Dogecoin (DOGE) Holds 200-Day EMA, Targets $0.27 Resistance

- Analysts predict a breakout if DOGE maintains strength above key long-term moving averages.

- Falling exchange supply and potential ETF approvals could trigger DOGE’s next market rally.

- Dogecoin trading drops 6.2% in volume, open interest down 2.47% to 4.47B DOGE.

Dogecoin (DOGE) continues to move sideways after failing to hold above the $0.26 mark. The failure triggered heavy profit-taking from institutional investors. Price action has since remained compressed, fluctuating near $0.25. Despite short-term pressure, the market structure suggests growing accumulation, with on-chain data showing reduced selling activity across major exchanges.

Crypto analyst Daan Crypto Trades noted that Dogecoin’s structure appears to be preparing for a sharp move. He said the price has been gradually climbing since June’s lows, maintaining a steady pattern of higher highs and higher lows. The analyst added that holding above the 200-day moving averages could be critical before a major upward breakout occurs.

Dogecoin Outflows Signal Market Shift

Daan also commented that upcoming ETF approvals might give Dogecoin a boost. However, he expressed doubt that capital inflows from such approvals would be significant. He emphasized that DOGE’s compressed price movement indicates an asset waiting for a trigger to establish direction. The current trading setup remains neutral but is showing early signs of potential expansion.

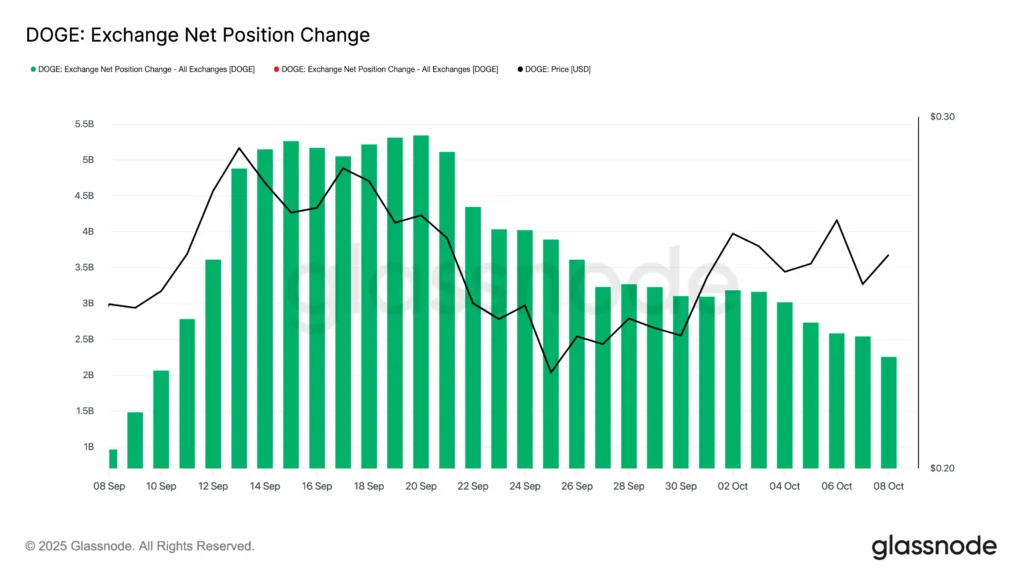

Data from Glassnode also shed some light on Dogecoin’s current market phase. The Exchange Net Position Change of Dogecoin has fallen to 2.25 billion this time. This indicates that a substantial volume of tokens has been transferred from exchanges to private wallets. Such movements have historically been interpreted as a lessening of short-term selling pressure.

If this trend persists into next week, it could have significance. If exchange supply continues dropping further, it may give DOGE enough fuel to retest the $0.27 resistance. A sustained break-above could clear the way for a return to $0.30, where the altcoin faced strong sellers in the past.

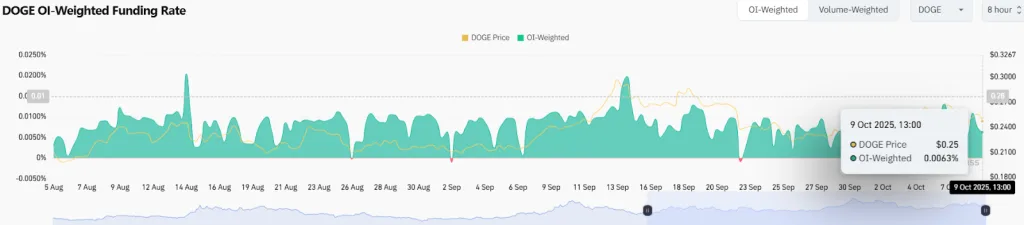

Crypto analytical platform Coinglass showed that Dogecoin trading activity had significantly decreased. The overall trading volume declined by 6.20% and the open interest decreased by 2.47% settling at 4.47 billion.

Further, DOGE’s open interest (OI)-weighted funding rate is positive at 0.0063, suggesting that the derivatives market is slightly biased toward long positions despite lower overall participation.

Over the last 24 hours, Dogecoin also showed total liquidations totaling $16.19 million. Long positions contributed $11.44 million, and short positions contributed $4.75 million of this.

Related: REX Shares Dogecoin ETF Nears Launch Under 40 Act Path

Technical Signals Hint at DOGE Resilience

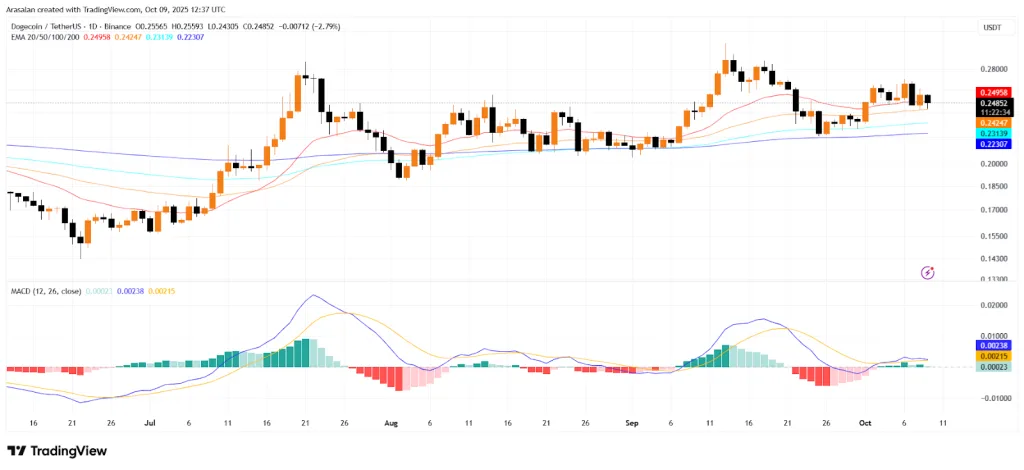

From the technical perspective, the Dogecoin price is trading with a bearish tint at $0.2485 level, losing 2.54% over the past day. This implies near-term weakness after a minor bounce in late September.

The immediate resistance is the 20-day Exponential Moving Average (EMA) at $0.2496. The 50-day EMA at 0.2424 and the 100-day EMA at 0.2314 are significant areas of support below the current price. These levels indicate a slightly positive mid-term forecast, and the long-term structural basis will be at the 200-day EMA at approximately $0.2230.

Momentum indicators show mild weakness. The MACD line is at 0.00238, above the signal line of 0.00215. The narrow gap between the two reveals diminishing bullish momentum, which is confirmed by the declining green histogram. A break below the signal line by the MACD can result in a bearish short-term momentum.

The range of $0.23–$0.24 is still the crucial support area for Dogecoin. A continuation below this region would rapidly move prices towards $0.22 (the 200-day EMA). On the flip side, if the price continues to stay above $0.25, it could test $0.27 again. The week ahead could decide whether Dogecoin continues to consolidate or starts another leg up.