DOGE Jumps 5% After Key Support Rebound: Will the Rally Hold?

- DOGE climbs 5 percent as the $0.13 support level draws fresh buyer interest again.

- Momentum shows early strength, though resistance at $0.15 and moving averages remain firm.

- Long-term charts show DOGE still respecting its multi-year rising trendline structure.

Dogecoin found fresh footing after slipping back to the familiar $0.13 support band, climbing roughly 5% as trading activity picked up across major venues. The rebound pushed the token toward $0.14, a zone that aligns with the 23.60% Fibonacci marker, and came alongside a sharp rise in daily volume to $1.67 billion. The renewed interest prompted traders to revisit a level that has repeatedly stopped declines this year.

Support Reaction Sparks a Short-Term Lift

The lower band around $0.13 has been one of DOGE’s more reliable defenses. Each time the price has dipped into that pocket, buyers have stepped forward quickly. This pattern appeared once more, though the broader trend has yet to turn.

According to CoinMarketCap data, the token remains down 3% on the week and nearly 19% over the past month, reflecting a market that still leans defensive despite short bursts of activity. Besides, DOGE sits below its 50-day and 200-day moving averages, lodged at $0.16 and $0.20.

Those levels have repeatedly capped advances. Any attempt to build momentum will run into those barriers first, and analysts say they remain the clearest checkpoints for whether a short-lived bounce evolves into something steadier.

Technical Indicators Show Early Signs of Stabilization

Despite the broader adverse price action, Dogecoin continues to trade within a descending broadening wedge, a structure identified by diverging trendlines that often emerges in downtrends. While the pattern can precede bullish reversals, confirmation typically requires a breakout above the upper resistance band.

For DOGE, a decisive move above $0.15 is seen as the first key threshold. Momentum indicators also show early improvement. The relative strength index currently sits near 45, hovering close to the neutral 50 level. Though still below the midpoint, the RSI’s climb from oversold territory signals that downward pressure may be easing.

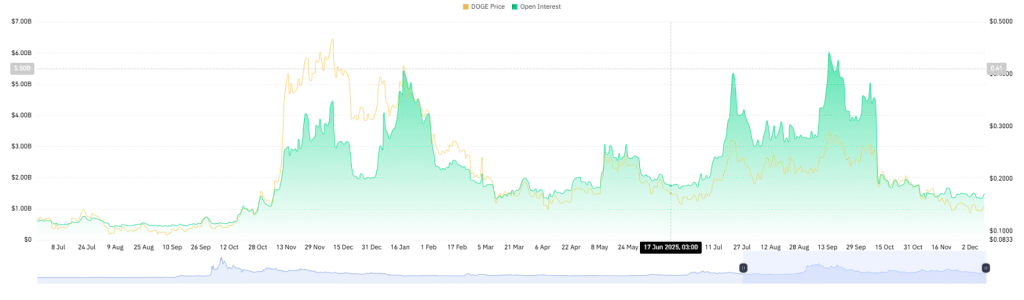

Analysts add that an RSI break above 50 would strengthen the case for continued upside. However, derivatives data paints a mixed picture. Open interest has been flat for days, now at $1.49 billion, revealing indecision rather than commitment.

The funding rate, however, has edged into positive territory at 0.0094%, showing that long positions are slightly more expensive to hold. That dynamic typically appears when traders begin leaning toward upside continuation.

What Must Happen for a Clear Bullish Reversal

Analysts point to three checkpoints that would give the market a clearer sense of direction:

- A break and hold above $0.15.

- An RSI move above the neutral 50 line.

- A recovery of the 50-day moving average.

None of these layers has shifted yet, leaving the broader structure unchanged even as shorter charts show relief.

Long-Term Structure Still Tracks a Rising Trendline

While near-term action looks mixed, higher-timeframe charts show a different picture. Analyst Trader Tardigrade highlighted a multi-year rising trendline that DOGE has respected since early 2023.

Price has returned to that line during major corrections, including in mid-2024, late 2024, and most recently in late 2025, near $0.17. Each retest has marked the beginning of a new build-up phase. Rounded cycle formations sit above those rebounds, outlining gradual expansions that unfolded over several months.

The analyst’s current projection shows a similar pathway forming again if the trendline continues to guide price action through 2026. Under that structure, the $1 region emerges as the target for the ongoing cycle.

Related: MemeCore Rebounds at Support and Jumps 10% in Fresh Rally: Will It Hold?

Outlook

Dogecoin’s latest rise reflects renewed activity at a level that has repeatedly drawn buyers. However, larger resistance zones remain untouched, and the wider market has yet to shift out of its defensive posture. The coming sessions will reveal whether DOGE can convert a routine rebound into the start of a longer recovery.