its slate of directors through a written-consent campaign.

If a majority of outstanding shareholders sign the white consent card, the action would shift control of the company to YZi Labs without a shareholder meeting. The firm argues that its proposals are necessary to stop what it calls “continued destruction of stockholder value.”

Why YZi Labs Is Mounting the Takeover Attempt

YZi Labs, which holds more than 2.1 million BNC shares, says CEA’s crypto treasury pivot has been mishandled from the start. In filings and shareholder communications, the firm cites multiple operational failures:

- Slow or incomplete regulatory filings

- Delayed or insufficient investor communications

- Minimal institutional outreach or marketing

- Confusion around treasury disclosures and mNAV reporting

- Concerns over board independence and competing interests

YZi Labs also accuses CEO David Namdar, appointed after the PIPE alongside several 10X Capital executives, of promoting competing digital-asset treasury projects while BNC struggled to reach institutions. The filing argues that these issues have directly contributed to a widening gap between the company’s market value and the worth of its BNB holdings.

Ella Zhang, head of YZi Labs, said the board lacked “effective oversight” and failed to convert strong fundamentals into shareholder gains. “Stockholders can not wait any longer,” she said.

Stock Collapse and BNB Holdings Fuel Shareholder Tension

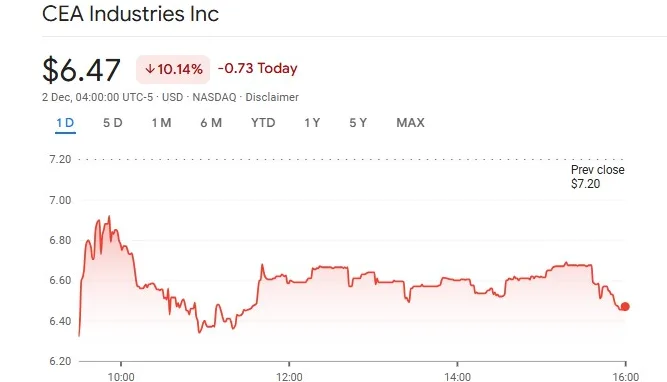

The performance of CEA Industries has been central to YZi’s activist push. The stock surged more than 600% in July after the PIPE announcement, but has since fallen 89% from its $57.59 peak. It closed Monday at $6.47, down more than 10% on the day and below its pre-pivot price.

By contrast, BNB is up 17.8% year-to-date, despite falling nearly 40% from its October all-time high. The token trades around the mid-$800 range, hitting a three-month low as broader macroeconomic pressure weighs on crypto markets.

BNC currently reports 515,054 BNB held at an average cost of $851.29, a position now valued at roughly $412 million. The disconnect between CEA’s market capitalization and its treasury has pushed its mNAV ratio to 0.79×, deepening the discount to net asset value.

Similar gaps in traditional closed-end funds have historically triggered activist campaigns, a parallel YZi Labs has emphasized to investors.

What Happens if YZi Labs Succeeds

If a majority of outstanding shares support the written-consent proposals, YZi Labs would gain effective control and could immediately restructure the board. The firm has signaled it will install new directors, review management performance, and explore leadership changes, including potentially naming a new CEO.

Such moves would focus on tightening reporting standards, accelerating regulatory filings, improving investor-relations output, and narrowing the valuation gap between BNC shares and the company’s BNB holdings.

The consent solicitation process is already underway. YZi Labs will distribute white consent cards urging holders to approve the expansion of the board and the election of its nominees. However, CEA Industries has not yet issued a public response to the allegations.

Related: BTC, Strategy, and Key Altcoins Dominate Social Market Focus

A Governance Battle With Industry-Wide Implications

The confrontation highlights a new era for publicly traded crypto treasury companies, where governance failures can rapidly trigger the type of activism long seen in traditional finance. With more than $500 million in capital tied to BNB exposure, the outcome of the fight between YZi Labs and the current board will help define how Web3-linked corporations manage transparency, communication, and fiduciary responsibility in volatile markets.

For now, YZi Labs’ attempt marks one of the most high-profile boardroom challenges yet in the crypto sector and could reshape the direction of the largest public BNB treasury in the United States.