DOGE Bearish Trend Holds Firm Despite Analysts’ Bullish Calls

- DOGE stays in a steep decline despite the Nasdaq ETF launch drawing weak early demand

- Long liquidations rise as open interest falls, marking fading conviction in the market

- Analysts highlight wedge and channel structures, suggesting long-range breakout potential

Dogecoin’s slide has stretched into another week, and the tone across markets remains heavy. The token has been drifting lower since early September, rarely finding enough strength to stabilize, let alone reverse course.

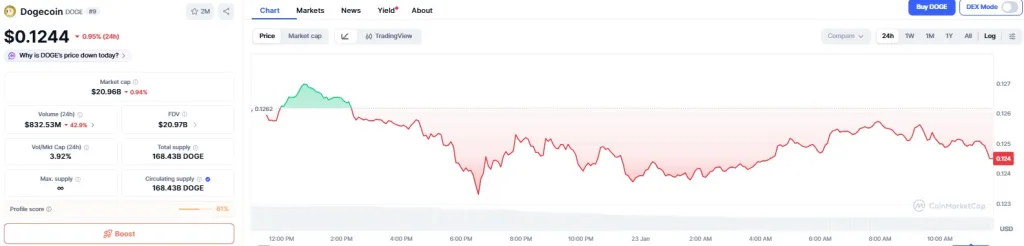

By mid-morning, DOGE hovered near $0.1244. The move shaved another percentage point off the day and pushed weekly losses to roughly 11%. Besides, its year-on-year performance tells a deeper story: a 64.67% decline that underlines just how persistent the trend has been.

Source: CoinMarketCap

Similarly, market depth continues to thin. DOGE’s market cap settles at $20.96 billion, yet trading activity looks weaker by the day. Volume slipped 42.9% in the last 24 hours to $832.53 million. That kind of contraction typically signals fatigue rather than preparation for a pivot.

And while traders had hoped for a spark from the 21Shares Dogecoin ETF, launched on Nasdaq on Jan. 22 under the ticker TDOG, no momentum followed. Instead, the debut landed quietly. The long run-up of anticipation ended in a textbook “buy the rumor, sell the news” fade, leaving markets exactly where they were: uninspired and drifting.

ETF Launch Brings Little Change

The absence of inflows after the ETF’s arrival became the clearest message of the week. Traders watching for institutional participation saw none. Without fresh orders to support spot demand, the bearish slope steepened.

Within hours of the first session, analysts began treating the listing as a neutral event rather than a catalyst. Flow trackers now point to ETF subscription data as a key gauge for sentiment. But even that remains more of a monitoring exercise than a near-term trigger. For now, the market has simply shrugged.

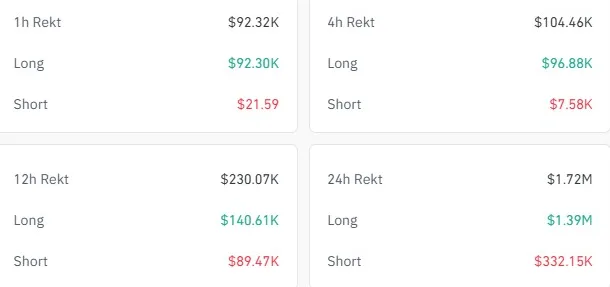

Derivatives Data Shows Long Pressure

The derivatives tape adds another layer. Over the past day, liquidations reached $1.64 million, and most of that came from the long side, about $1.30 million versus $332.13K in short positions.

Source: CoinGlass

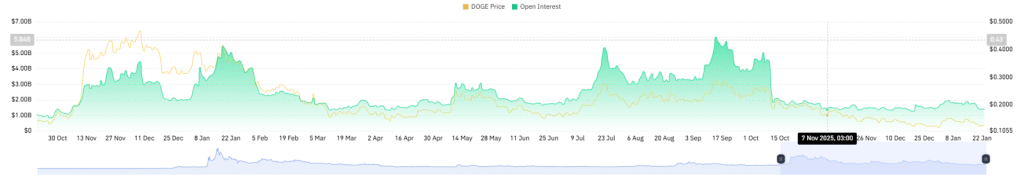

That imbalance suggests buyers were pushed out as prices slipped, reinforcing direction rather than challenging it. Open interest tells a similar story. It has eased to roughly $1.41 billion from this year’s peak of around $1.96 billion.

Source: CoinGlass

When OI falls this steadily, it often reflects participants stepping back, trimming exposure, and letting the market drift until conditions reset. None of that helps DOGE price build a base.

Analysts Point to Long-Term Wedge Structure

Even so, not every analyst sees this as a terminal slide. Ali Charts highlighted a long-running descending wedge he’s tracked for years, patterns that, in past cycles, eventually resolved with sharp breaks to the upside. His chart places DOGE near the lower boundary of this structure, almost pressed against the floor around the $0.124 area.

He described prior wedge breakouts in 2017 and 2021 as precursors to strong rallies. The same setup now points to potential targets near $0.29, $0.55, and $1.10, though only if the price clears the upper line. At the moment, nothing confirms such a move.

Related: RIVER Price Hits $48 Record High Amid Rising Market Manipulation Scrutiny

Monthly Chart Shows a Rising Channel

Another analyst, Trader Tardigrade, turned to the monthly chart instead. His work shows DOGE holding a broad rising channel stretching across several years, with repeated pullbacks into support that later gave way to continuation moves.

Source: X

The recent test of that support, he noted, keeps the long-term structure intact. The trend of higher lows persists, even if day-to-day action suggests exhaustion. No formal target was attached, though the chart implies room for advance if the channel holds.

For now, DOGE remains shaped by the same forces that defined recent months: thinning interest, heavier long liquidations, and a lack of fresh capital. Until those conditions shift, the downtrend stays in control.